FAQ

Bounced Payments in Foreign Currencies

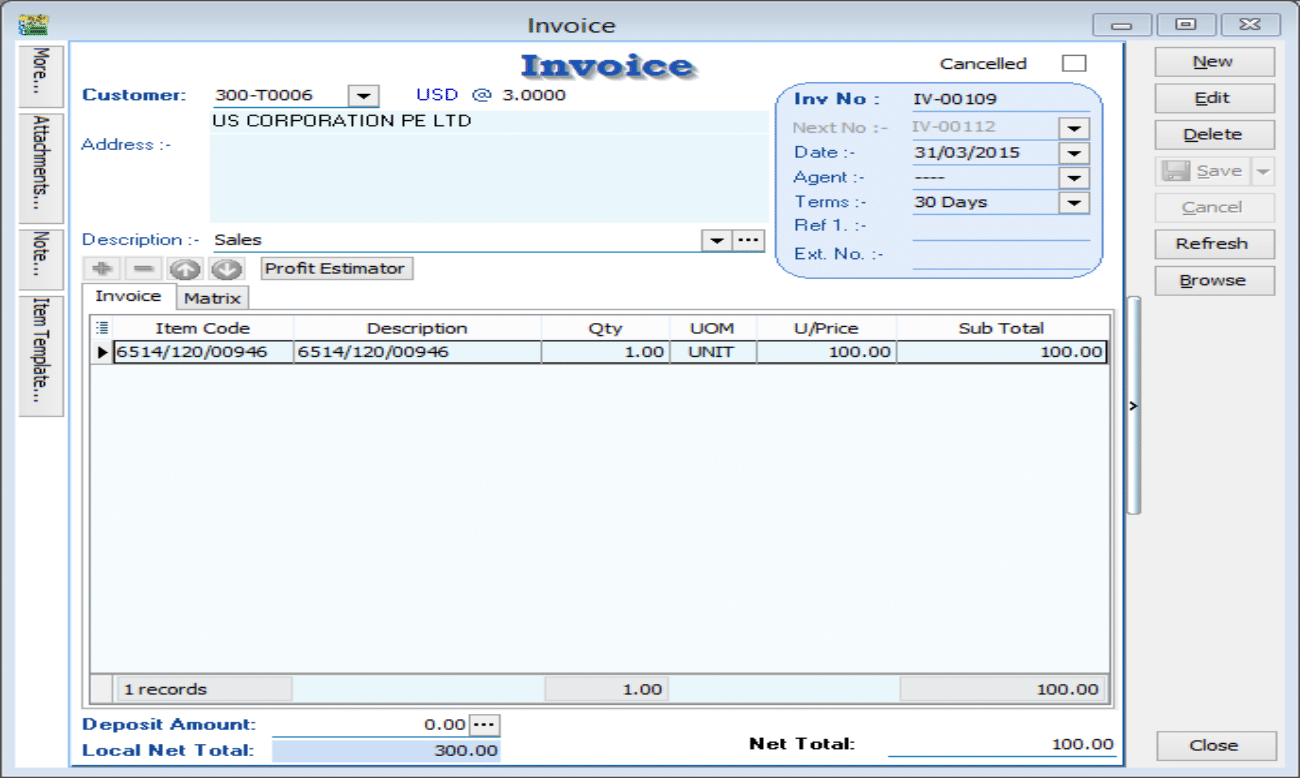

Customer Invoice

Example: Invoice amount USD 100 | Rate 3.00 | Local Net Total = RM 300

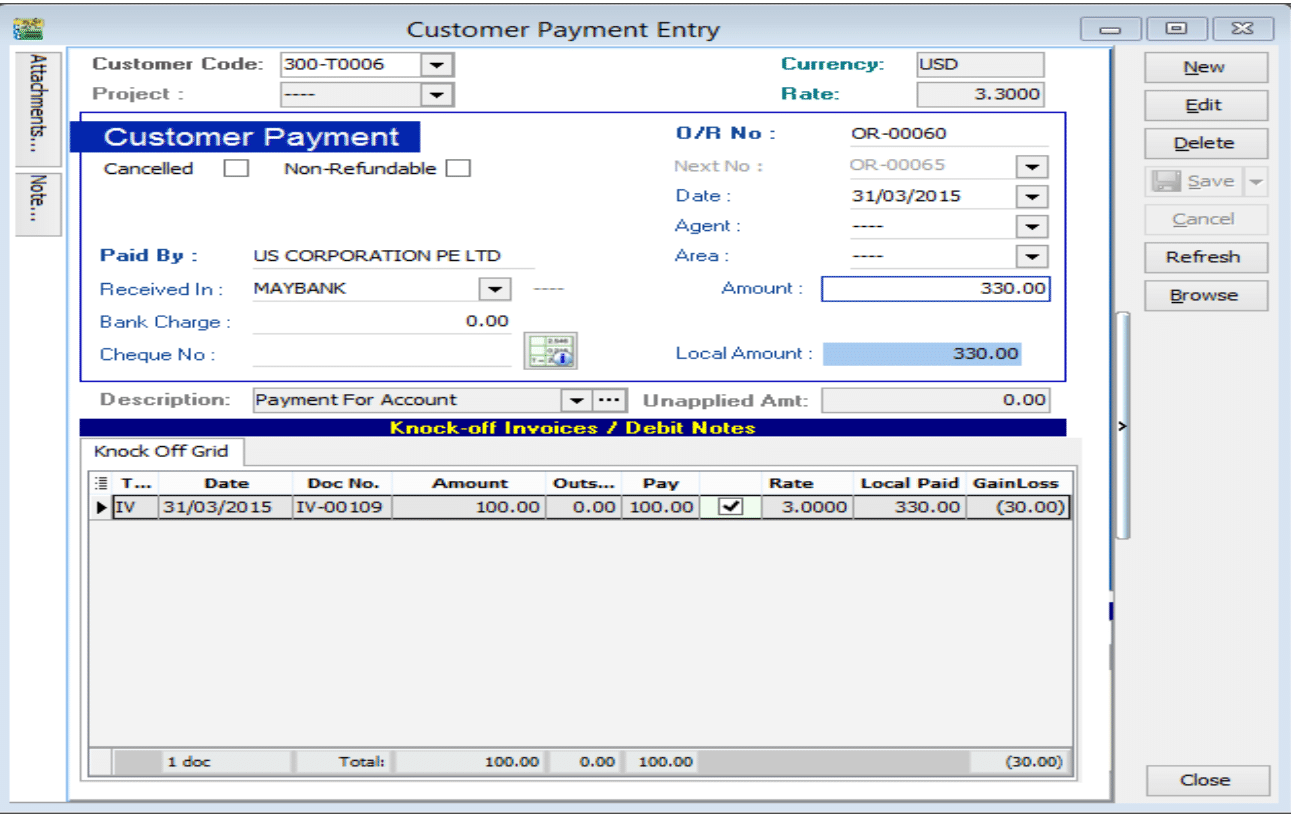

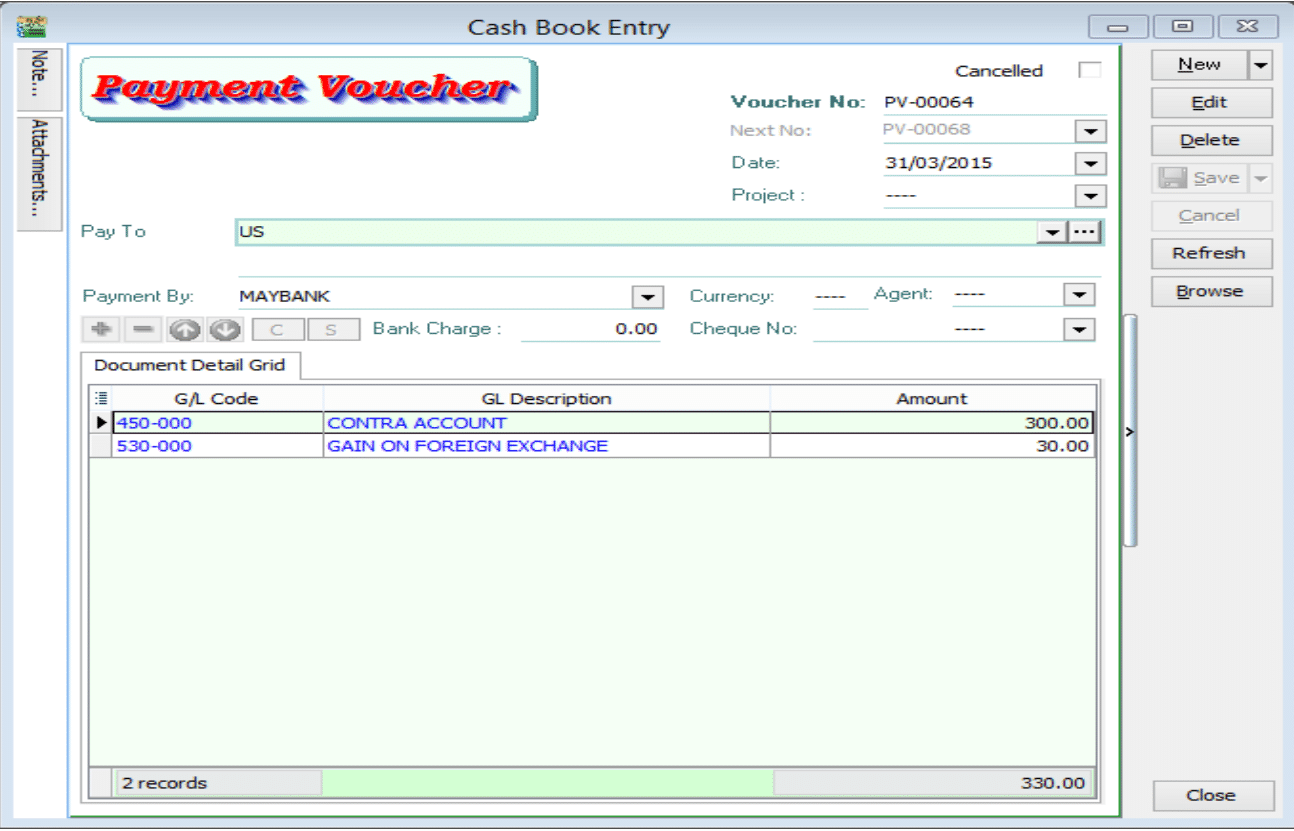

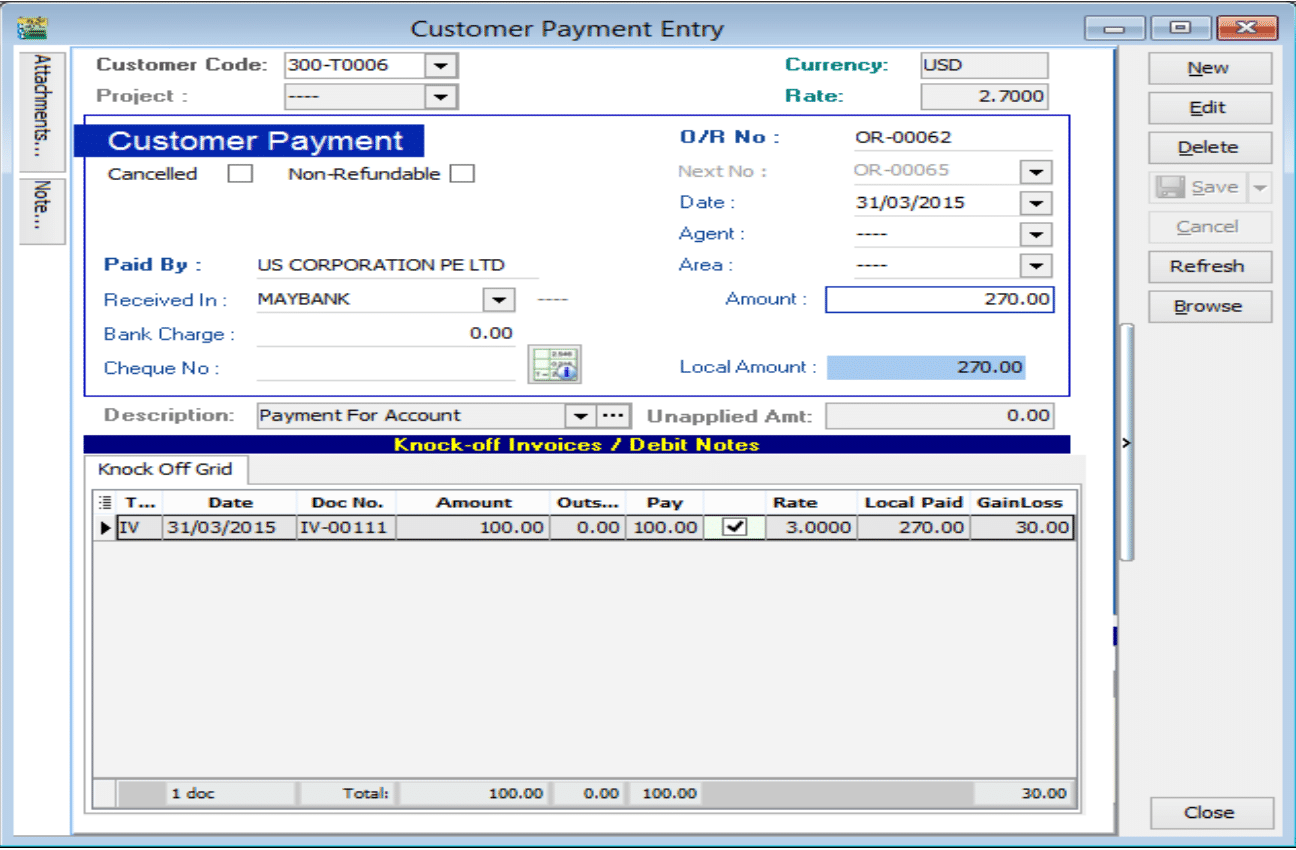

Scenario 1: Payment Received at a Higher Rate (Gain)

Example: Received RM 330 (Gain of RM 30).

