Non-Malaysian Employee

Overview

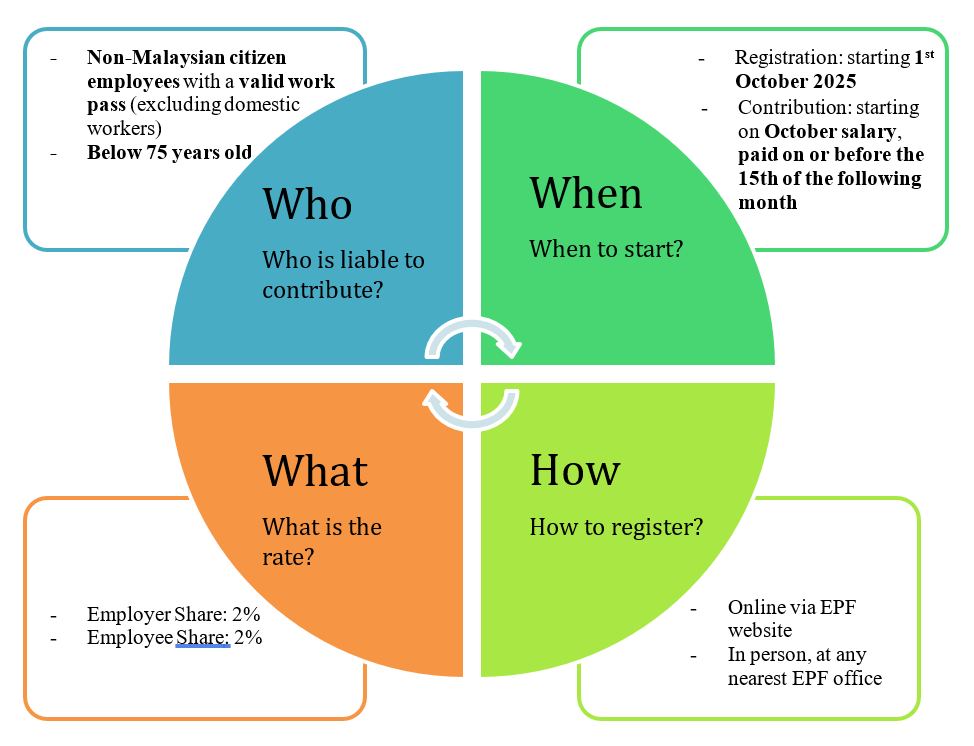

Starting from October 2025, employers are required to ensure that all non-Malaysian citizen employees with valid work passes are registered and contribute to the EPF in accordance with Malaysian law.

This guide will walk you through the setup process and requirements for EPF contributions for foreign workers.

EPF Settings in SQL Payroll

Setting up the new EPF policy in SQL Payroll is straightforward. You need to ensure the correct settings are configured to comply with the new EPF rates for non-Malaysian citizen employees.

There are 2 scenarios for EPF contribution for foreign workers:

- Non-Malaysian citizen employees without Permanent Residential Status - 2% contribution rate

- Non-Malaysian citizen employees with Permanent Residential Status - Standard Malaysian rates

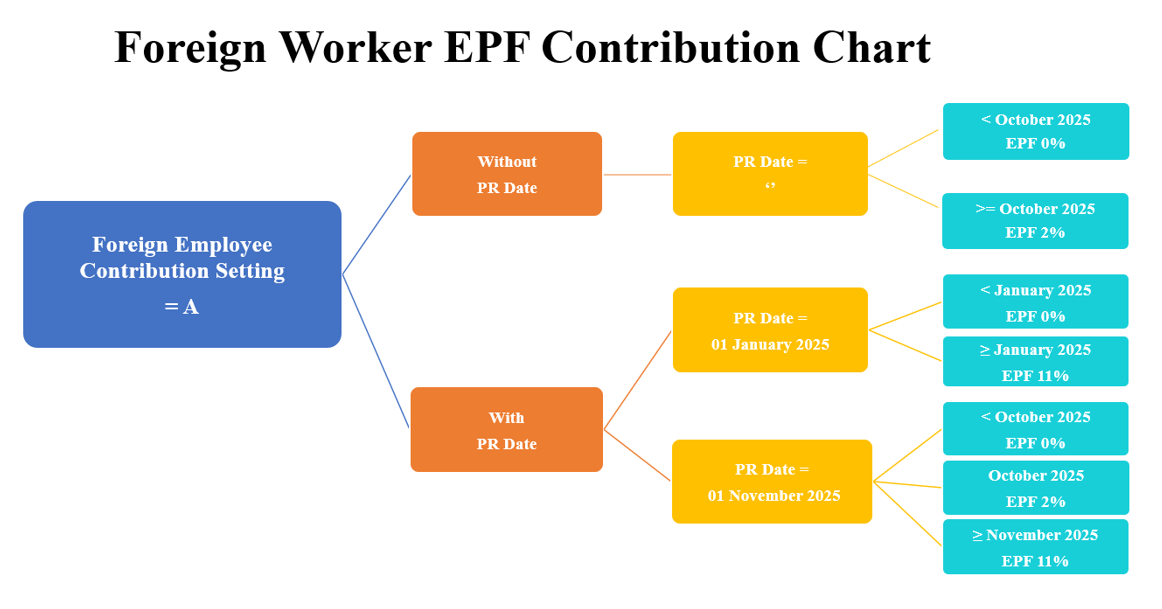

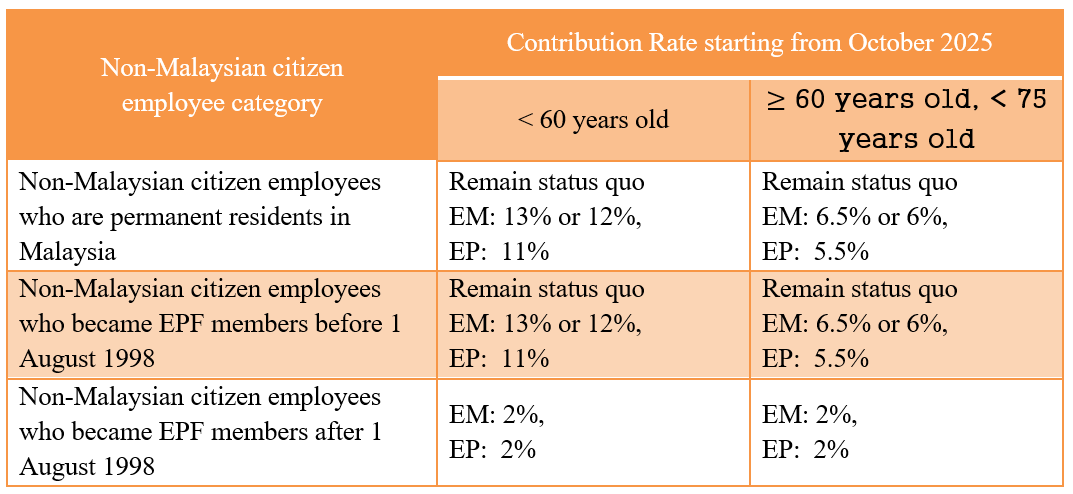

SQL Payroll automatically determines the appropriate EPF rates based on the employee's nationality, permanent resident status, and age. Refer to the chart below for details.

Non-Malaysian Citizen Employees Without Permanent Residential Status (2%)

Non-Malaysian individuals who have been granted legal work rights in Malaysia but do not hold Permanent Resident status are required to contribute to EPF starting October 2025.

EPF contribution rates:

