Tax Benefit

Process Tax Benefit

-

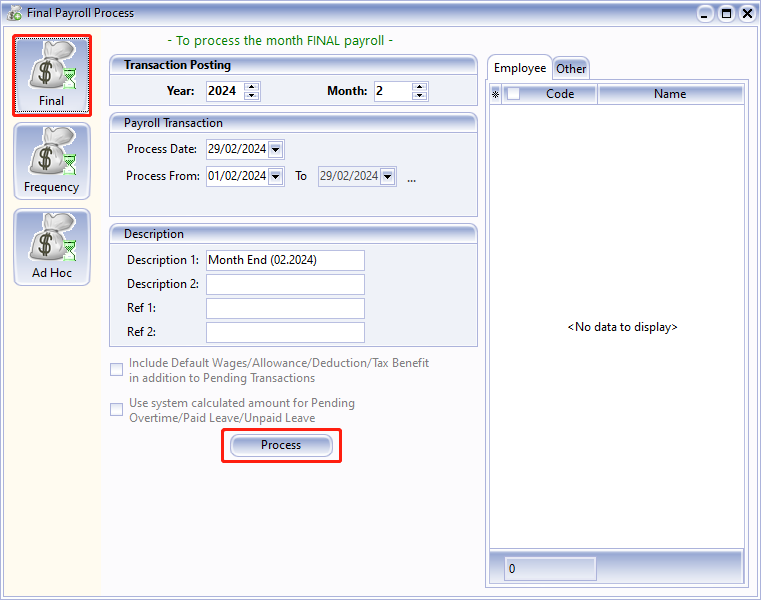

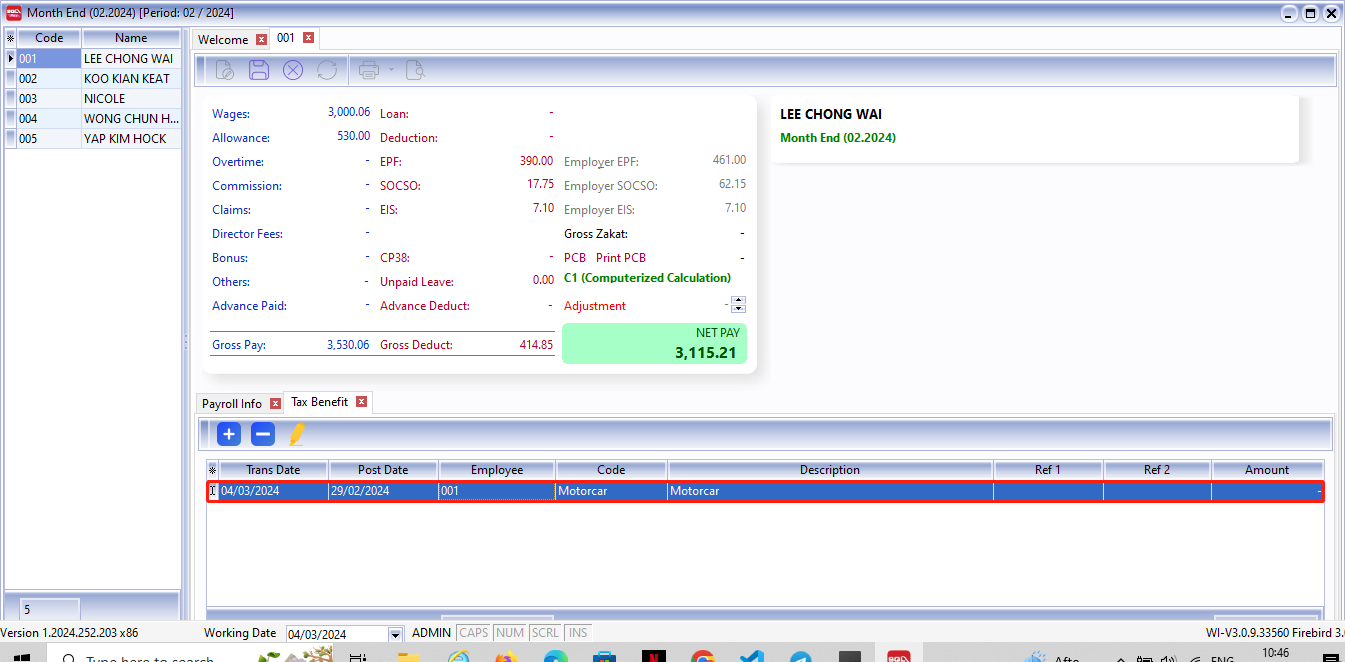