To process the bounced payment:

-

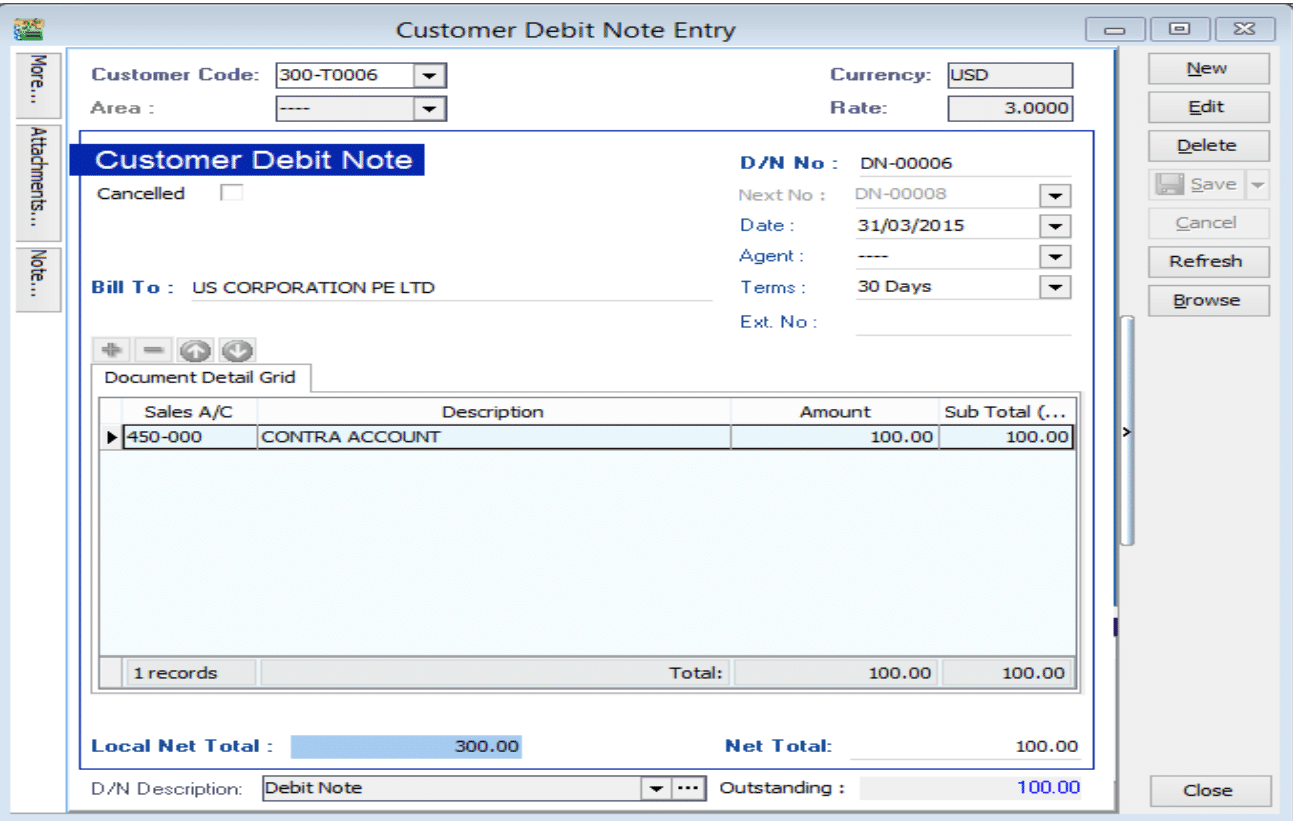

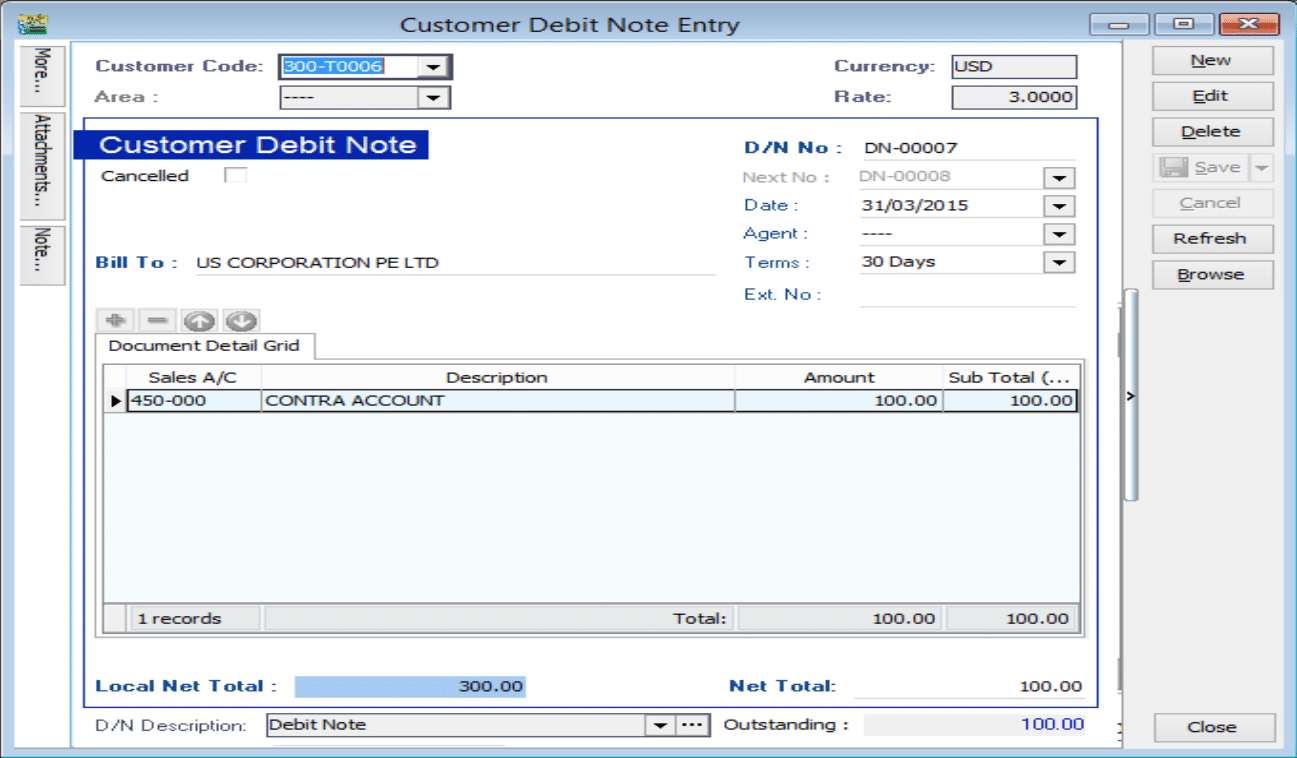

Issue a Customer Debit Note: Create a Debit Note to reverse the original invoice amount.

-

Issue a Payment Voucher: Create a Payment Voucher to credit out the amount that was previously knocked off.

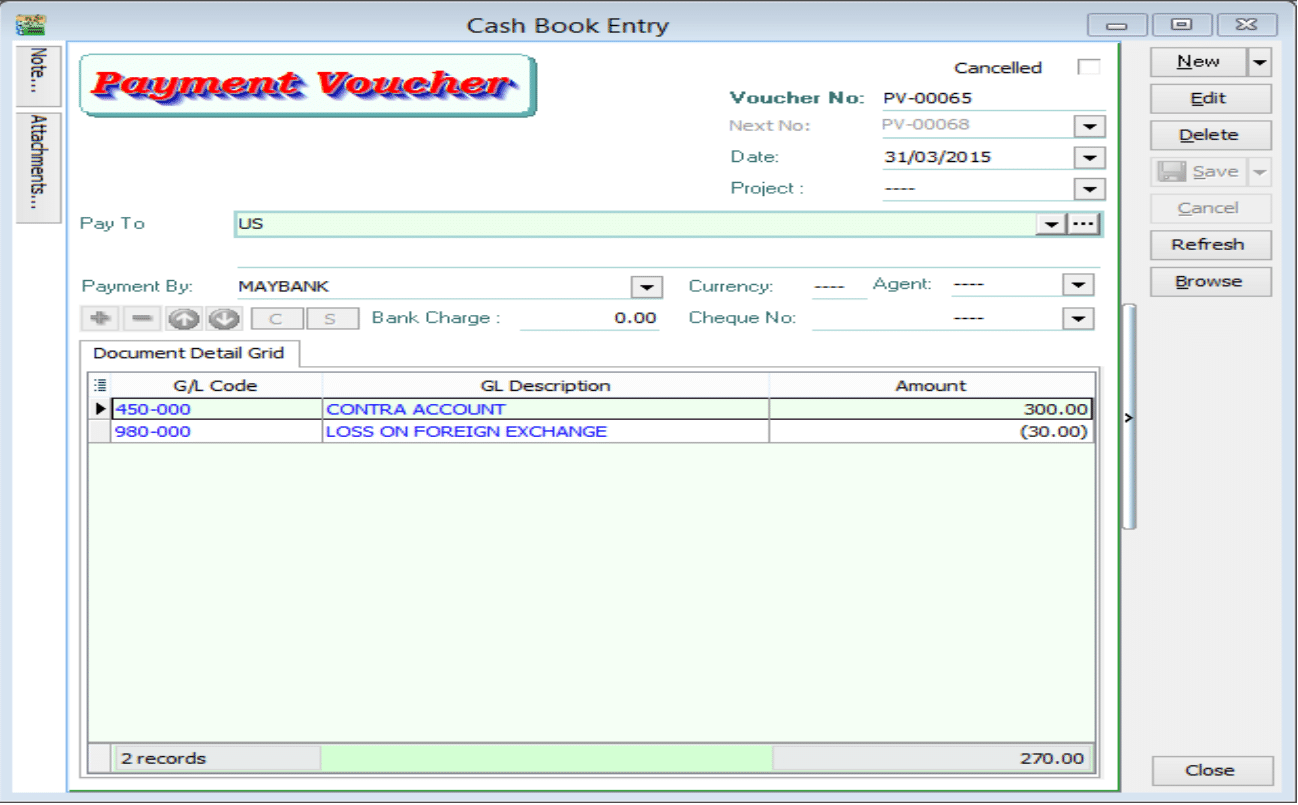

Scenario 2: Payment Received at a Lower Rate (Loss)

Example: Received RM 270 (Loss of RM 30).

To process the bounced payment:

-

Issue a Customer Debit Note: Create a Debit Note to reverse the original invoice amount.

-

Issue a Payment Voucher: Create a Payment Voucher to credit out the amount that was previously knocked off.