| < 60 years old | >= 60 years old and < 75 years old | |

|---|---|---|

| EM | 2% | 2% |

| EP | 2% | 2% |

* EM – Employer Share, EP – Employee Share

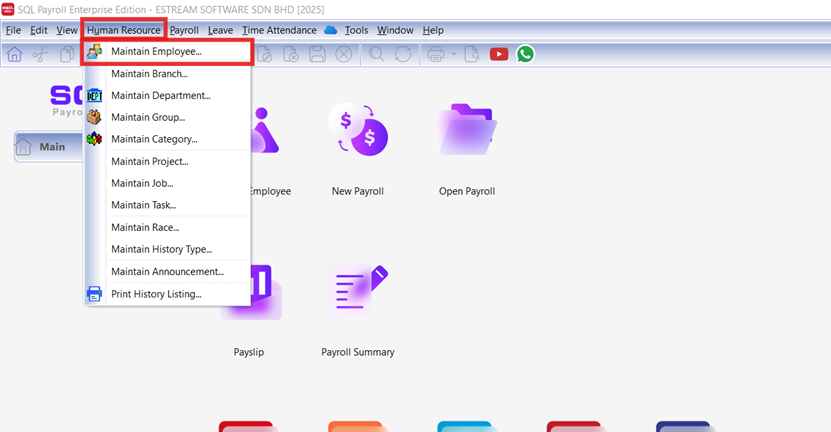

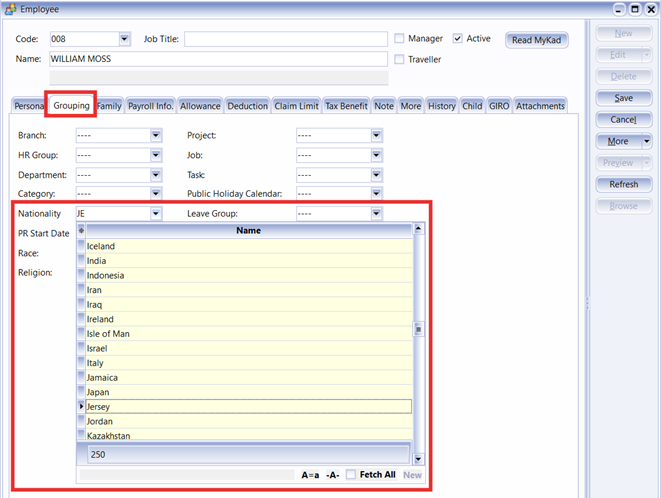

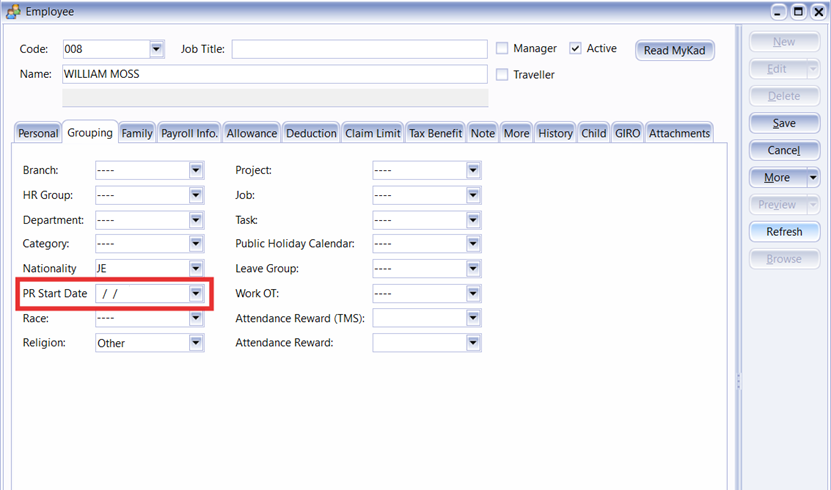

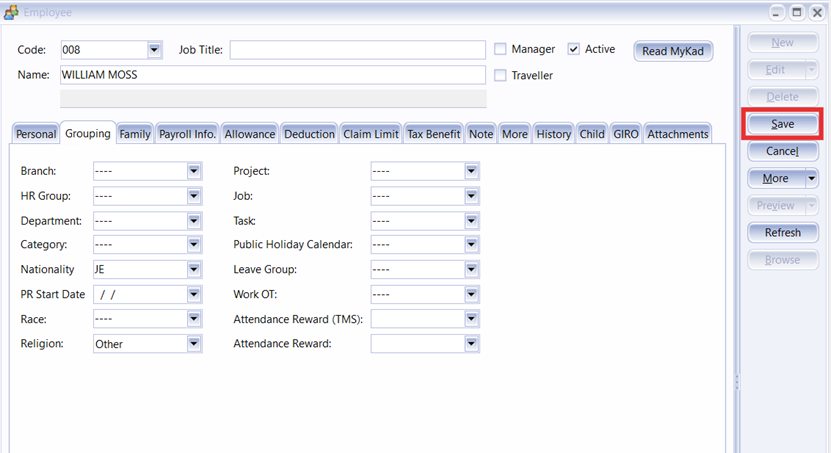

Step 1: Configure Employee Profile (Non-PR)

-

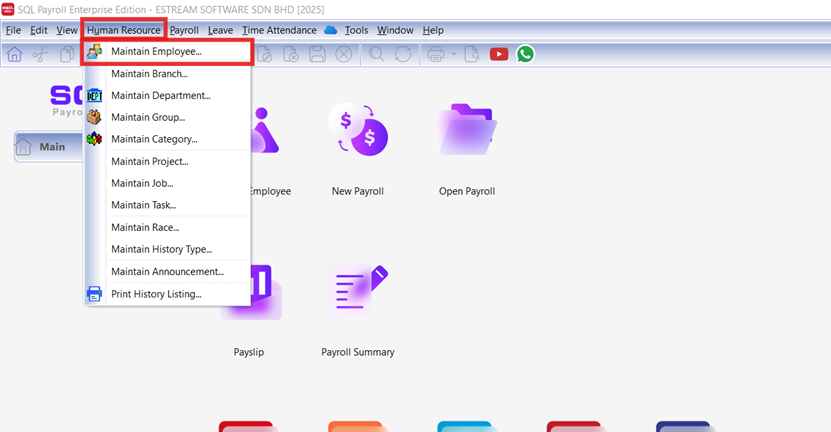

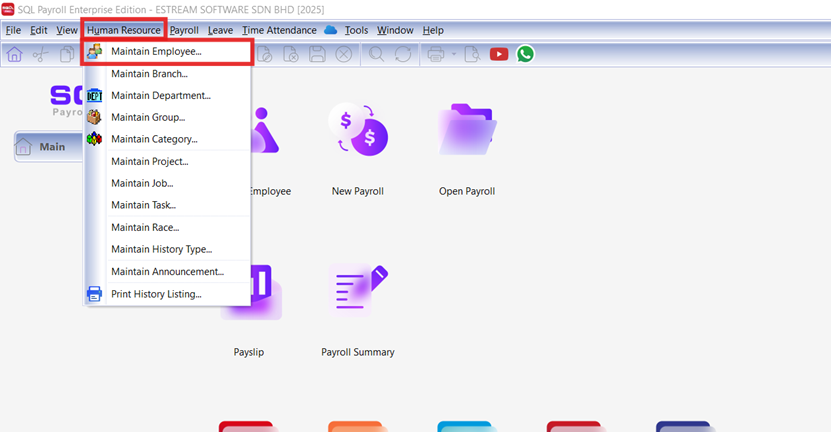

Navigate to Human Resource → Maintain Employee

-

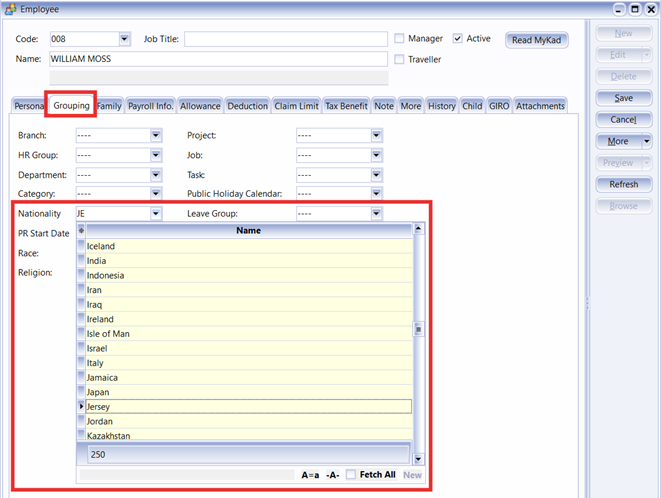

Under Grouping, select the correct Nationality for the employee

-

Ensure the PR Date field is left empty (this indicates non-PR status)

-

Click Save to apply changes

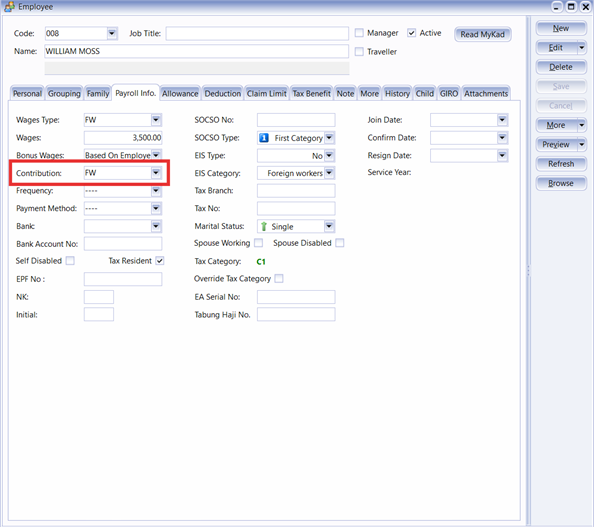

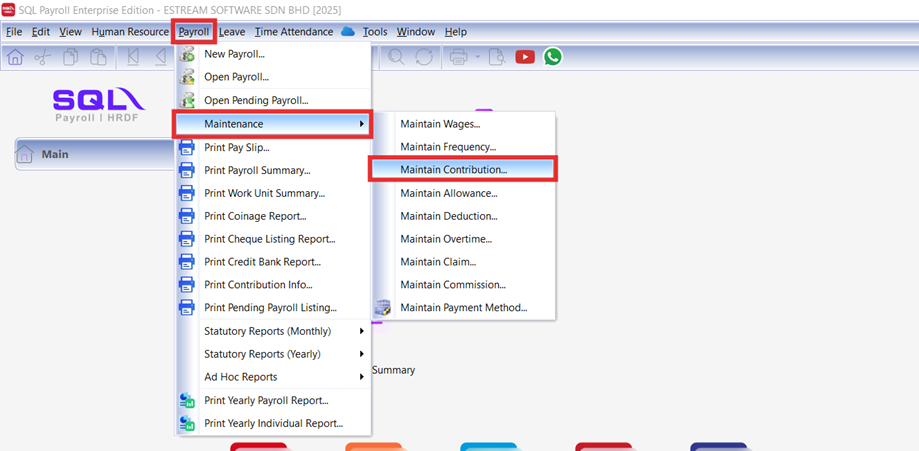

Step 2: Contribution Setting (Non-PR)

At this stage, you need to set the EPF contribution rate to “A”.