Process Month End

-

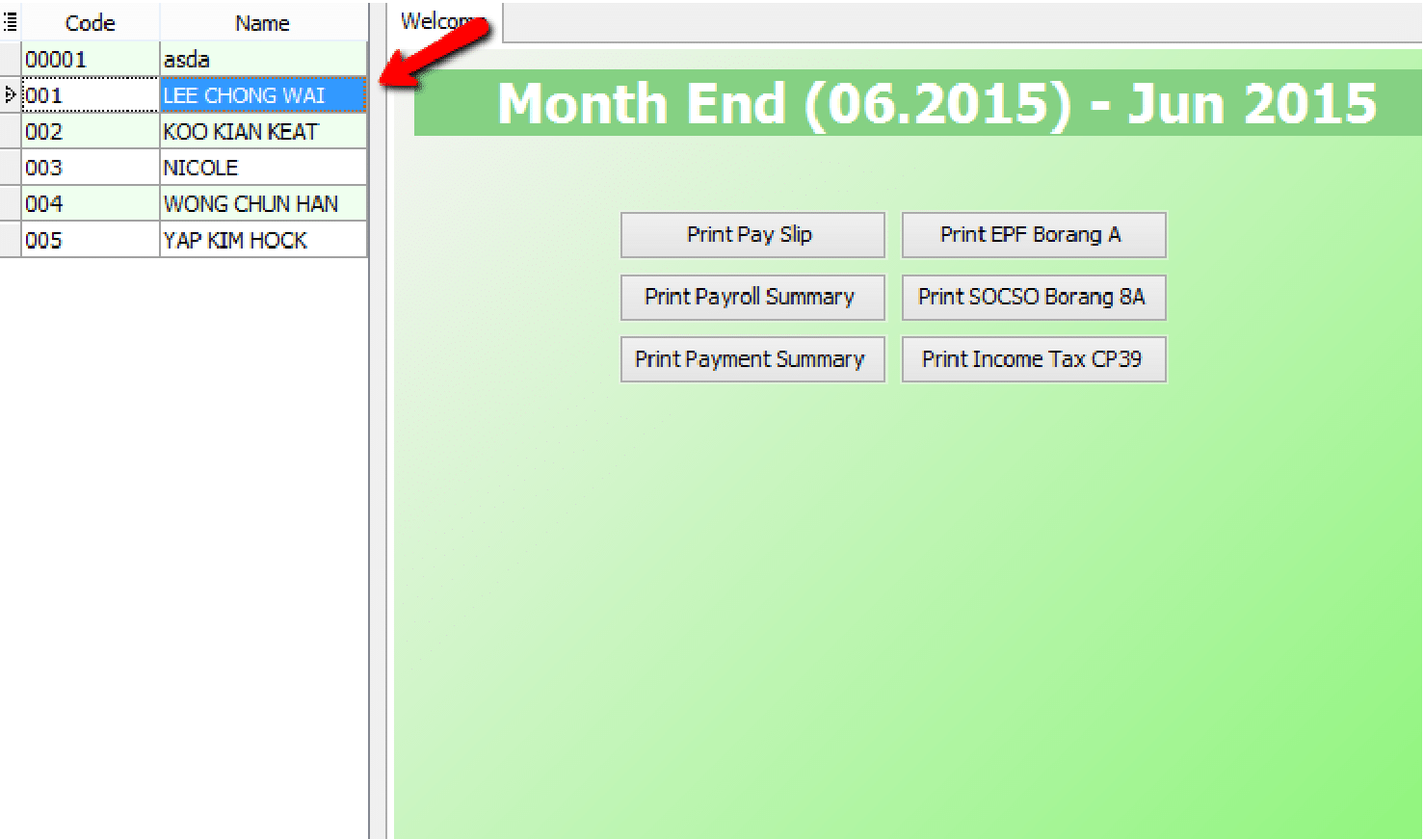

Select the employee (eg : Lee Chong Wai )