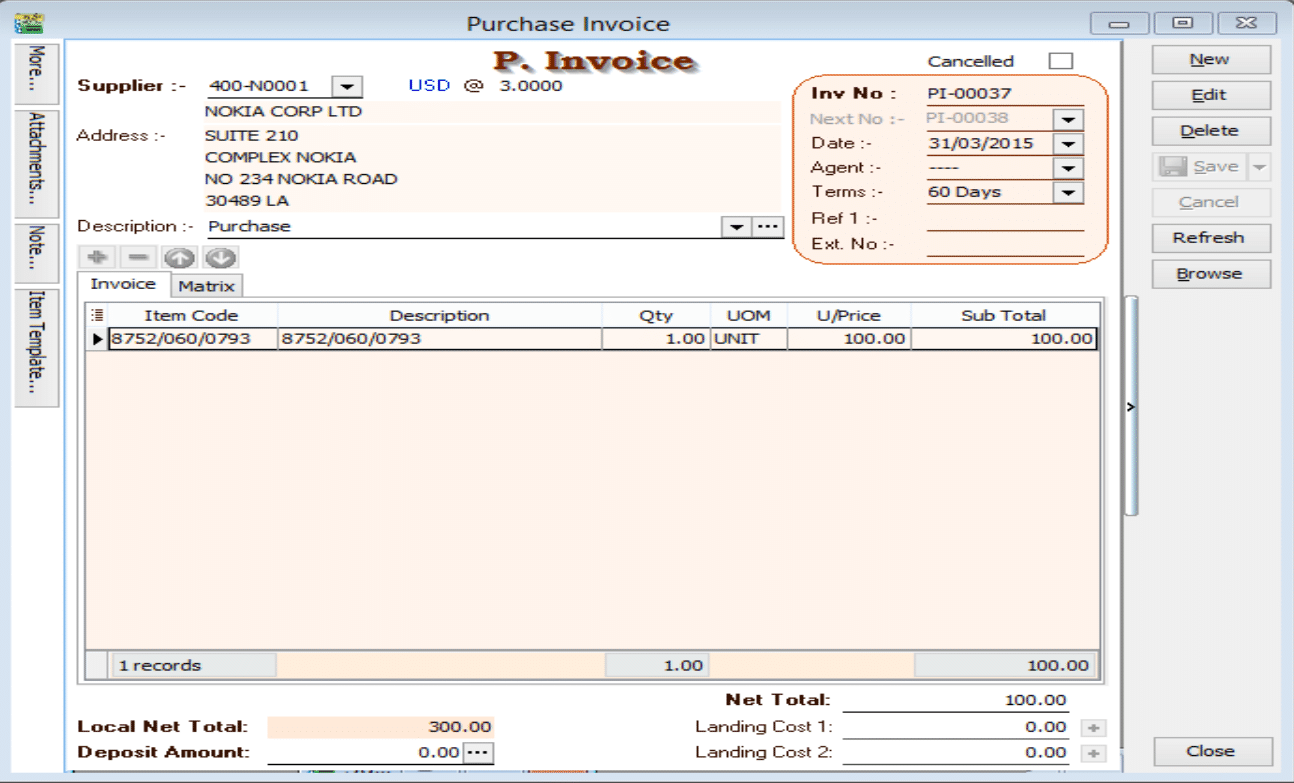

Supplier Invoice

Example: Supplier Invoice amount USD 100 | Rate 3.00 | Local Net Total = RM 300

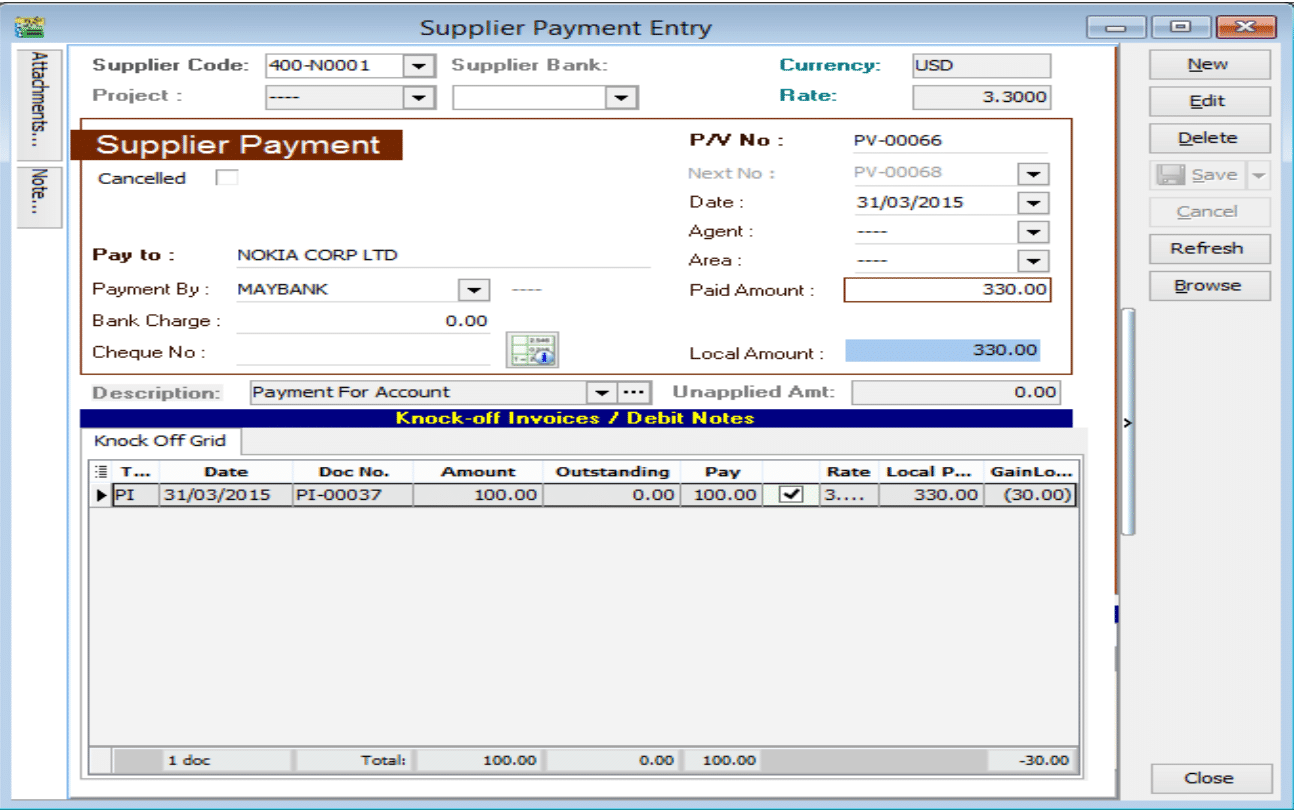

Scenario 1: Payment Made at a Higher Rate (Loss)

Example: Made payment of RM 330 (Loss of RM 30).

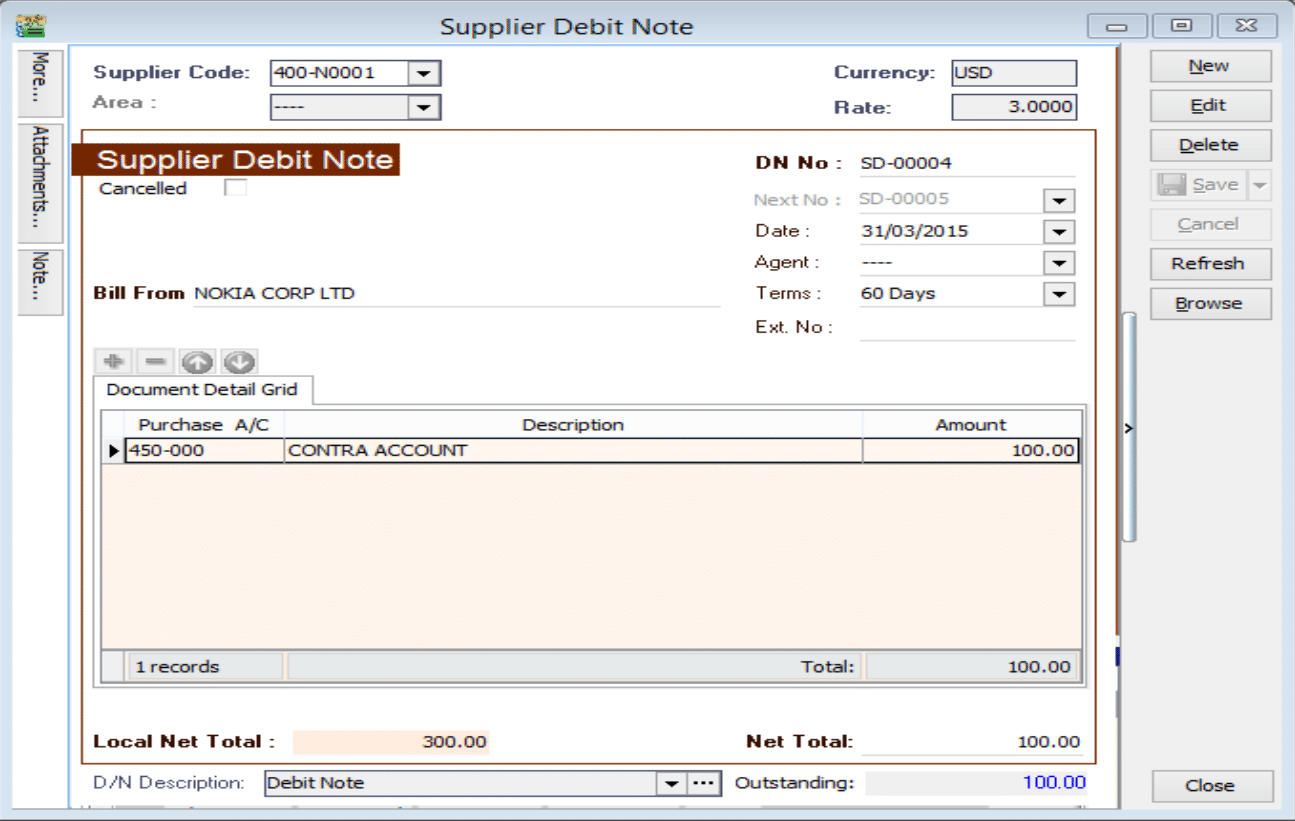

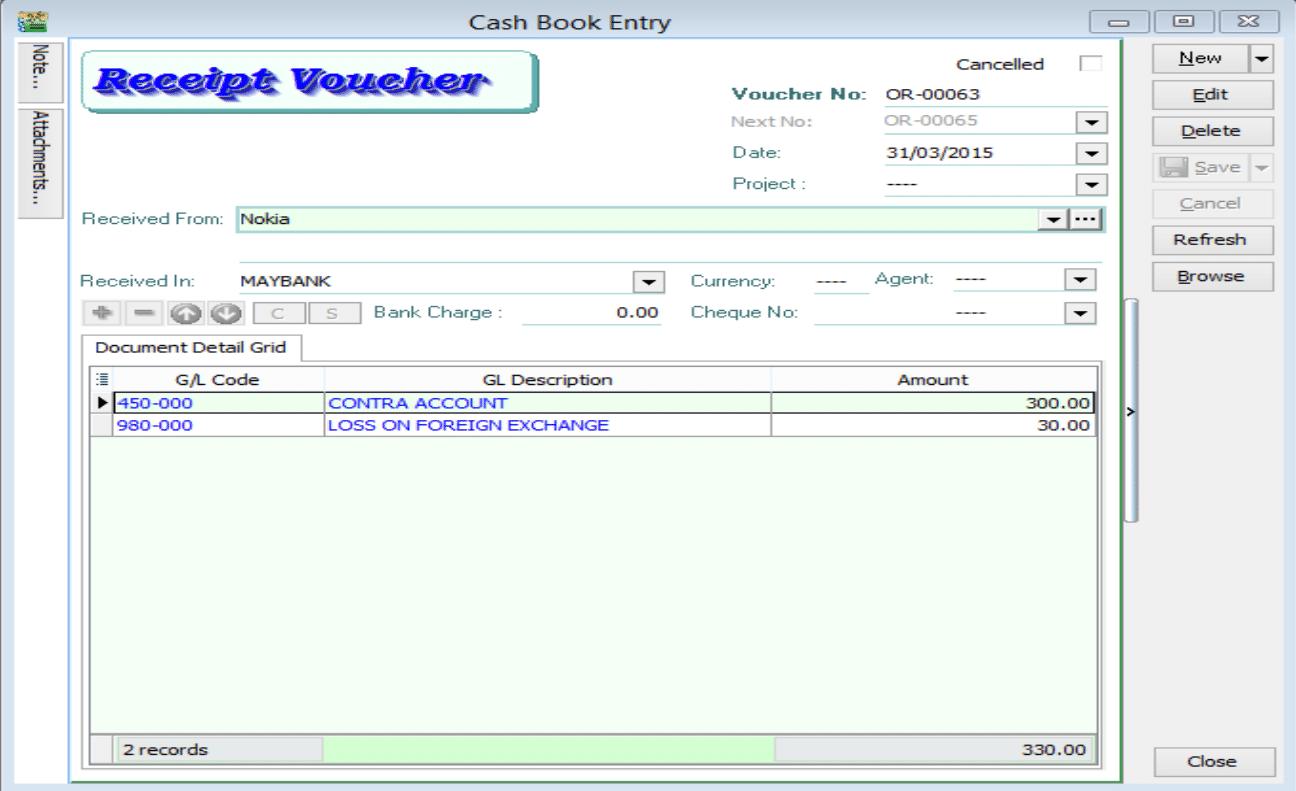

To process the bounced payment:

-

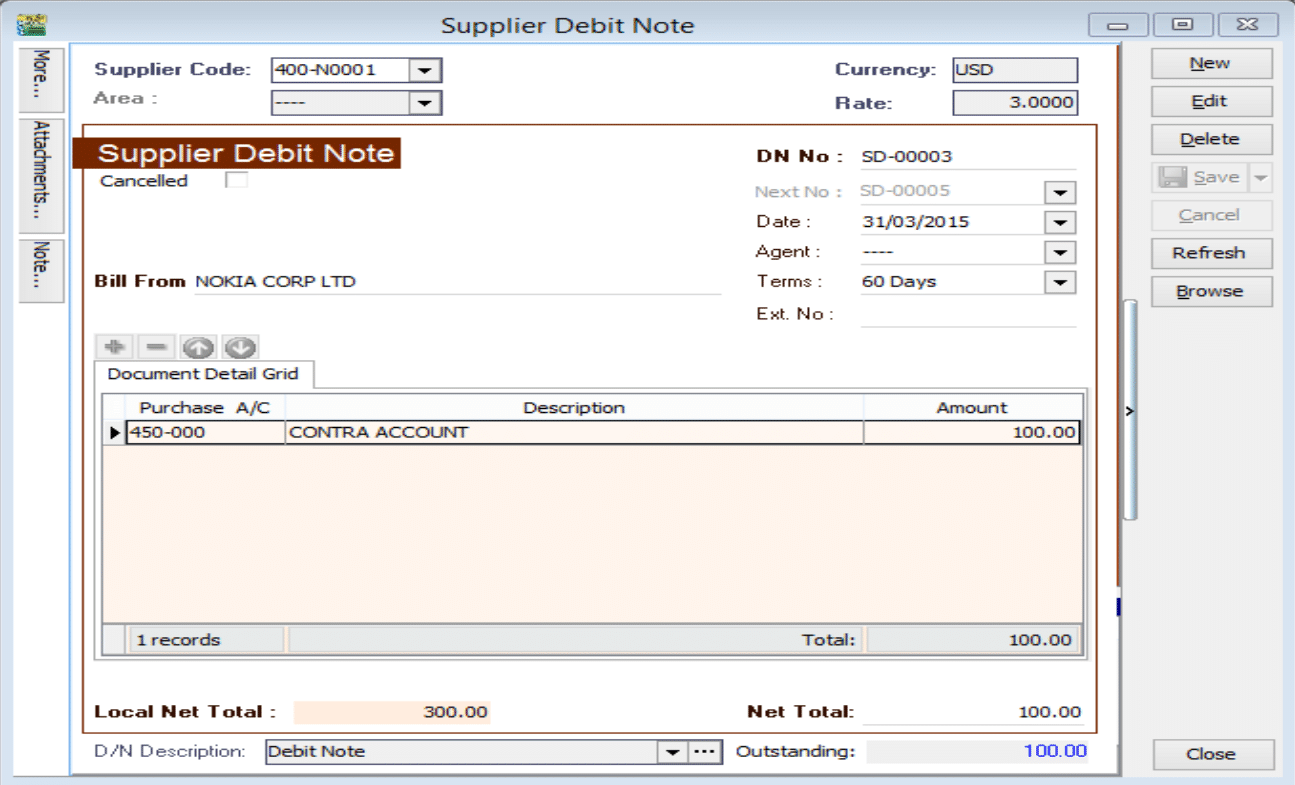

Issue a Supplier Debit Note: Create a Debit Note to reverse the original invoice amount.

-

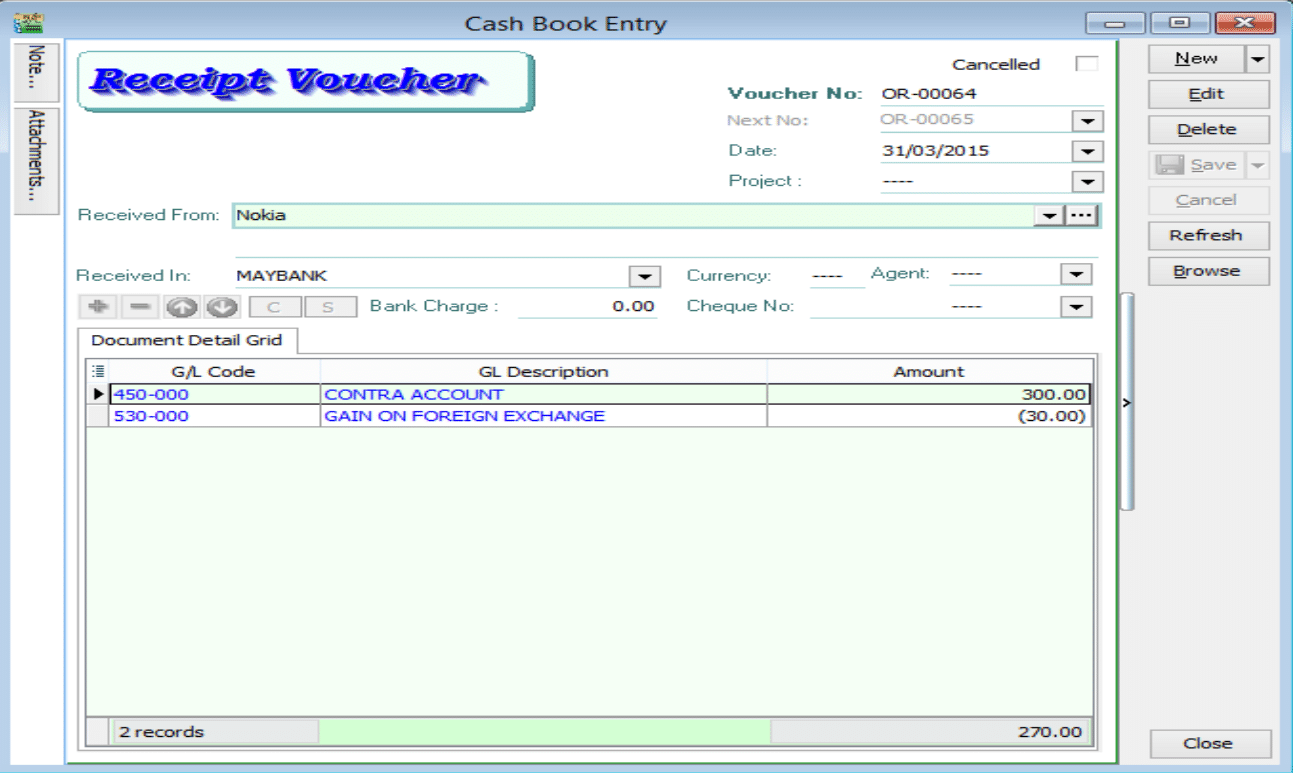

Issue an Official Receipt: Create an Official Receipt to debit the amount that was previously knocked off.

infoAssign the USD 30 difference to a Loss on Foreign Exchange GL account.

Scenario 2: Payment Made at a Lower Rate (Gain)

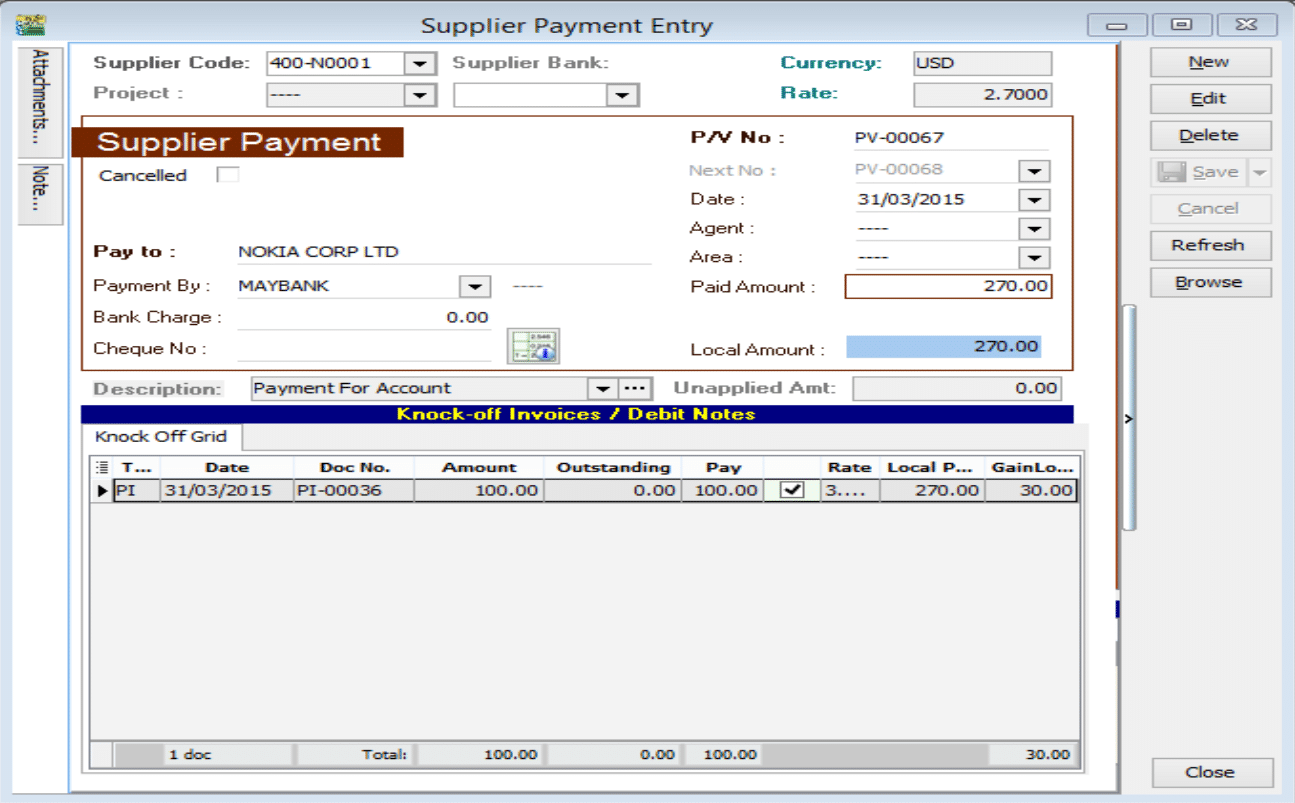

Example: Made payment of RM 270 (Gain of RM 30).

To process the bounced payment:

-

Issue a Supplier Debit Note: Create a Debit Note to reverse the original invoice amount.

-

Issue an Official Receipt: Create an Official Receipt to debit the amount that was previously knocked off.

infoAssign the USD -30 difference to a Gain on Foreign Exchange GL account.

Unrealized Foreign Exchange Gain/Loss

Posting Unrealized Gain/Loss

-

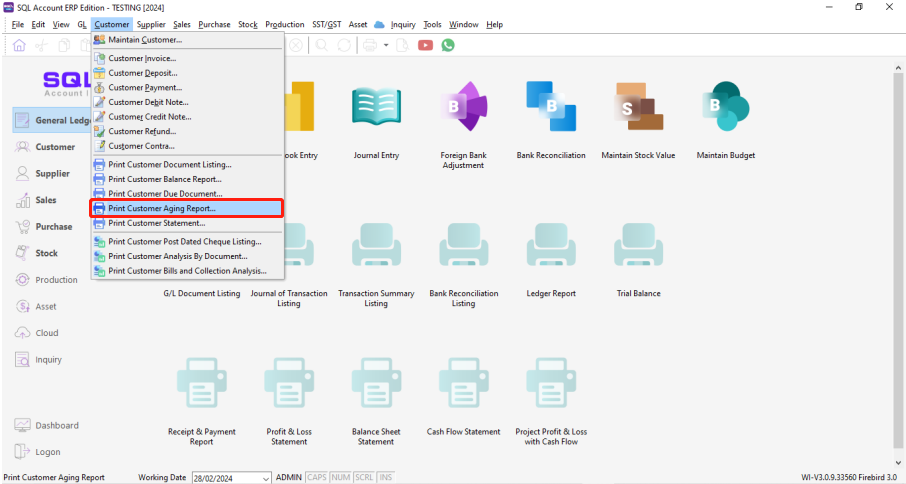

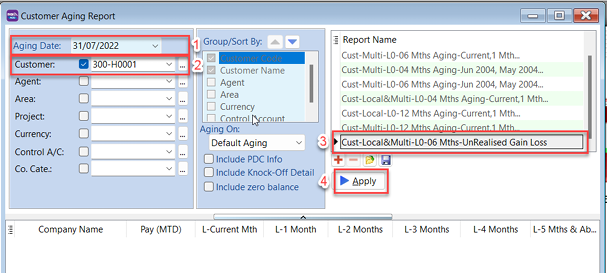

Go to Customer → Print Customer Aging Report.