-

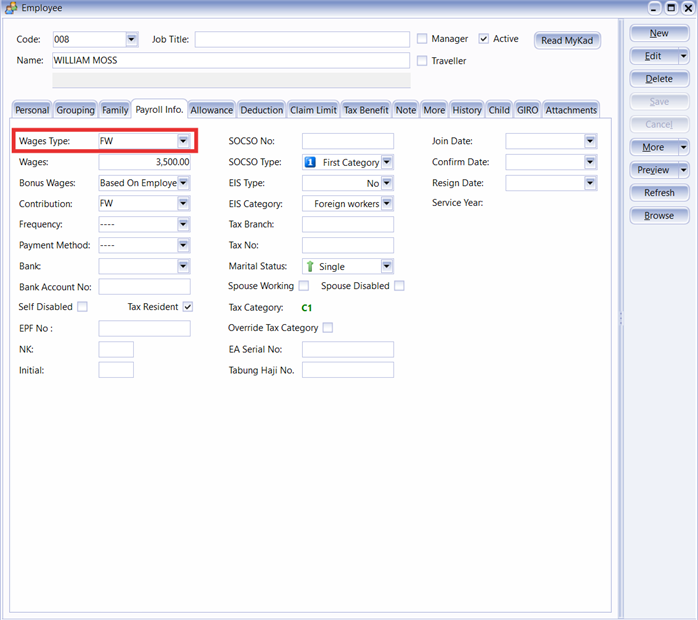

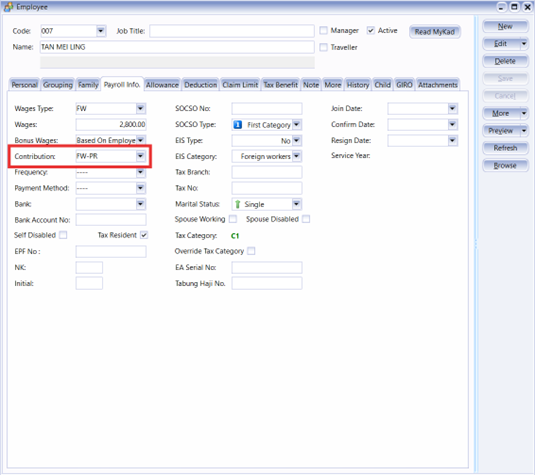

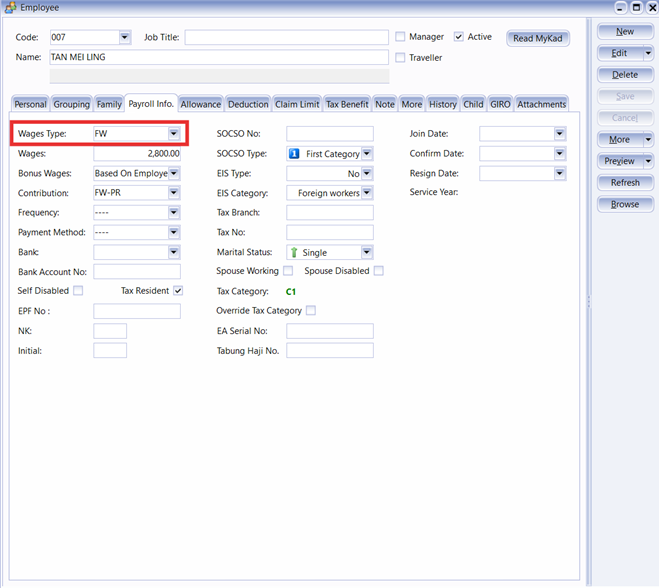

Go to Maintain Employee → Payroll Info, check the current Contribution type of this employee, e.g. FW

-

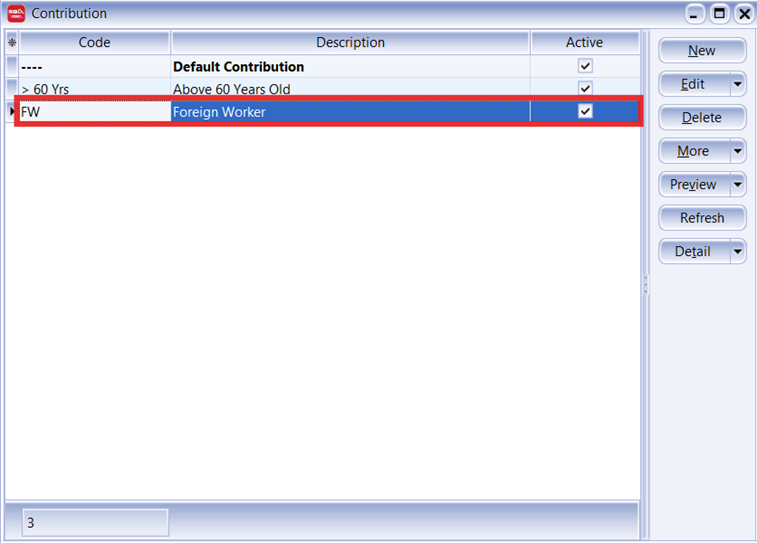

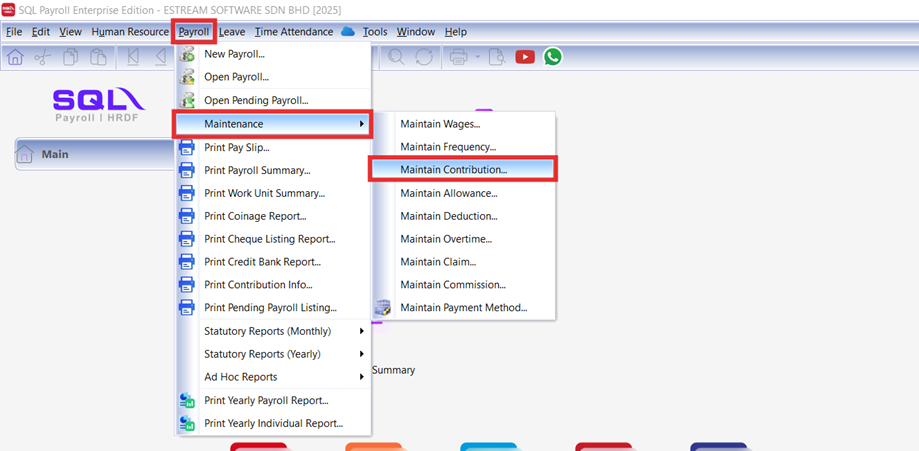

Go to Payroll → Maintenance → Maintain Contribution

-

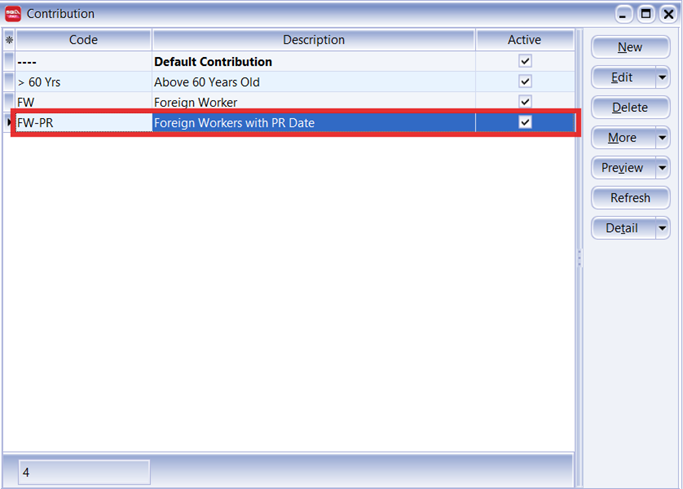

Select the contribution type from Step 1 (e.g., FW)

-

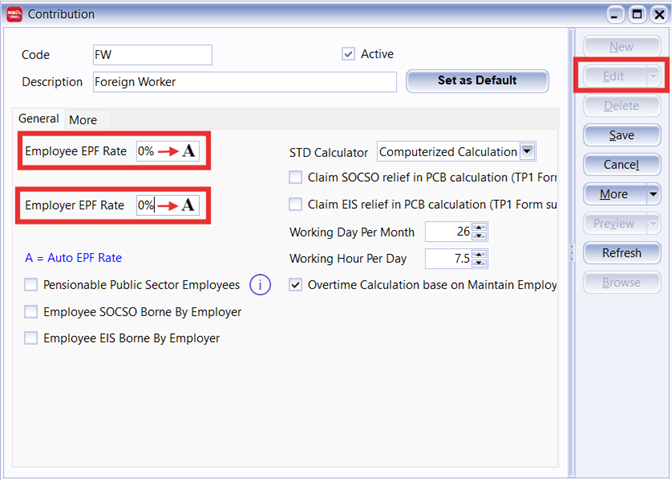

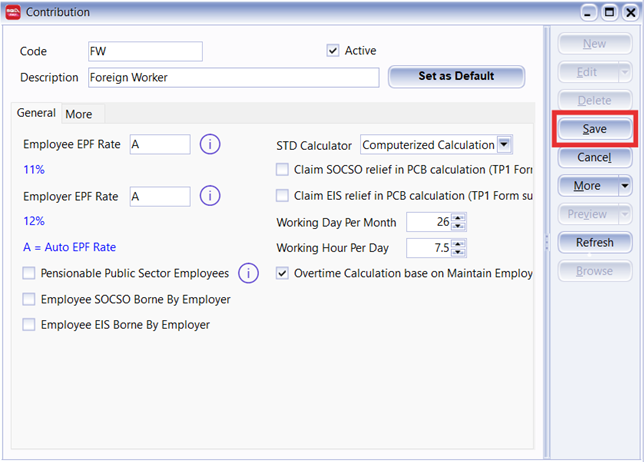

Click Edit and update both Employee EPF Rate and Employer EPF Rate from

0%toA(Auto EPF Rate) Auto EPF Rate

Auto EPF RateThe "A" setting enables automatic EPF rate calculation based on employee status and effective dates. Hover over the ⓘ icon for more details.