-

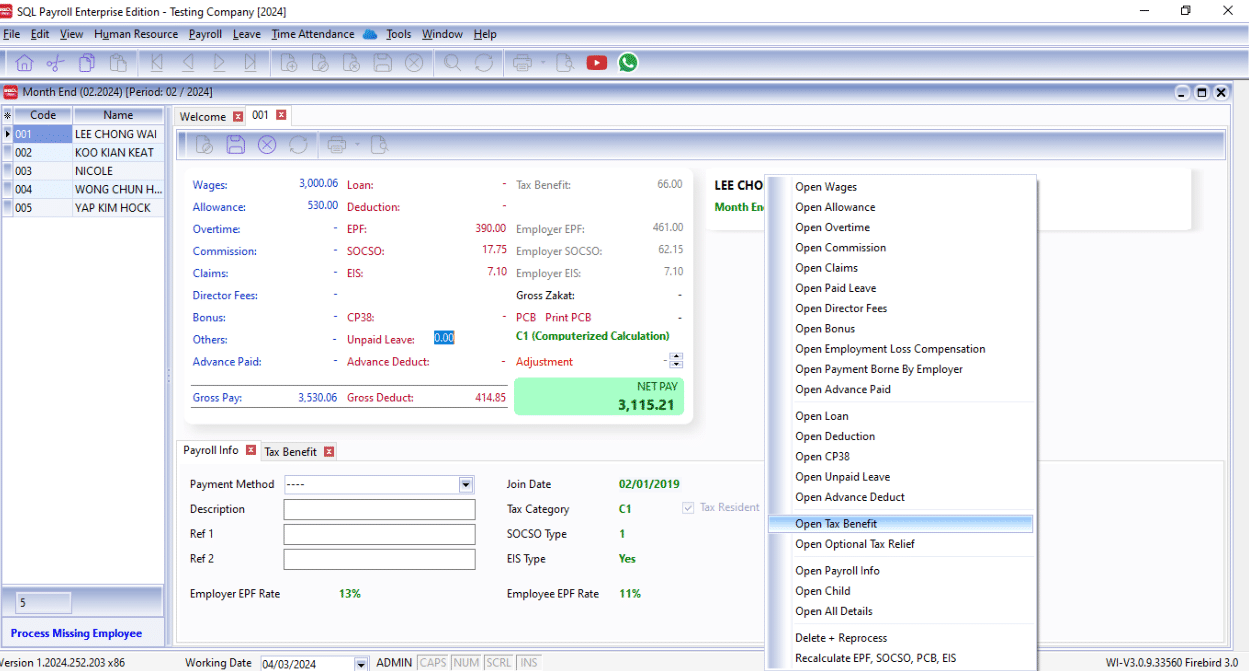

Right click on an empty space and click on “Show Tax Benefit”

-

Insert the tax benefit and also the amount.