-

Select the Date.

-

Select the Foreign Customer.

-

Select the Unrealized Gain Loss report format.

-

Click Apply.

-

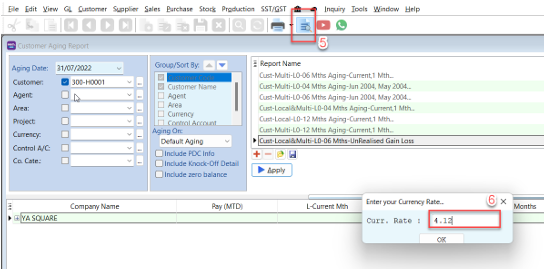

Click Preview. A dialog will prompt you to enter the currency rate.

-

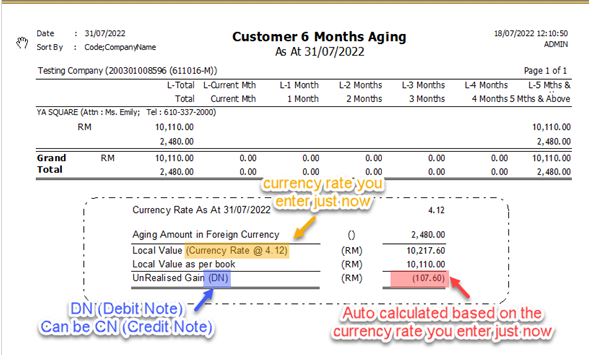

Enter the Closing Currency Rate and click OK.

-

The system will display the report with the auto-calculated Unrealized Gain/Loss Amount.

-

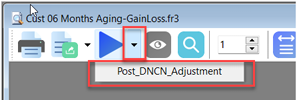

Click Post_DNCN_Adjustment.

-

A "Posting Done" message will appear.

-

Go to Customer Credit Note or Customer Debit Note to verify the posted adjustment.

- The same steps apply to Suppliers.

- For more information, watch the tutorial on YouTube.

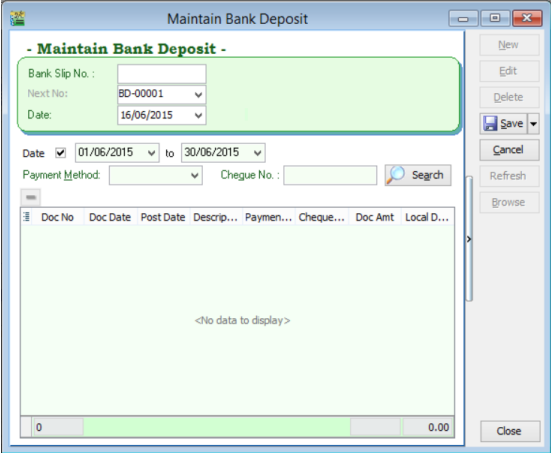

Bank Deposit Management

Bank Deposit is used when banking in two or more cheques in a single transaction slip. This groups the transactions in the Bank Reconciliation screen for easier matching.

Steps to Create a Bank Deposit

-

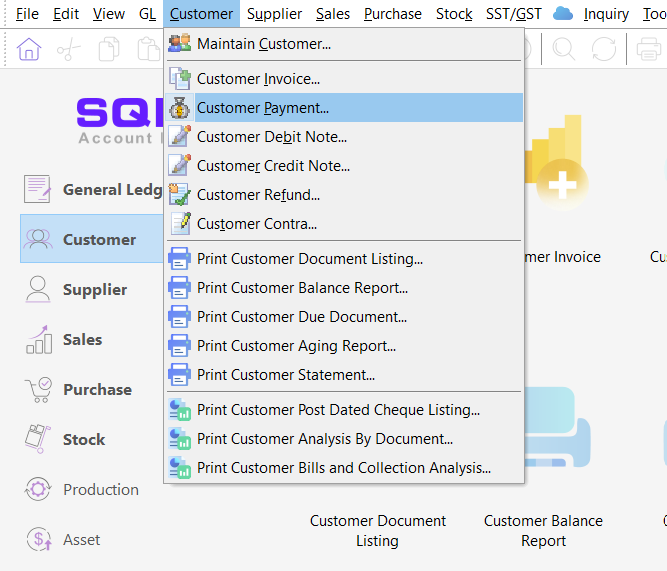

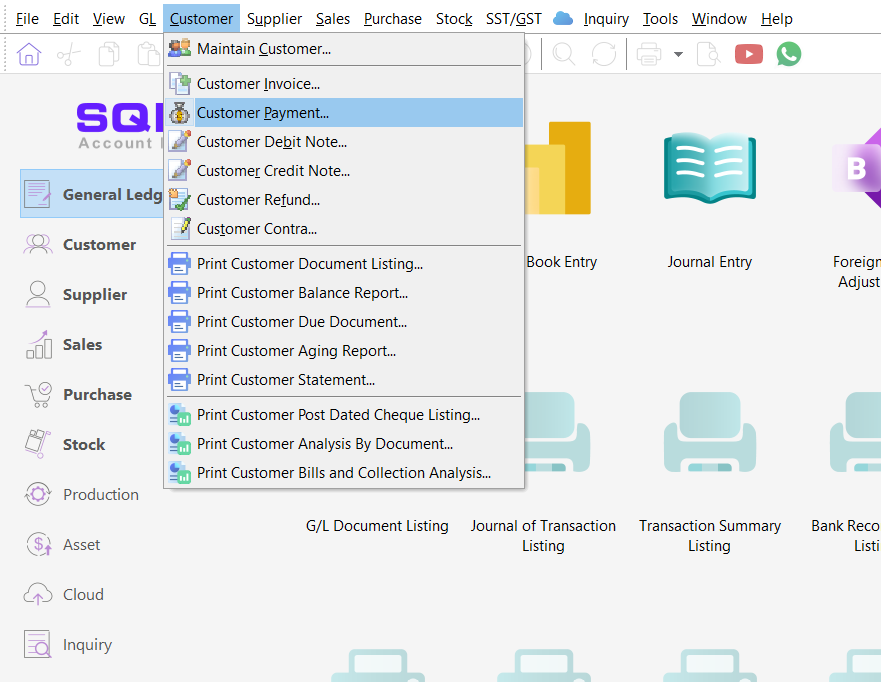

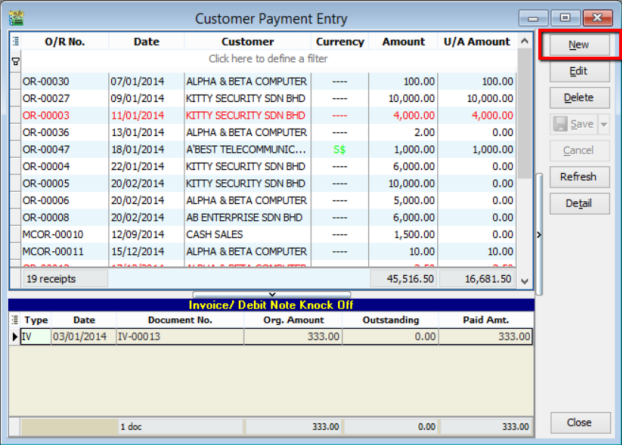

Go to Customer → Customer Payment.

-

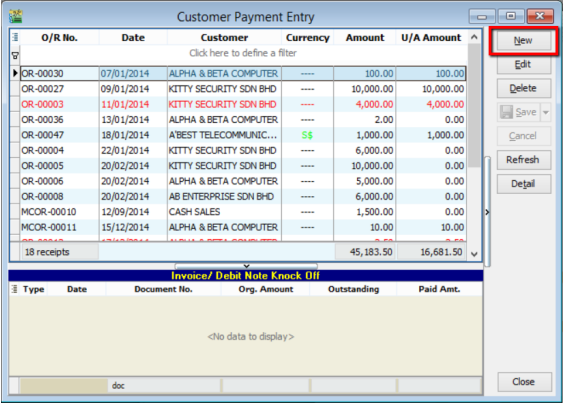

Click New.

-

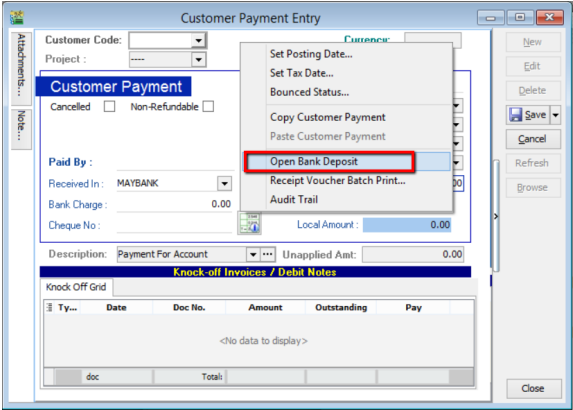

Right-click in the blank space of the entry grid and select Open Bank Deposit.

-

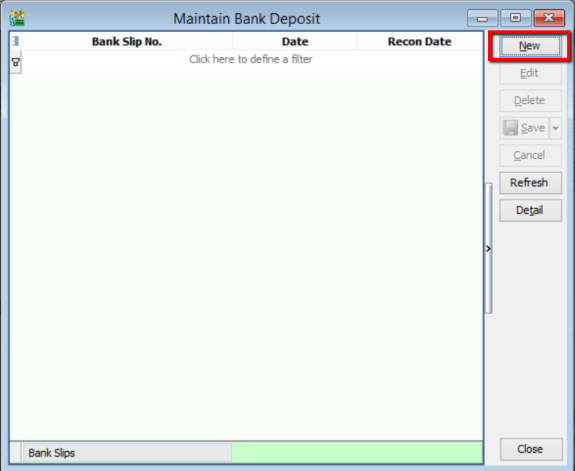

Click New.

-

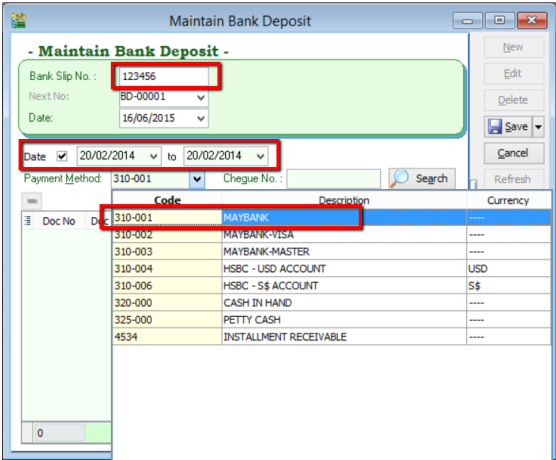

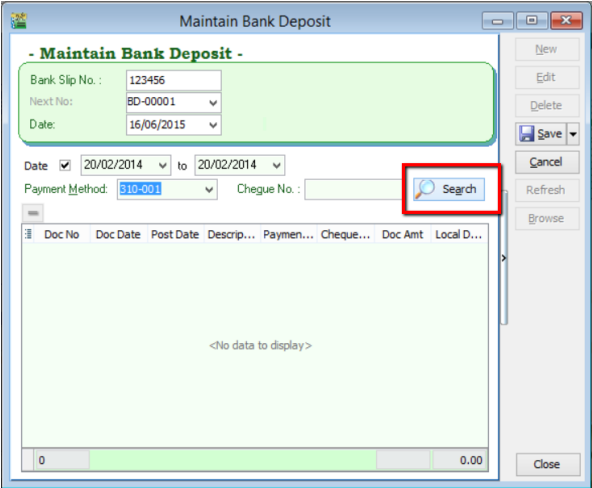

Enter the Transaction Slip Number, select the Date, and choose the Bank Account.

-

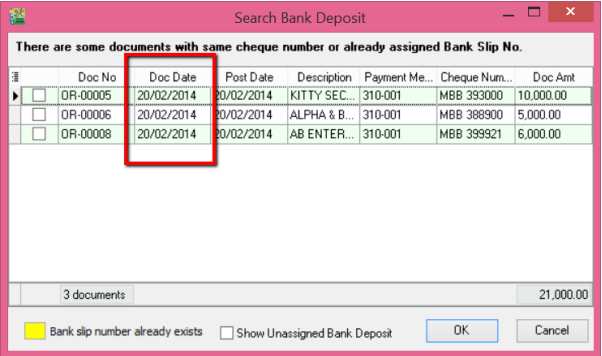

Click Search. The system will find customer payments within the selected date range.