-

Click Save to apply the changes

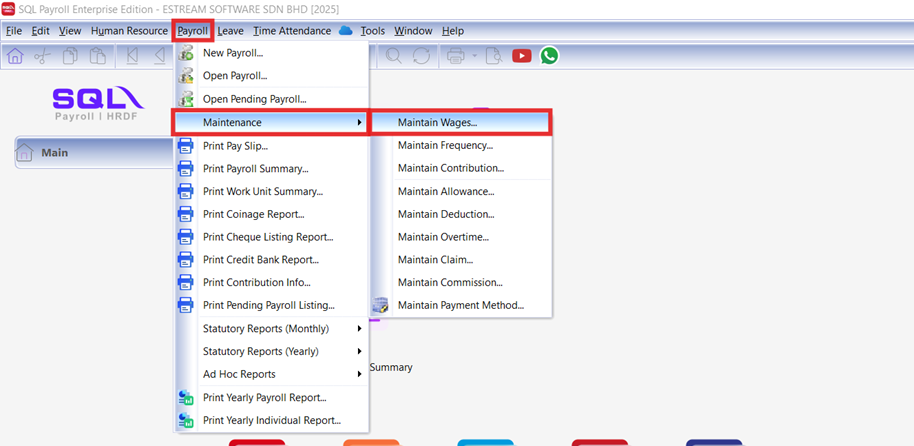

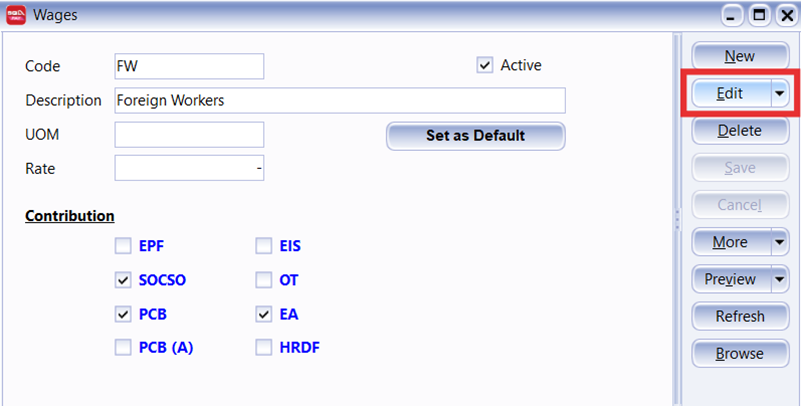

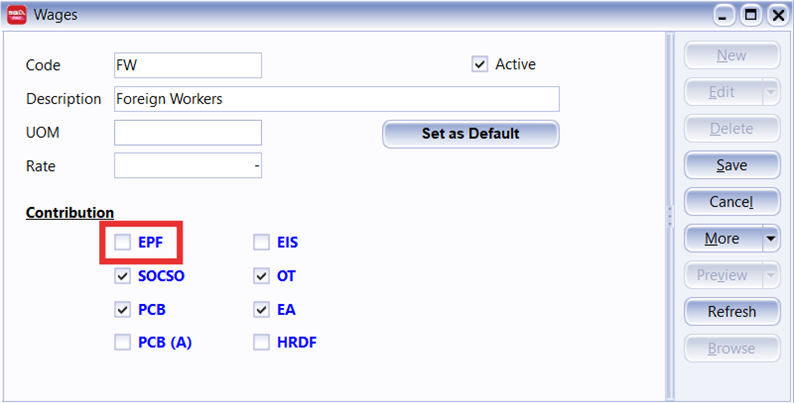

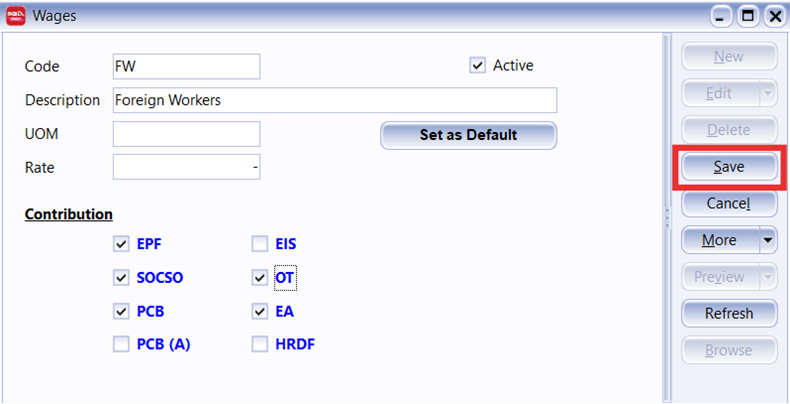

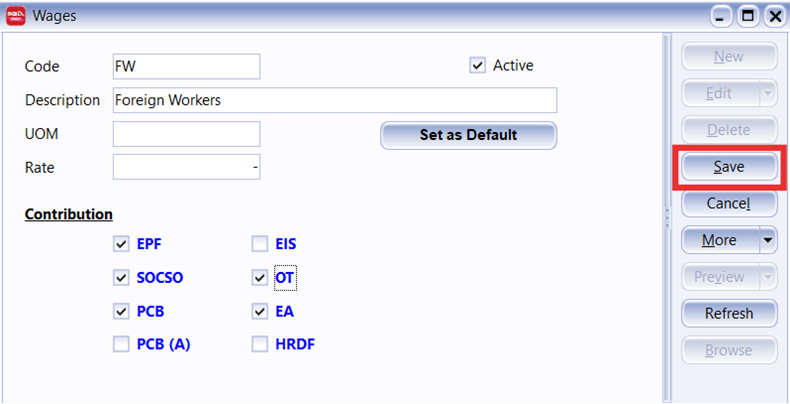

Step 3: Configure Wages Settings (Non-PR)

-

Navigate to Maintain Employee → Payroll Info and note the Wages type (e.g., FW)

-

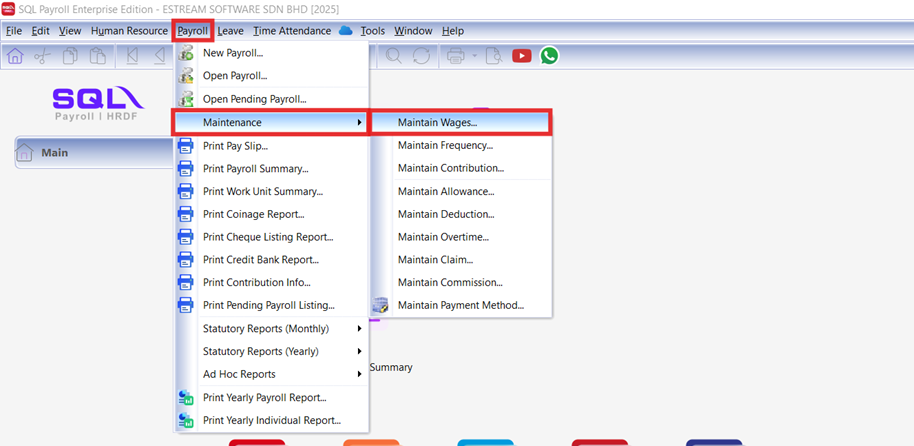

Go to Payroll → Maintenance → Maintain Wages

-

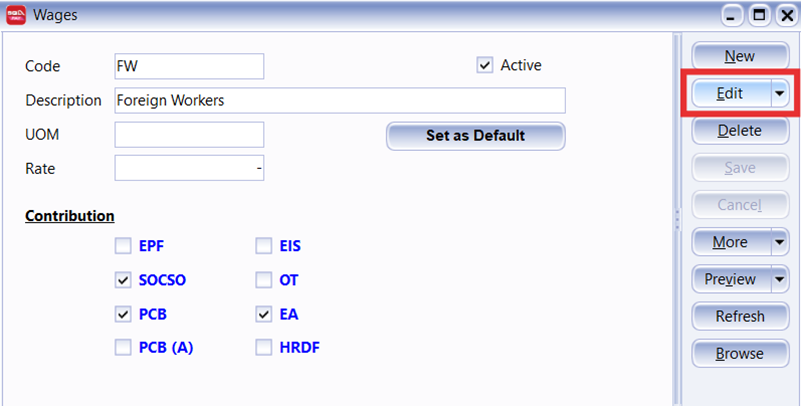

Select the wages type from Step 1 (e.g., FW) and click Edit

-

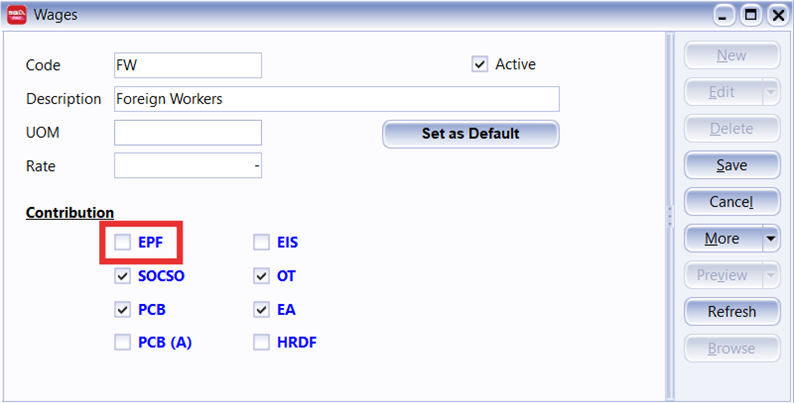

Enable EPF contribution by ticking the EPF checkbox to include wages in EPF calculations

Other Contributions

Other ContributionsOther contributions such as SOCSO, PCB, EA, and OT settings are for reference purposes and can be configured as needed.

-

Click Save to apply the changes

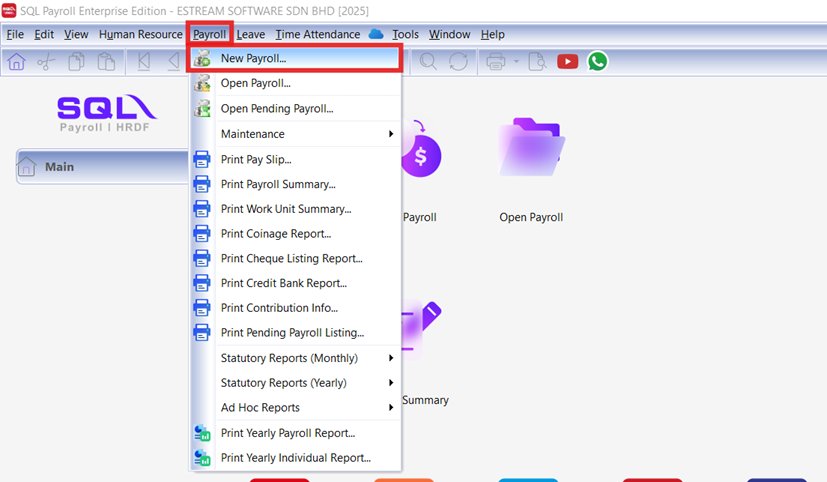

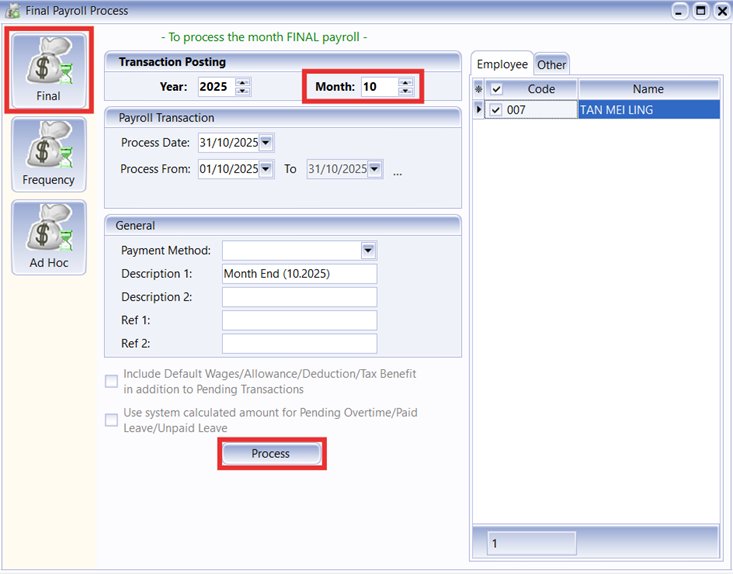

Step 4: Verify Results (Non-PR)