-

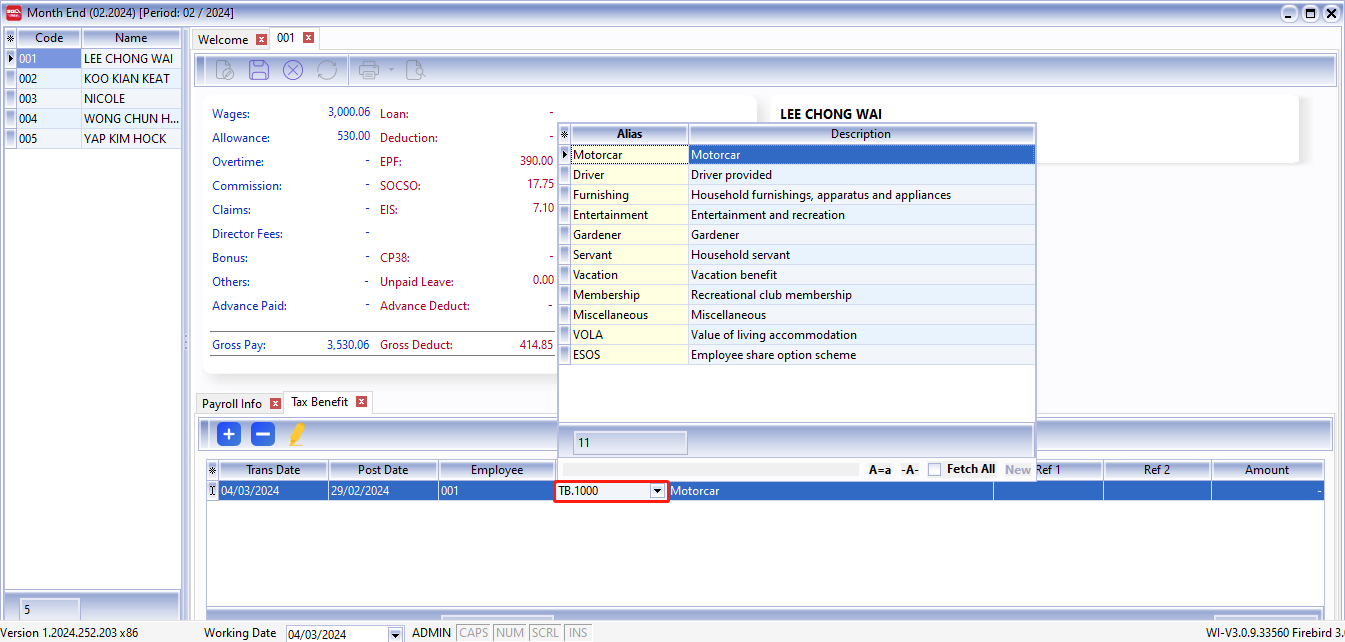

Click code to select the tax benefit.

Code EA Form (Section B) Motorcar 2(a.i) Driver 2(a.ii) Furnishing 2(c.iii – Perabot dan Kelengkapan) Entertainment 2(c.iii – Hiburan dan Rekreasi) Gardener 2(d) Servant 2(d) Vacation 2(e) Membership 2(c.iii – Hiburan dan Rekreasi) Miscellaneous 2(f) VOLA 3 -

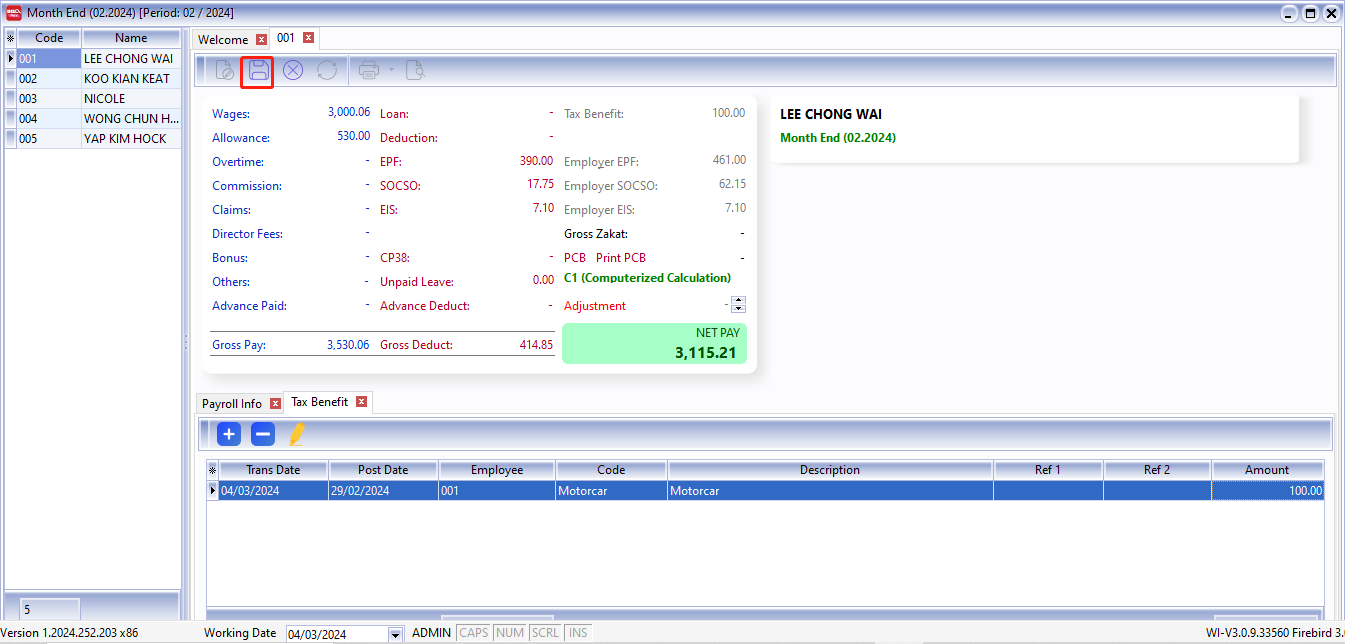

For example, I key in RM100 for “Motorcar”:

-

Select the tax benefit/ key in amount/ Click Save

-

-

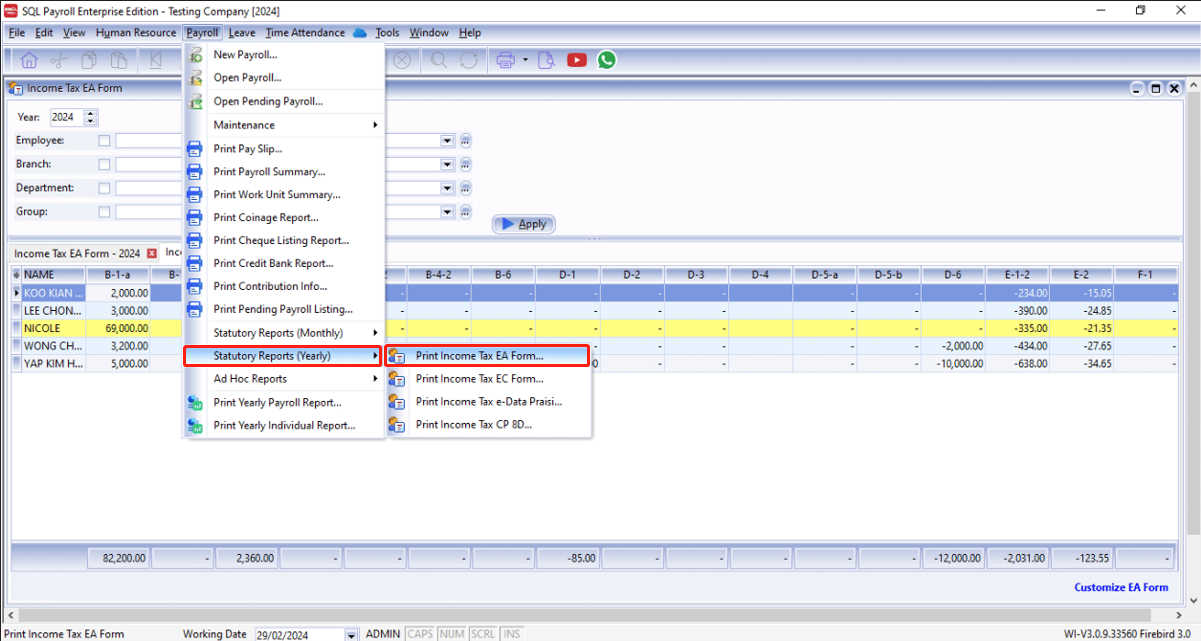

Now, we go to preview EA Form to check the tax benefit amount:

-

Payroll -> Statutary Reports (Yearly) -> Print Income Tax EA Form...