-

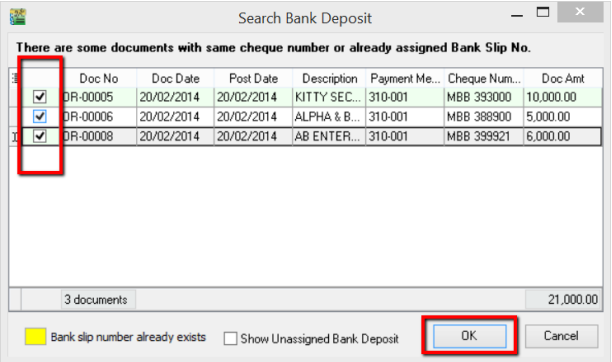

Check the payments included in the same transaction slip and click OK.

-

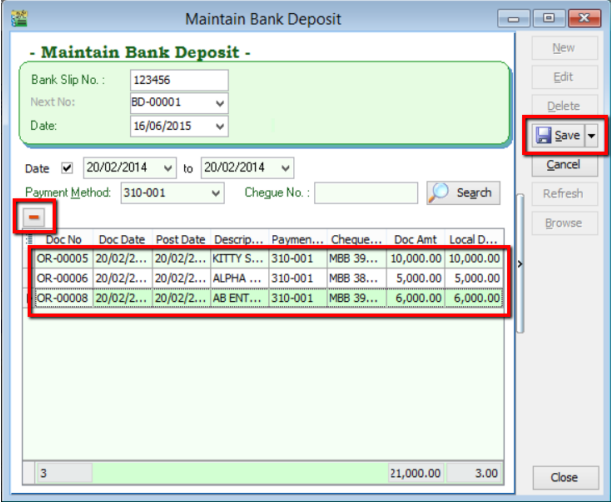

The selected payments will appear in the panel. You can remove incorrect entries using the [-] button. Click Save.

Reconciling the Bank Deposit

-

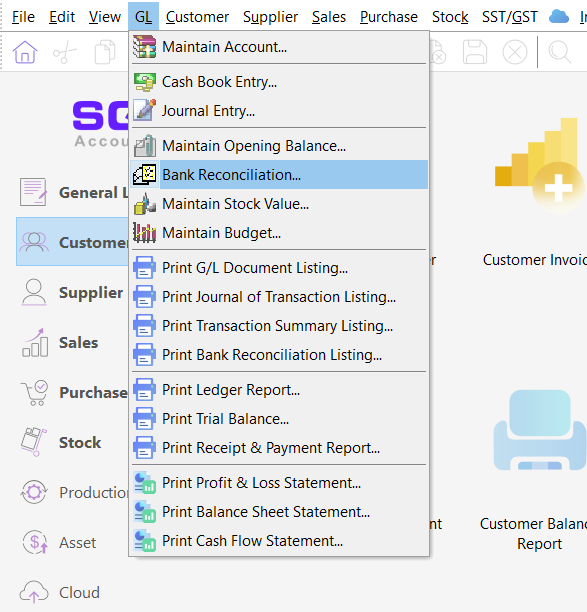

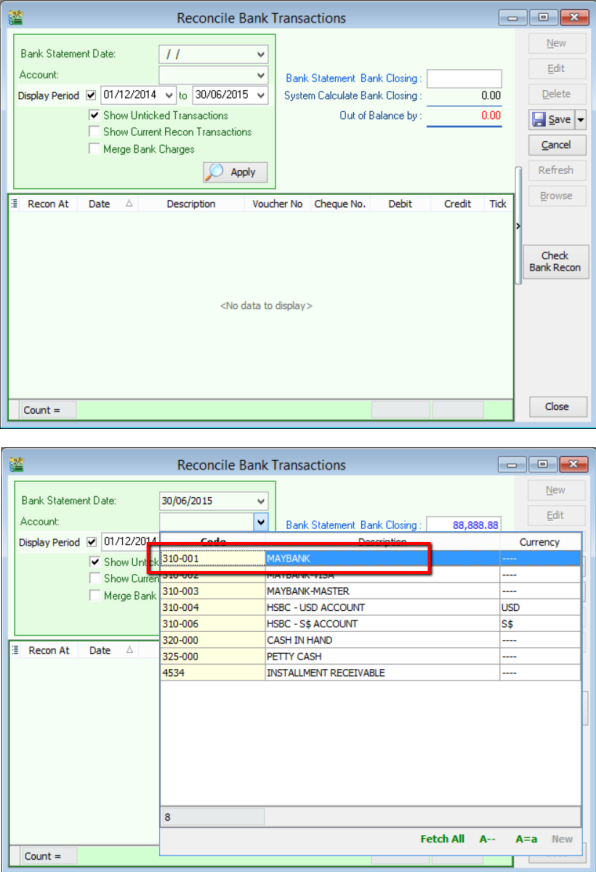

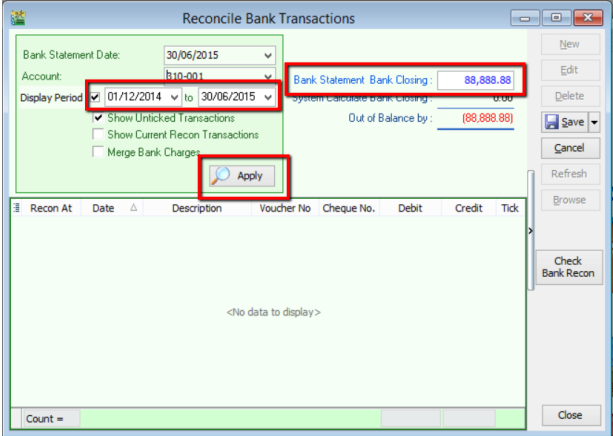

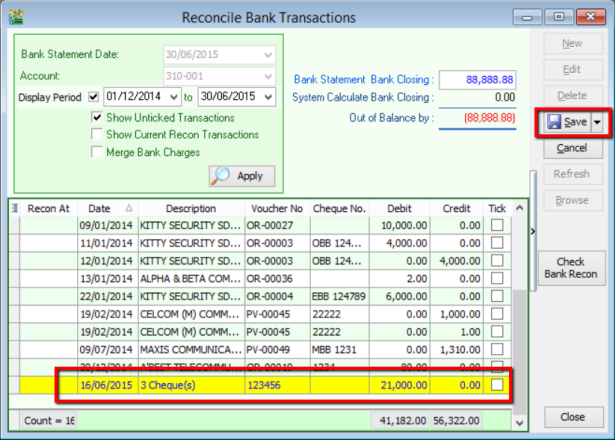

Go to GL → Bank Reconciliation.

-

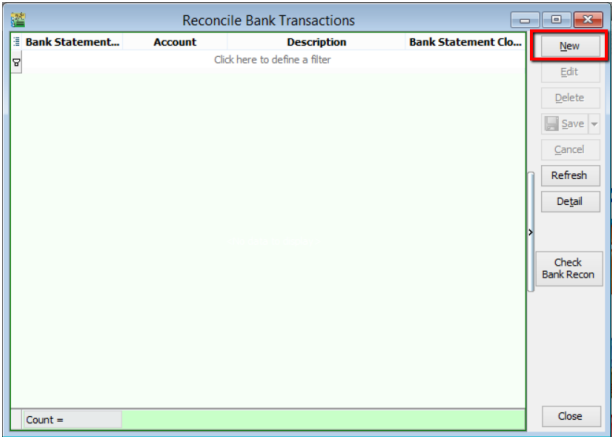

Click New.

-

Select the Bank Statement Date and the correct Bank Account.

-

Set the Display Period (ensure it includes the bank deposit date). Enter the Bank Closing Balance from your statement and click Apply.

-

The cheques from the Bank Deposit will be displayed as a single row with the total amount. Check the row and click Save.

Bank Deposit via Cash Book Entry

You can also create a bank deposit through the Cash Book.

-

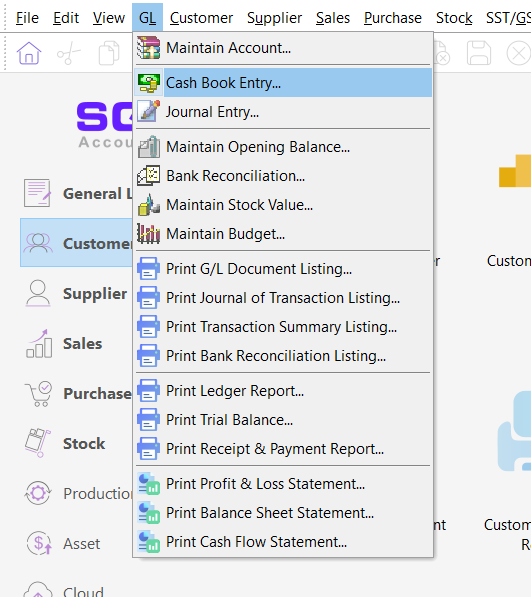

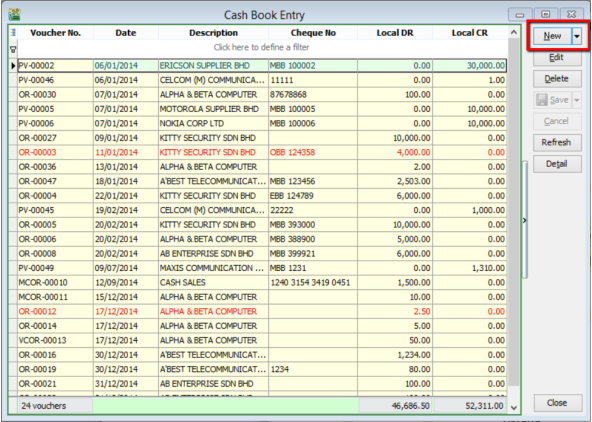

Go to GL → Cash Book Entry.

-

Click New.

-

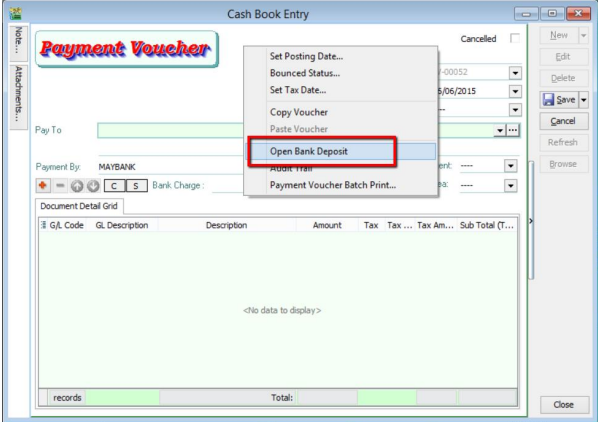

Right-click in the blank space next to the Payment Voucher tab and select Open Bank Deposit.