-

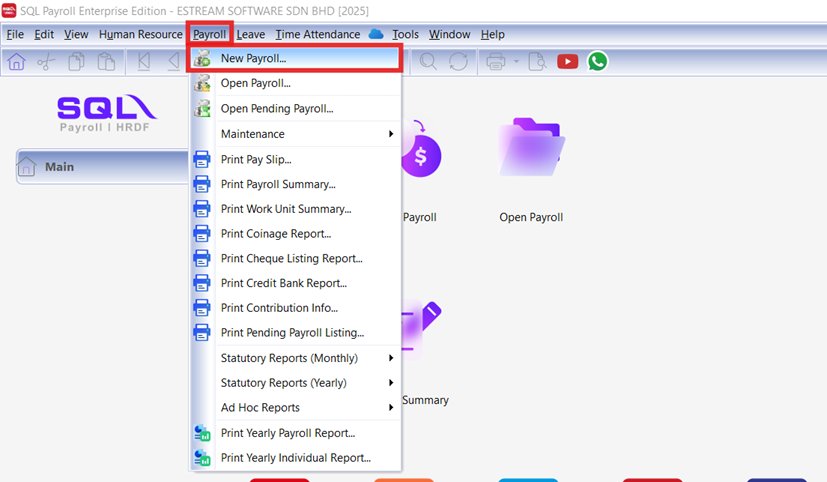

Navigate to Payroll → New Payroll

-

Select Final, choose September (9) and click Process to generate Month End, then repeat for October (10)

-

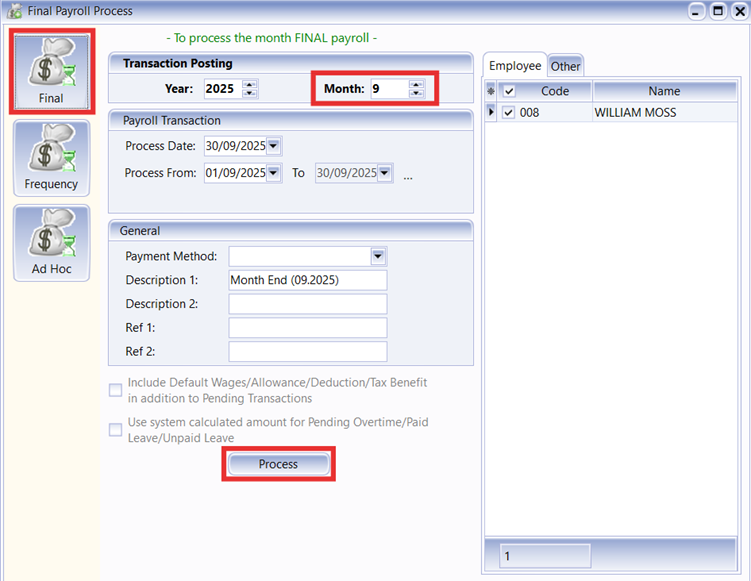

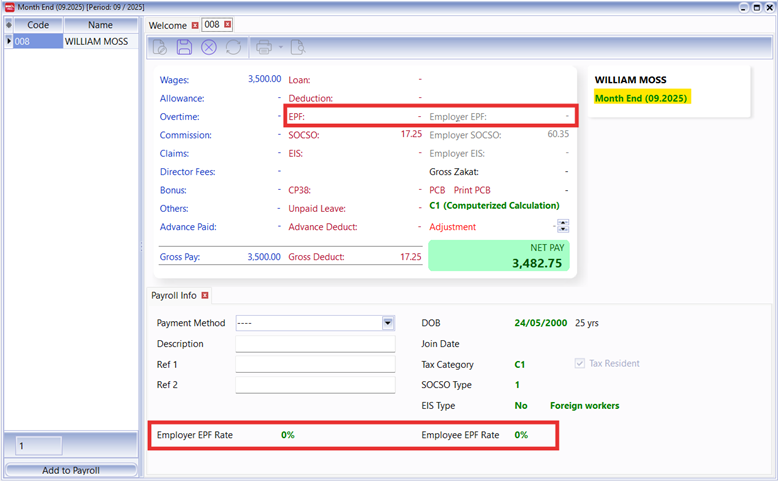

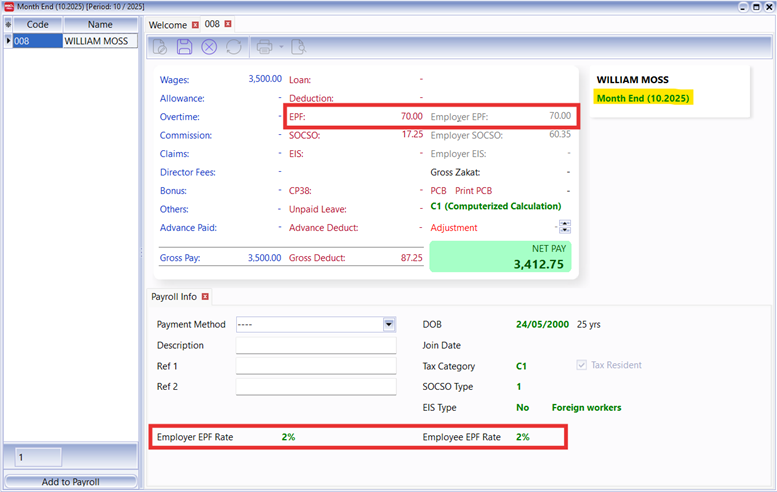

Compare the results between September and October 2025 to observe the EPF contribution rate changes:

-

Before October 2025: System automatically sets both Employee and Employer EPF rates to

0%

-

October 2025 onwards: System calculates both Employee and Employer EPF rates as

2%

-

Non-Malaysian Citizen Employees With Permanent Residential Status

Non-Malaysian individuals who have been granted Permanent Resident status by the government are treated the same as Malaysian citizens for EPF purposes.

EPF contribution rates:

| < 60 years old | >= 60 years old and < 75 years old | |

|---|---|---|

| EM | 13% or 12% | 6.5% or 6% |

| EP | 11% | 5.5% |

* EM – Employer Share, EP – Employee Share

Step 1: Configure Employee Profile with PR Status

-

Navigate to Human Resource → Maintain Employee

-

Under Grouping, select the correct Nationality for the employee

-

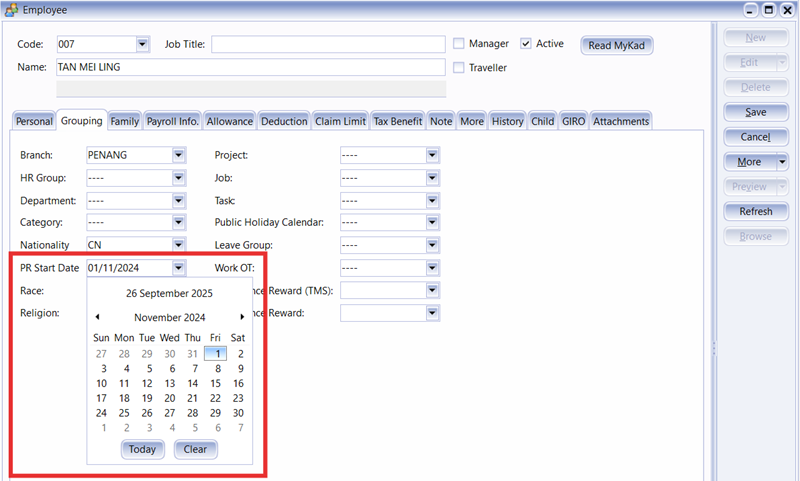

Enter the PR Start Date to indicate Permanent Resident status

-

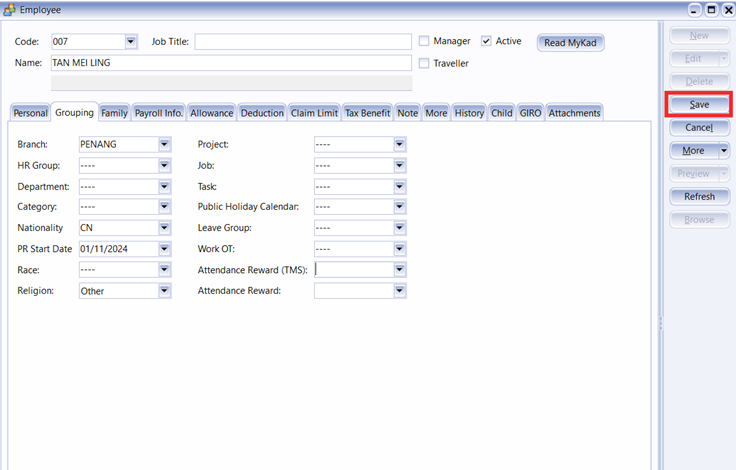

Click Save to apply the changes

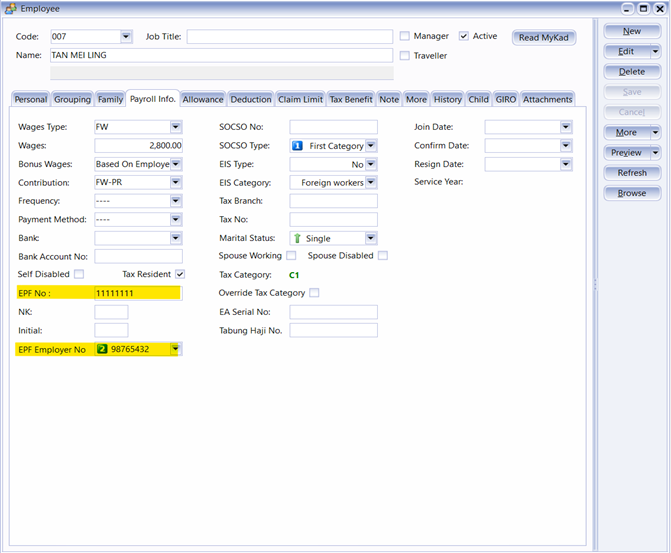

Step 2: Contribution Setting (PR)

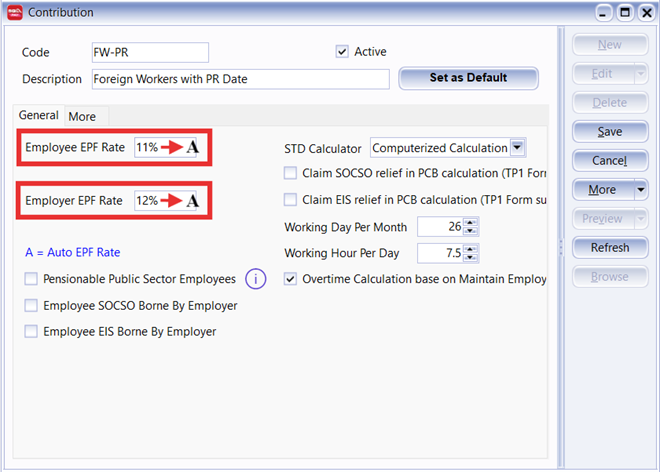

At this stage, you need to set the EPF contribution rate to “A”.