-

-

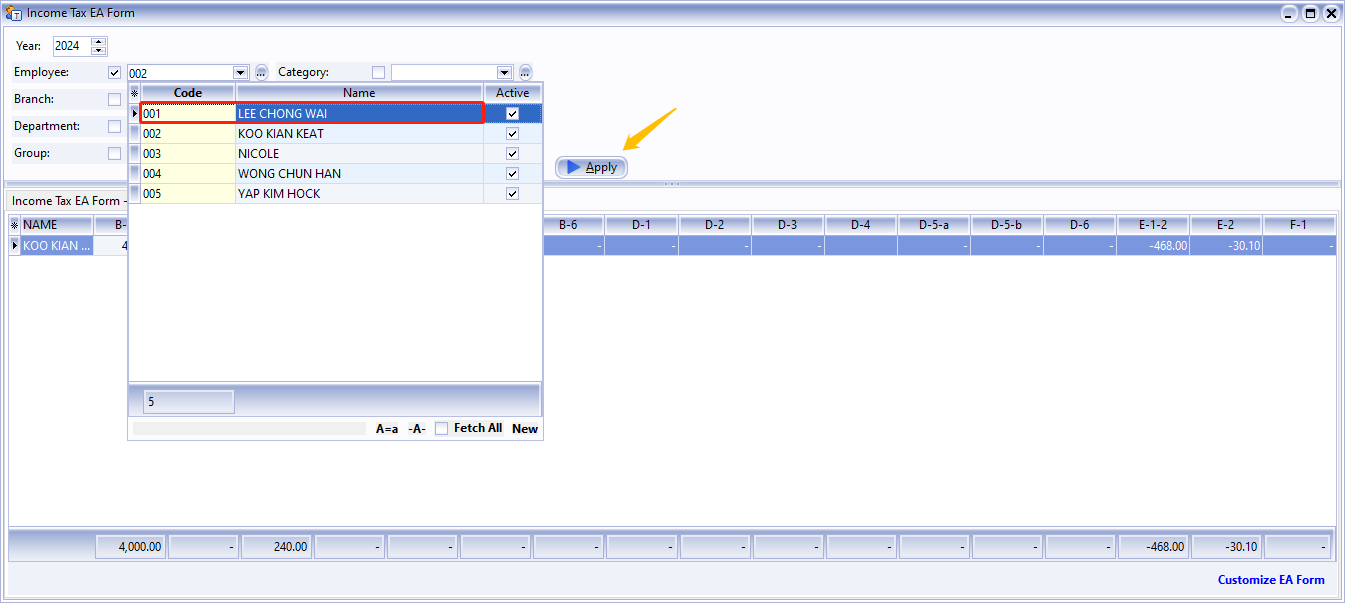

Select the employee and click "Apply":