Multi-Currency Payment Guide

Customer Payment Scenarios

| # | Customer Currency | Payment Received In |

|---|---|---|

| 1 | RM | RM |

| 2 | USD | RM |

| 3 | USD | USD |

| 4 | USD | SGD |

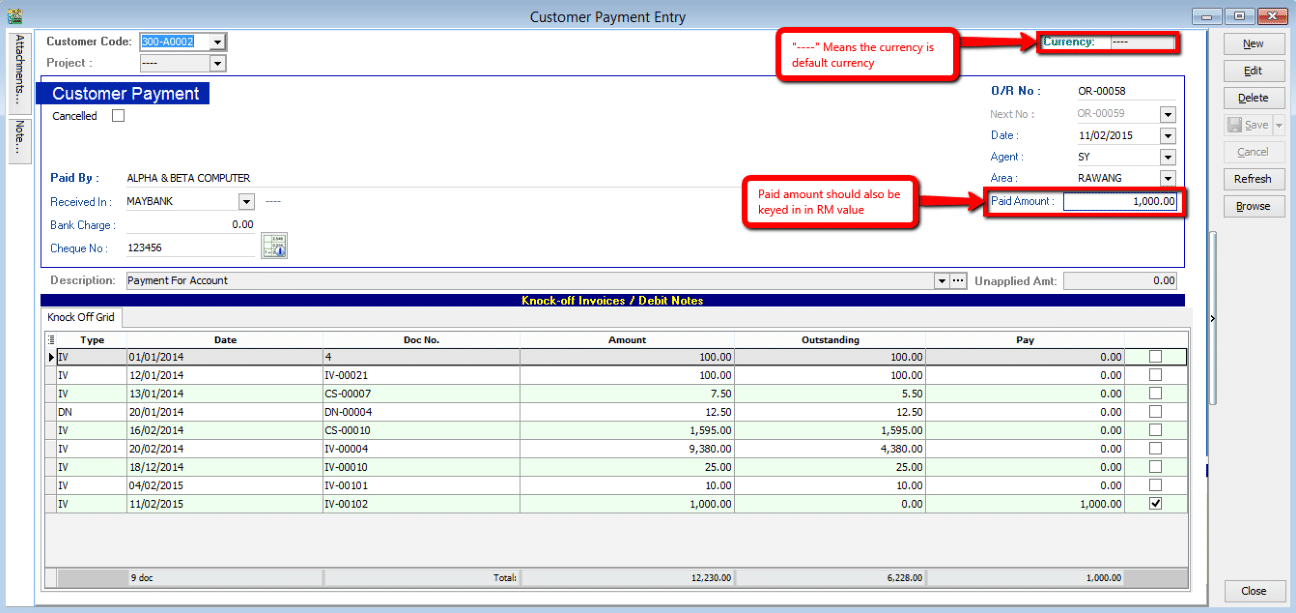

1. Customer Paid in RM & Payment Received in RM

-

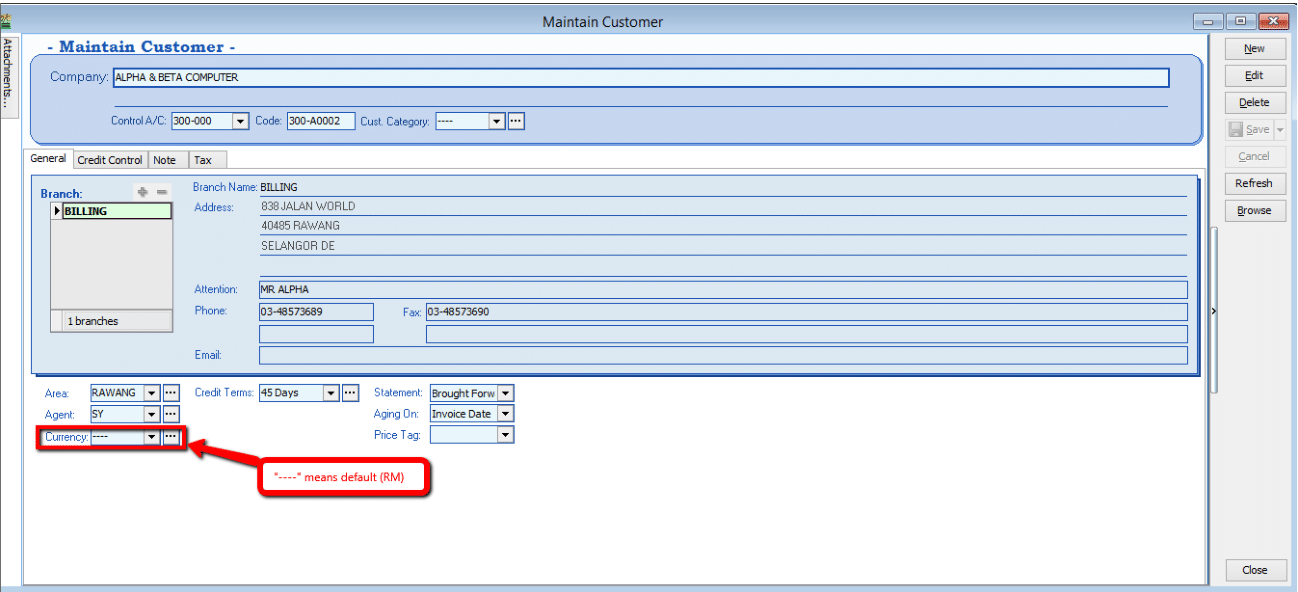

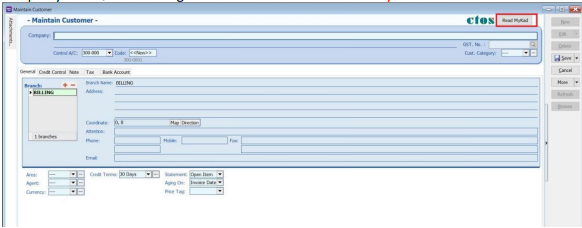

Verify the customer's currency is set to RM (indicated by

----). Go to Customer → Maintain Customer.

-

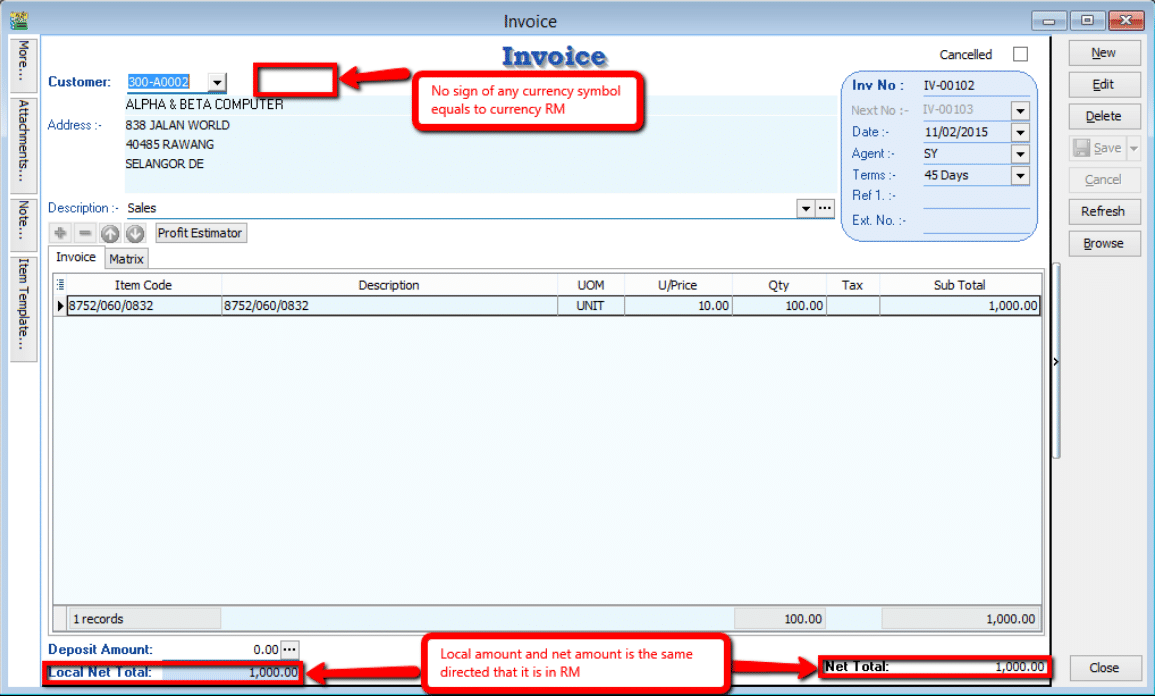

Create the Invoice. Go to Sales → Invoice.

-

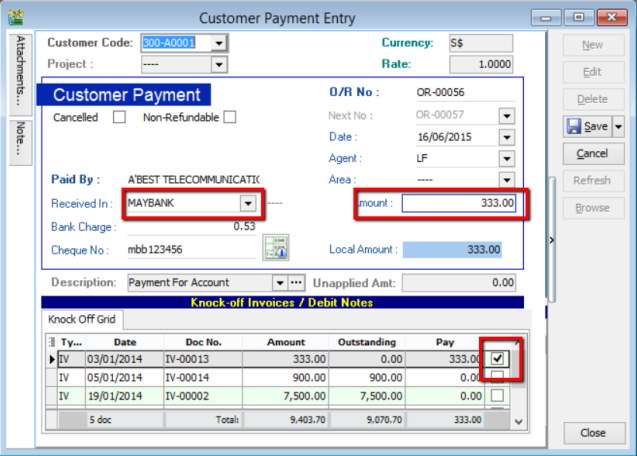

Process the Payment. Go to Customer → Customer Payment.

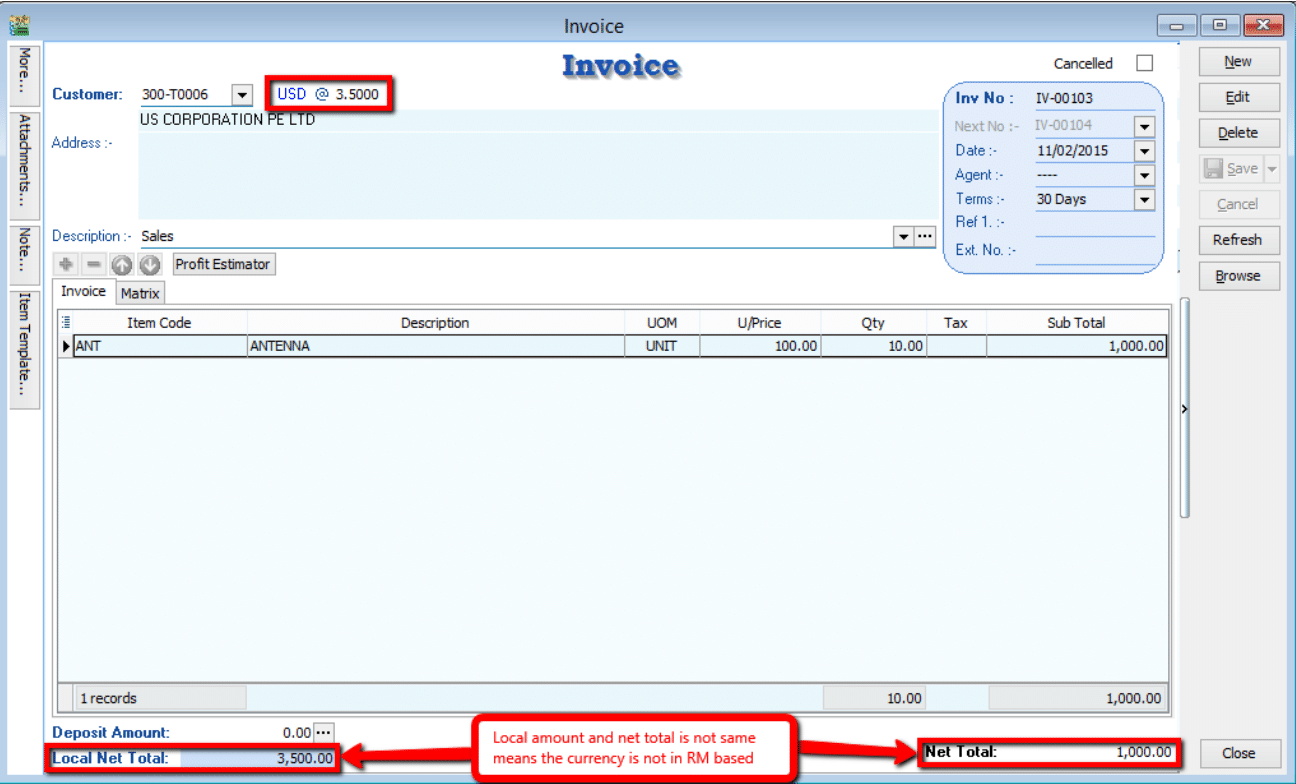

2. Customer Paid in USD & Payment Received in RM

Refer to Scenario 1 to verify if the customer is using USD.

-

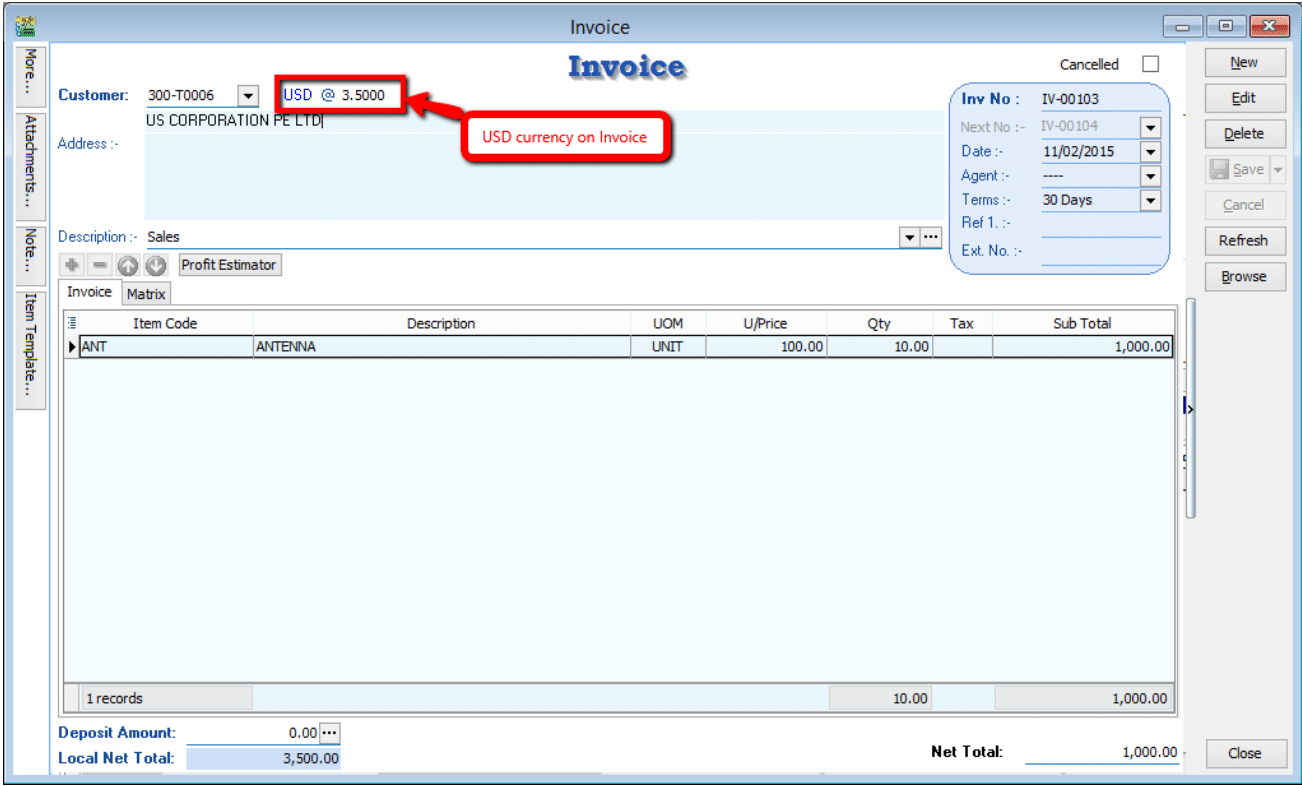

Check the Local Amount and Net Total. If they differ, the document is in a foreign currency (e.g., USD). Go to Sales → Invoice.