-

Go to Maintain Employee → Payroll Info, check the current Contribution type of this employee, e.g. FW-PR

-

Go to Payroll → Maintenance → Maintain Contribution

-

Select the contribution type from Step 1 (e.g., FW-PR)

-

Click Edit and update both Employee EPF Rate and Employer EPF Rate to

A(Auto EPF Rate) Auto EPF Rate

Auto EPF RateThe "A" setting enables automatic EPF rate calculation based on employee status and effective dates. Hover over the ⓘ icon for more details.

-

Click Save to apply the changes

Step 3: Configure Wages Settings (PR)

-

Navigate to Maintain Employee → Payroll Info and note the Wages type (e.g., FW)

-

Go to Payroll → Maintenance → Maintain Wages

-

Select the wages type from Step 1 (e.g., FW) and click Edit

-

Enable EPF contribution by ticking the EPF checkbox to include wages in EPF calculations

Other Contributions

Other ContributionsFor PR employees, it's recommended to enable other contributions such as SOCSO, PCB, EA, and OT as shown, since they follow the same rules as Malaysian citizens.

-

Click Save to apply the changes

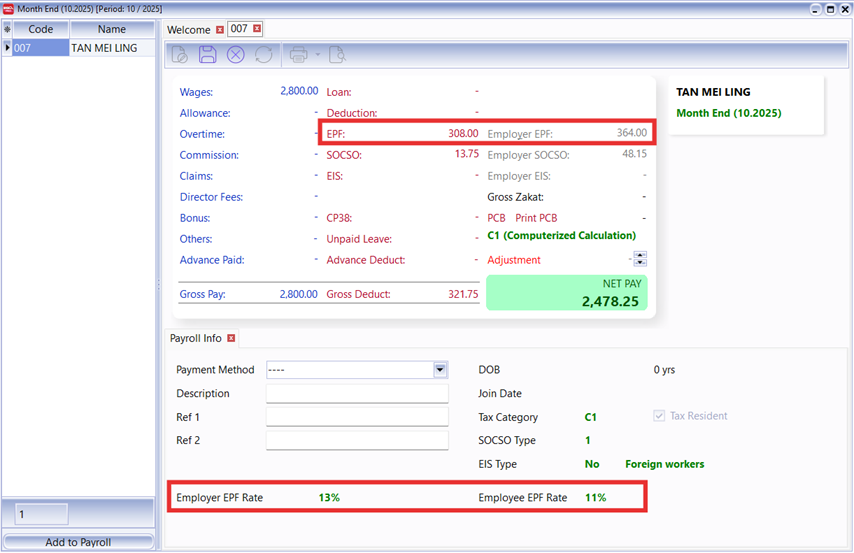

Step 4: Verify Results (PR)

-

Navigate to Payroll → New Payroll

-

Select Final, choose October (10) and click Process to generate Month End

-

Review the EPF calculation: The system will calculate EPF rates for foreign workers with PR status at Employee EPF rate 11% and Employer EPF rate 13% (for employees with wages less than RM 5,000)

Generate EPF Submission File from SQL Payroll

In SQL Payroll, you can directly generate the EPF submission text file to upload at KWSP portal.

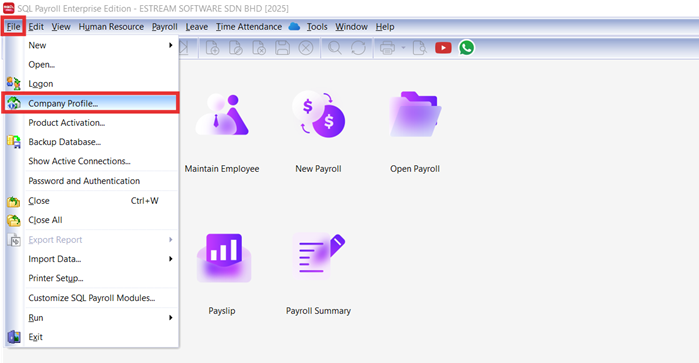

Step 1: Fill In Employer EPF Number

-

Navigate to File → Company Profile

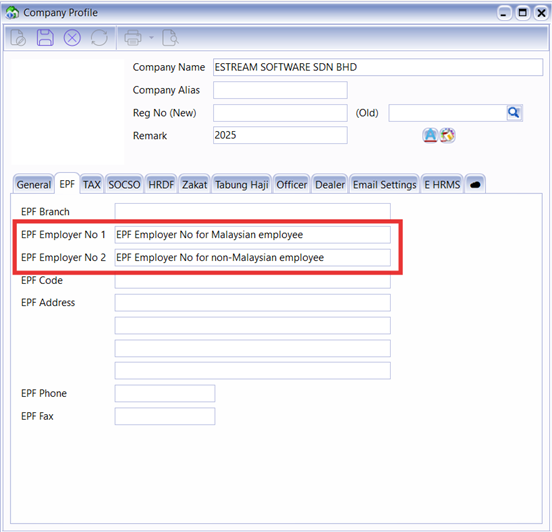

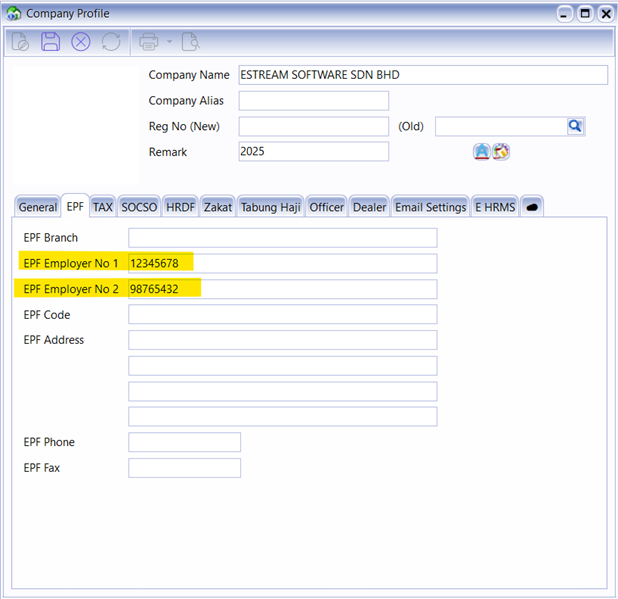

-

Under EPF tab, the system is updated with new extra field EPF Employer No. 2 to update Foreign worker employer EPF No.

*EPF Employer No 1 = Malaysian Employee

*EPF Employer No 2 = Non-Malaysian Employee (Optional)

-

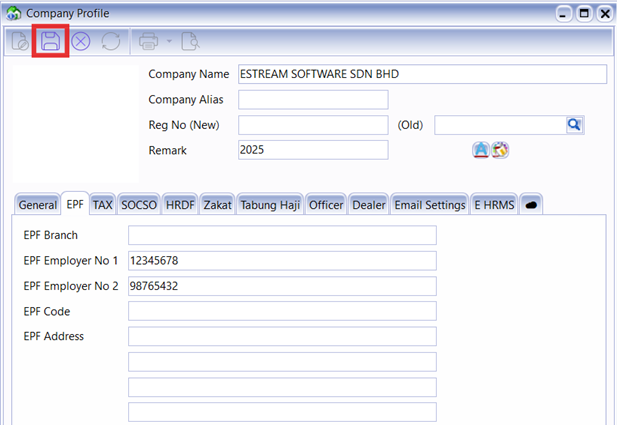

Ensure that the EPF Employer Number is filled in accurately.

-

Click Save to apply changes.