-

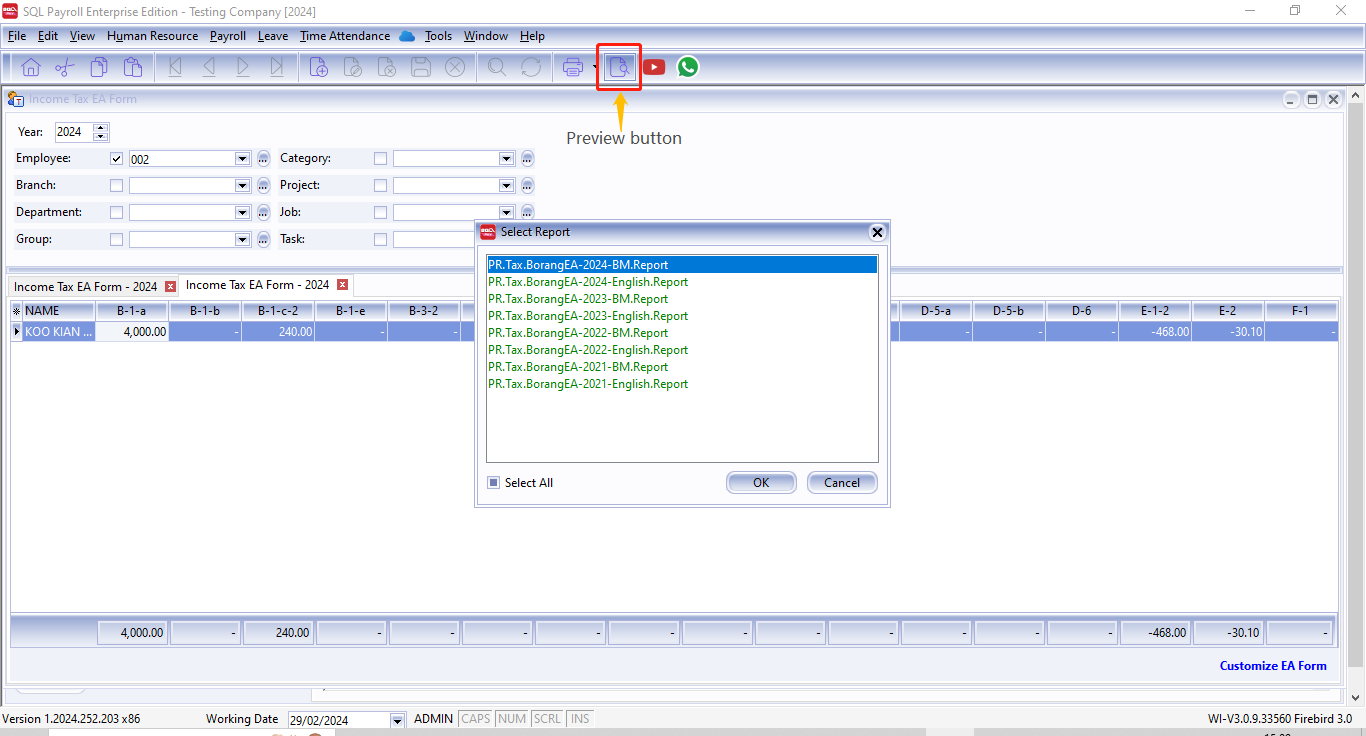

Click preview and select any format :

-

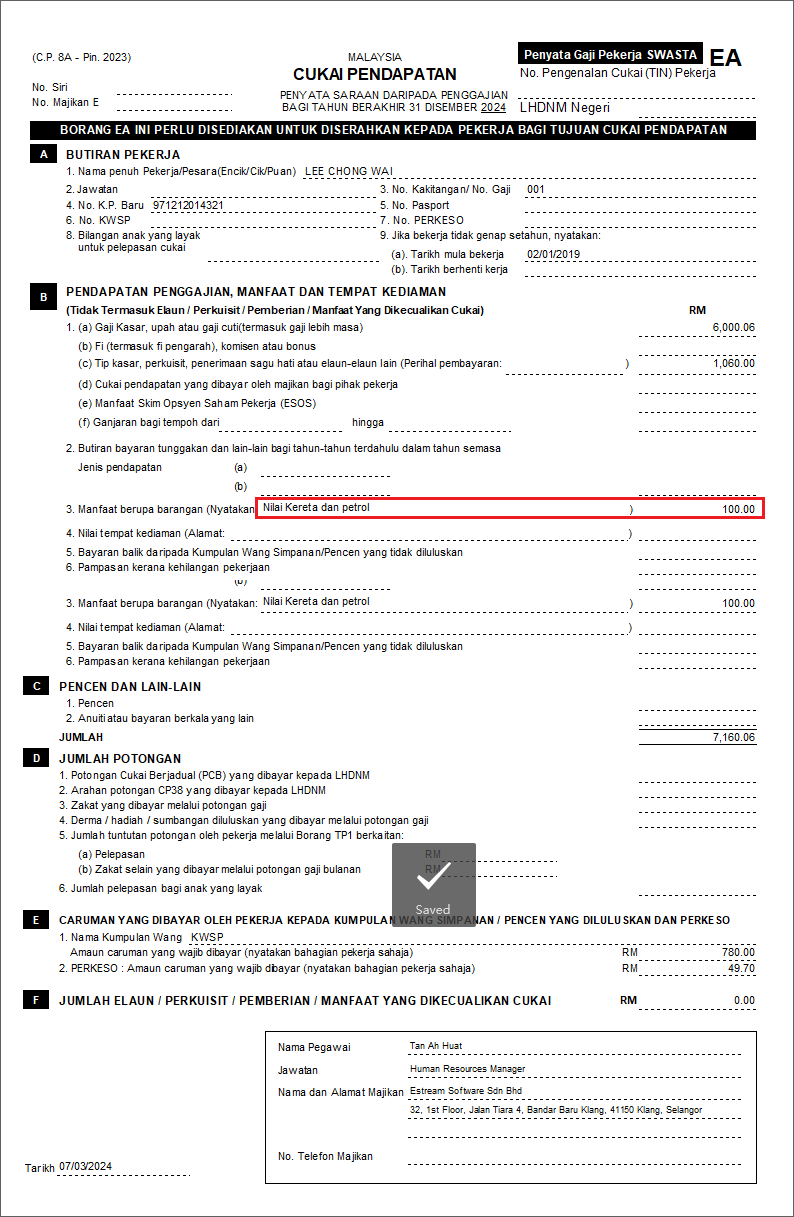

Check the EA Form

**Nilai Kereta dan petrol = RM100