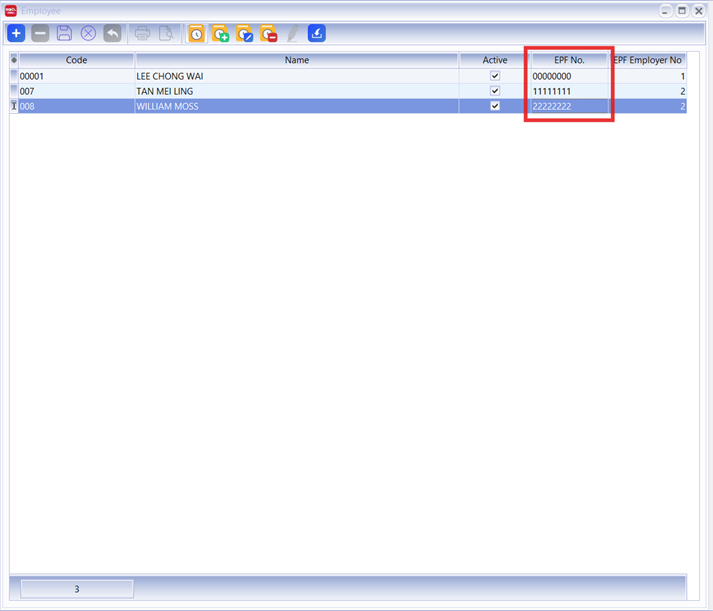

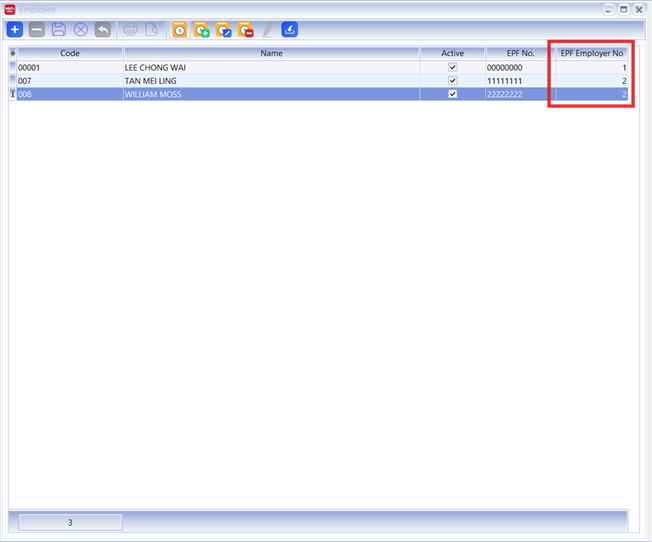

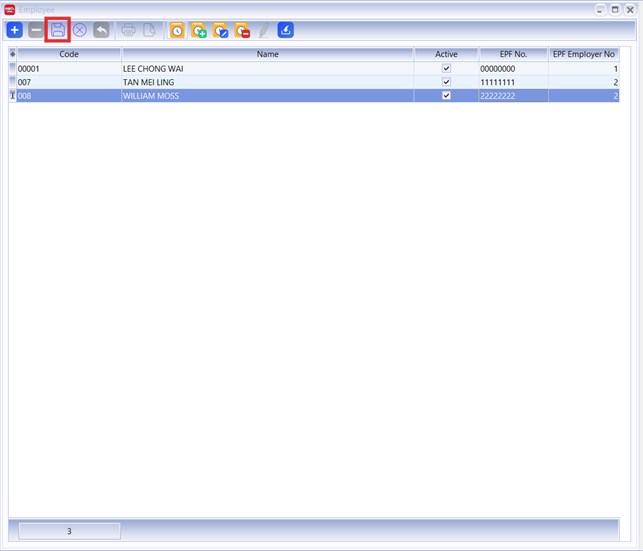

Step 2 : Batch Edit Employee EPF Number

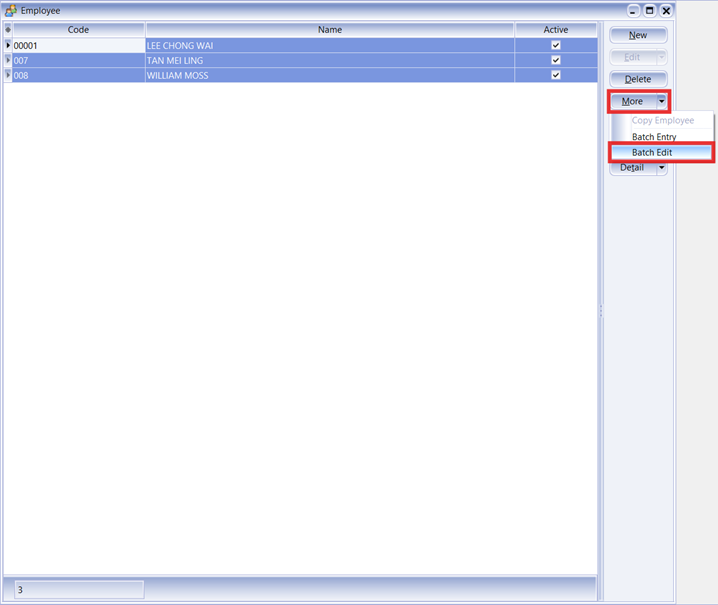

SQL includes a Batch Edit function that allows you to update employees’ EPF information all at once.

-

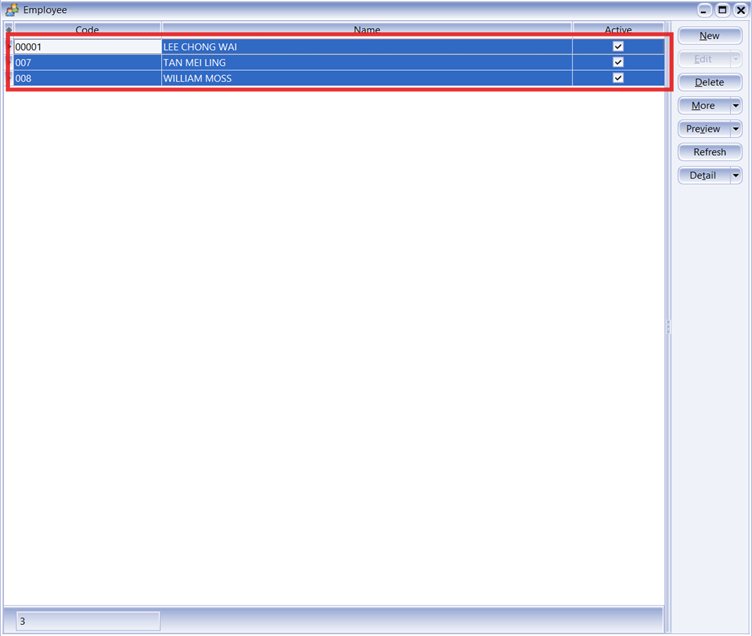

Go to Human Resource → Maintain Employee

-

Select the foreign employees by highlighting the employees using Ctrl button

-

Click on the More option, and select Batch Edit

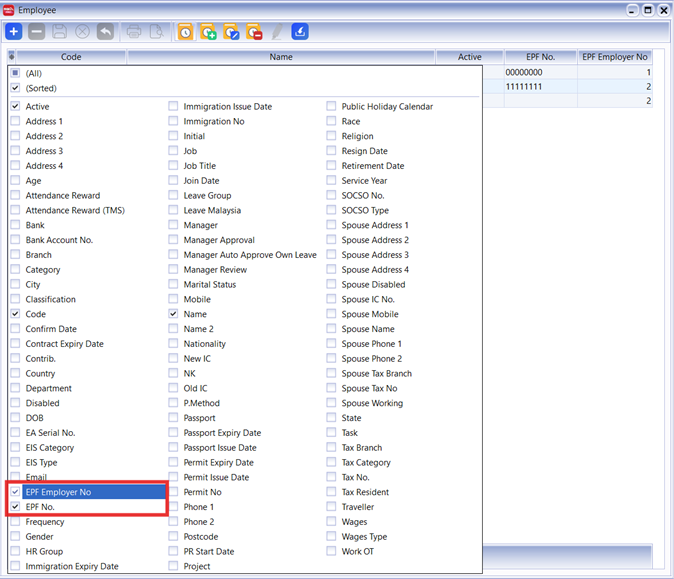

-

Select the field chooser (* icon on top left of the table), then select the EPF No. to display it in table (hidden by default).

-

Now, you may update the EPF No. for each employee

-

By default, the system assigns employees to EPF Employer Account 1. If a non-Malaysian employee needs to be registered under EPF Employer Account 2, update the EPF Employer No. field accordingly.

The EPF Employer No. field determines which EPF account the non-Malaysian employee is assigned to:

- 1 = EPF Employer Account 1 (default)

- 2 = EPF Employer Account 2 (if applicable)

noteThis field can only be modified for employees whose Nationality is NOT Malaysia.

-

Click Save to apply changes.

-

Verify that you have successfully updated the EPF Employer No and EPF No. for all employees

note

noteThe EPF Employer No. field is only visible when the employee’s Nationality is NOT Malaysia.

Step 3 : Generate EPF Submission File

-

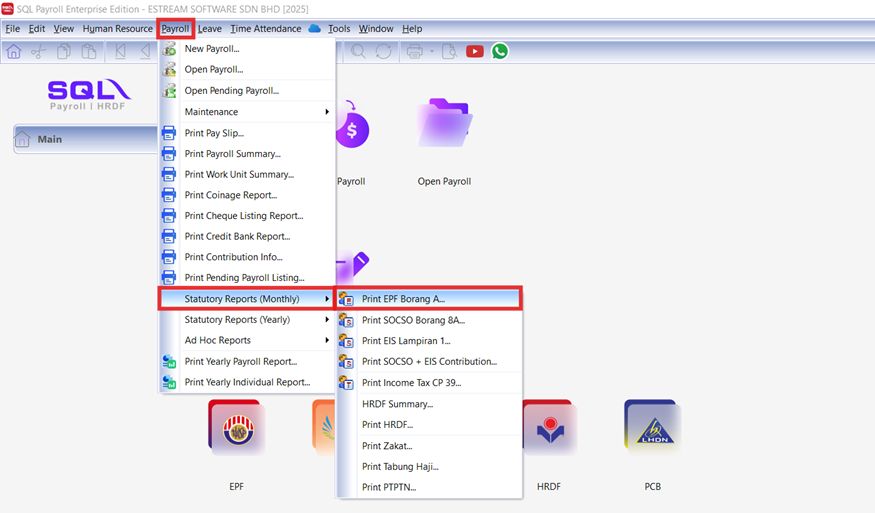

Go to Payroll → Statutory Reports (Monthly) → Print EPF Borang A…

-

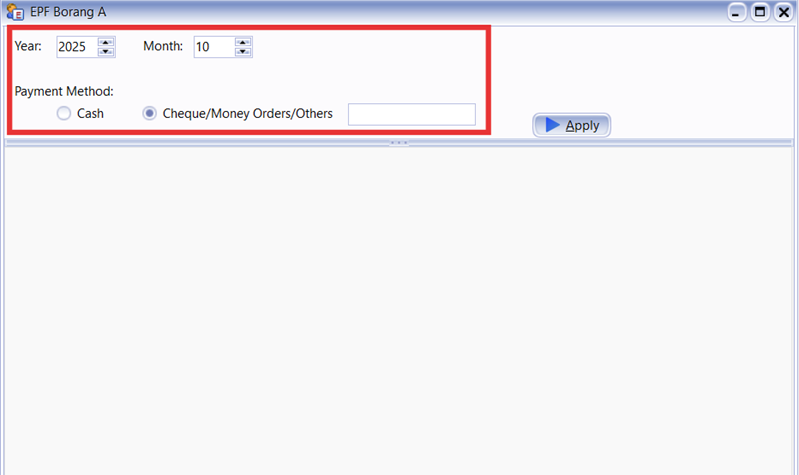

Select the Year, Month and payment method for the EPF

-

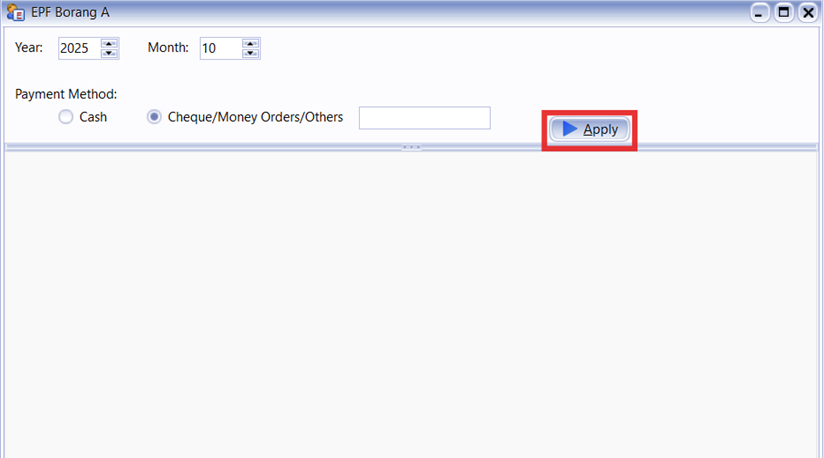

Click Apply

-

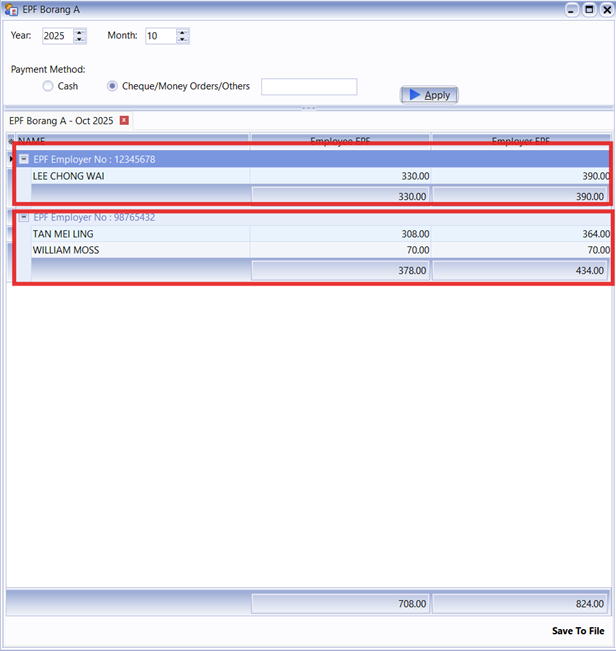

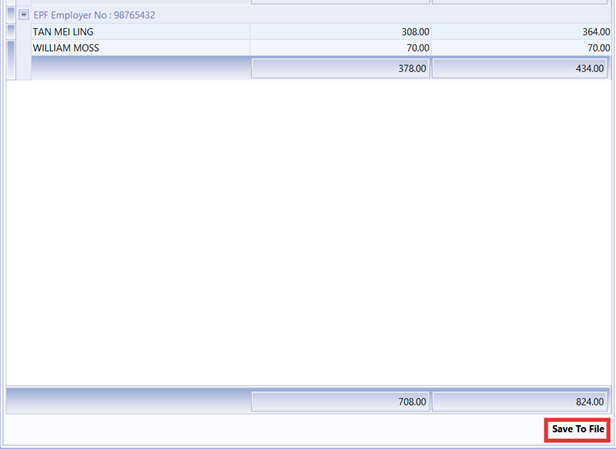

The system will group employees based on Employer EPF Number and display the EPF contribution details, including both employee and employer portions.

*Note : If employee's nationality is not Malaysia, he/she will be group to Employer EPF No 2

-

Click the Save to File to generate the EPF submission text file

-

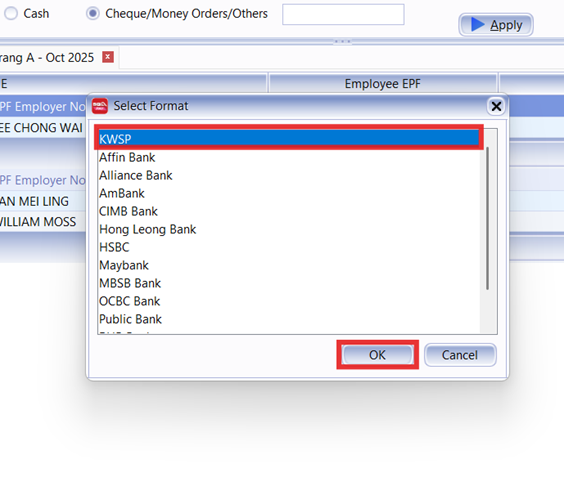

Choose the desired format, and click OK

-

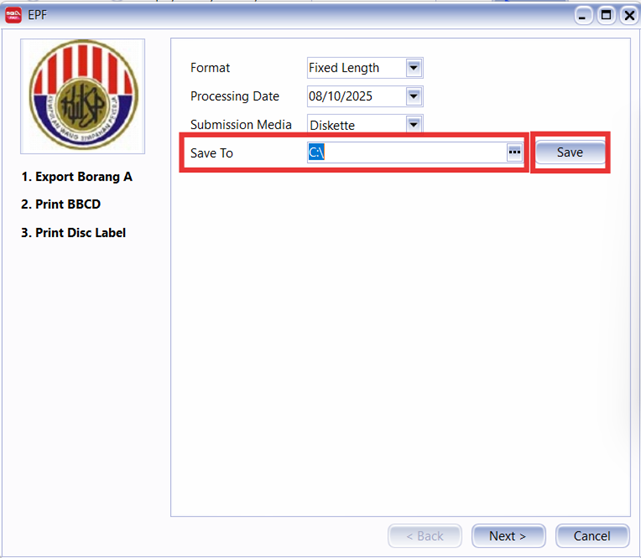

Select the download path, then click Save

-

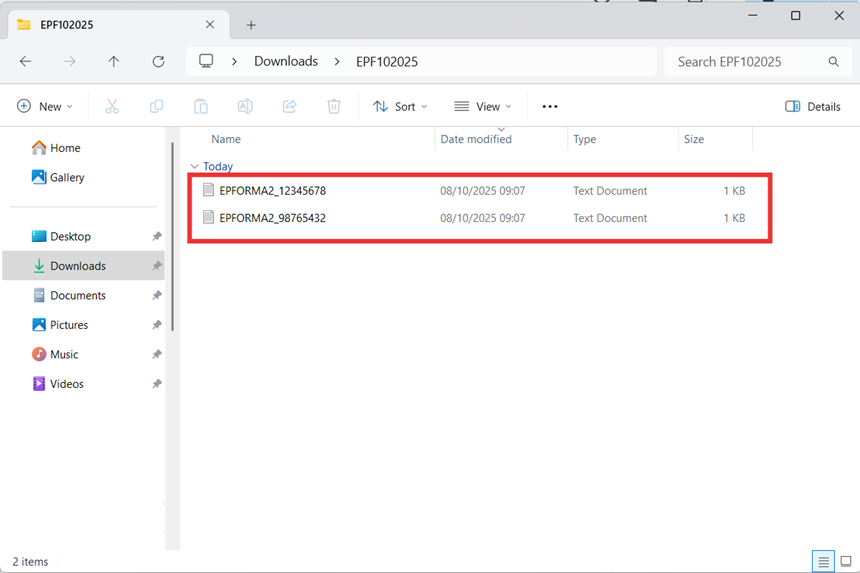

Once done, the system will automatically generate 2 text files separately for local and foreign employees

Now, you can upload the files generated from SQL Payroll to KWSP portal for EPF submission!

Frequently Asked Questions (FAQ)

-

What are the employer’s and employee’s share contribution rates for non-Malaysian citizen employees starting from the implementation date?

- The contribution rates for non-Malaysian citizen employees starting from October 2025 are as follows:

- The contribution rates for non-Malaysian citizen employees starting from October 2025 are as follows:

-

What must the non-Malaysian citizen employees do to maintain the employee’s share contribution rate at 11%?

- To maintain the employee's share contribution rate at 11% after the effective date of the new policy, employees must complete and submit the relevant form to their employer.

- The employer must then submit an application to contribute above the statutory rate via i-Akaun (Employer). Download the EPF application form

-

For non-Malaysian citizen employees who have already opted to contribute to the EPF before the effective date of this new policy, do they need to re-register with the EPF?

- No. Non-Malaysian citizen employees who are already registered and whose EPF member accounts remain active do not need to submit a new membership registration. Their existing member number will remain valid for all dealings with the EPF.

-

Where can members verify their registration status?

-

Registration can be verified through the following channels:

- Verification by employers via i-Akaun (Employer)

- Verification by members at any EPF offices

-

-

What types of work passes require EPF contribution?

-

Non-Malaysian citizen employees who are employed starting from October 2025 salary and hold any of the following work passes are required to contribute to EPF:

- Visitor's Pass (Foreign Workers except Foreign Domestic Helpers)

- Employment Pass

- Professional Visitor Pass

- Student Pass

- Residence Pass

- Long-Term Social Visit Pass

Important Notes- The obligation to contribute applies to non-Malaysian citizen employees who are employed and receive wages in the form of money starting from the October 2025 salary

- Work permission for Professional Visitor Pass (Specialized), Student Pass, Residence Pass and Long-Term Social Visit Pass must be obtained in advance from the Immigration Department of Malaysia

-

-

Do employers need new registration for mixed workforce?

- No. If an employer hires both Malaysian and non-Malaysian citizen employees, the employer is NOT REQUIRED to submit a new employer registration and may use the existing employer number.

-

When can EPF contributions be stopped for foreign workers?

- The obligation to contribute for non-Malaysian citizen employees ceases during the final two (2) months before the expiry of the employee's work pass, even if the employee is still in service.