-

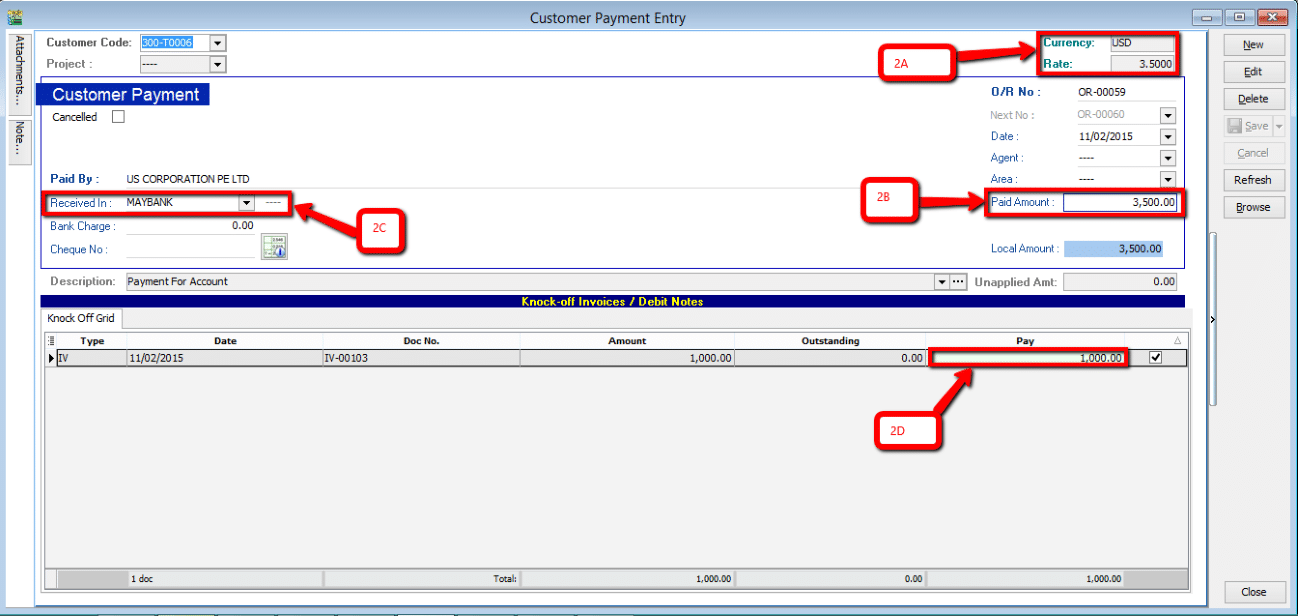

Process the Payment. Go to Customer → Customer Payment.

- 2A. Currency Rate: The rate used for knocking off the payment (auto-calculated).

- 2B. Payment Amount: The amount received in RM (based on the Bank payment method currency).

- 2C. Payment Method: Select the correct bank account.

- 2D. Pay Amount: You can enter the desired amount; the currency rate (2A) will update when you knock off the invoice.

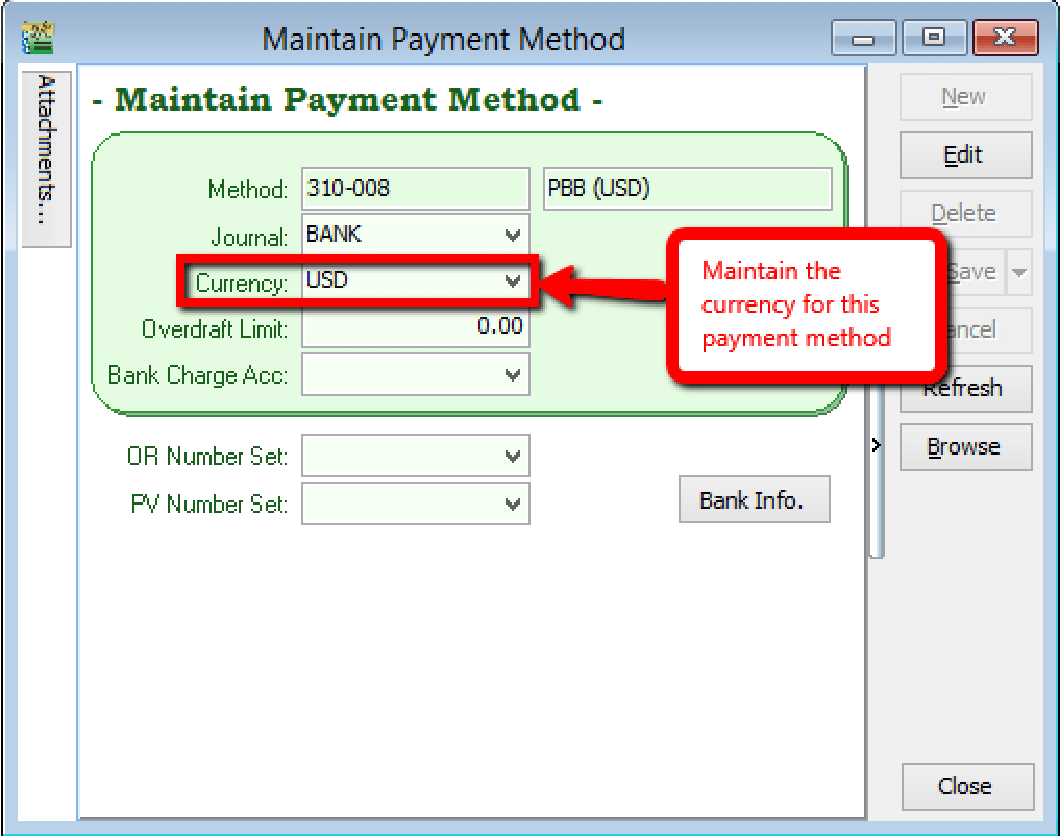

3. Customer Paid in USD & Payment Received in USD

-

Setup:

- Maintain a USD Bank account in the General Ledger (GL → Maintain Account).

- Assign the USD currency to the payment method (Tools → Maintain Payment Method).

-

Create the Invoice (USD currency). Go to Sales → Invoice.

-

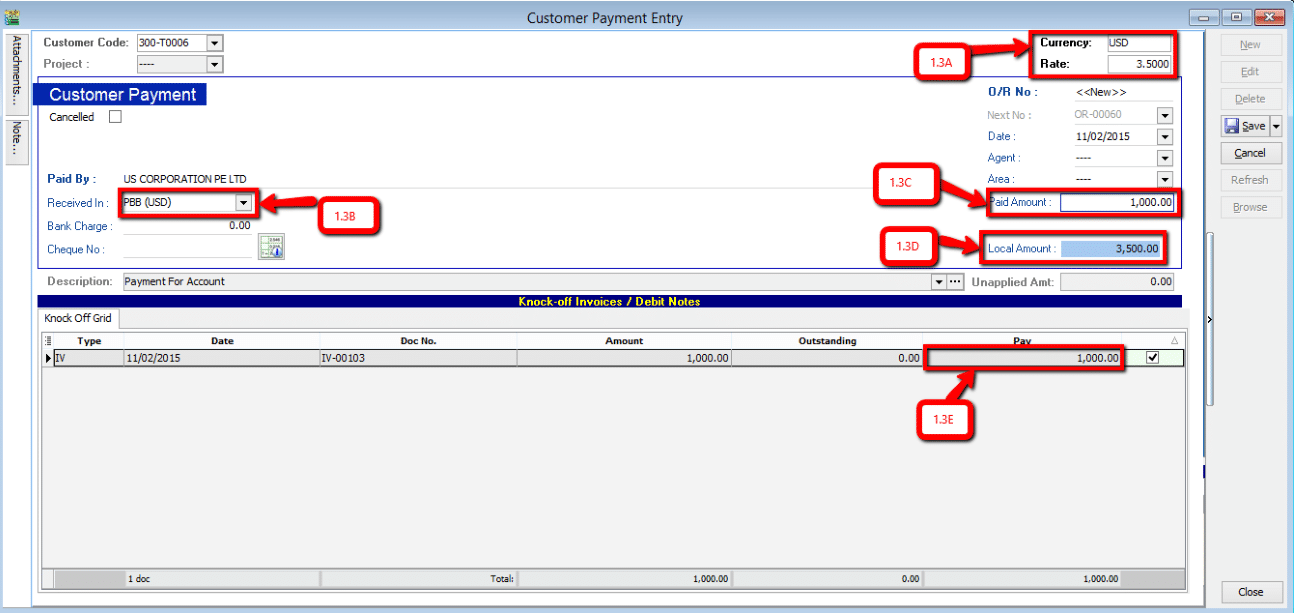

Process the Payment. Go to Customer → Customer Payment.

infoThe currency rate in the top-right corner can only be edited if the customer's currency matches the payment currency.

- Rate: Update the rate according to the current market value.

- Payment Method: Select the USD payment method.

- Paid Amount: Enter the amount of USD received.

- Local Amount: Auto-calculated as

Paid Amount × Currency Rate. - IV Amount: This follows the foreign currency amount, not the local amount.

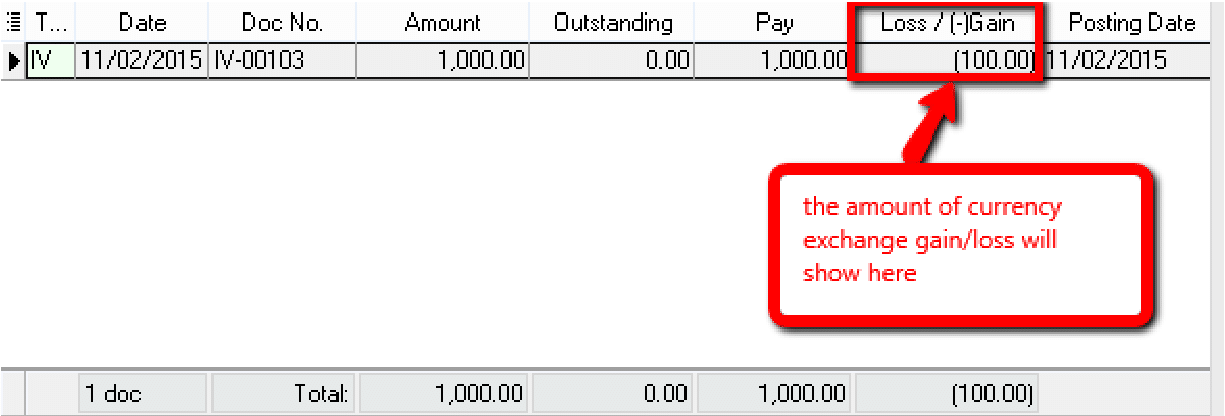

If the currency rate differs from the Invoice rate, the system will prompt a message showing the Gain/Loss on Foreign Exchange upon saving.

note

noteIf the Invoice rate was 3.5 and the payment rate is 3.6, the system will auto-calculate and display the gain/loss when you click Save.

4. Customer Paid in USD & Payment Received in SGD

For customers using USD where payment is received in a different foreign currency (e.g., SGD), ensure the corresponding payment method is maintained. Refer to Scenario 3 for setup instructions.

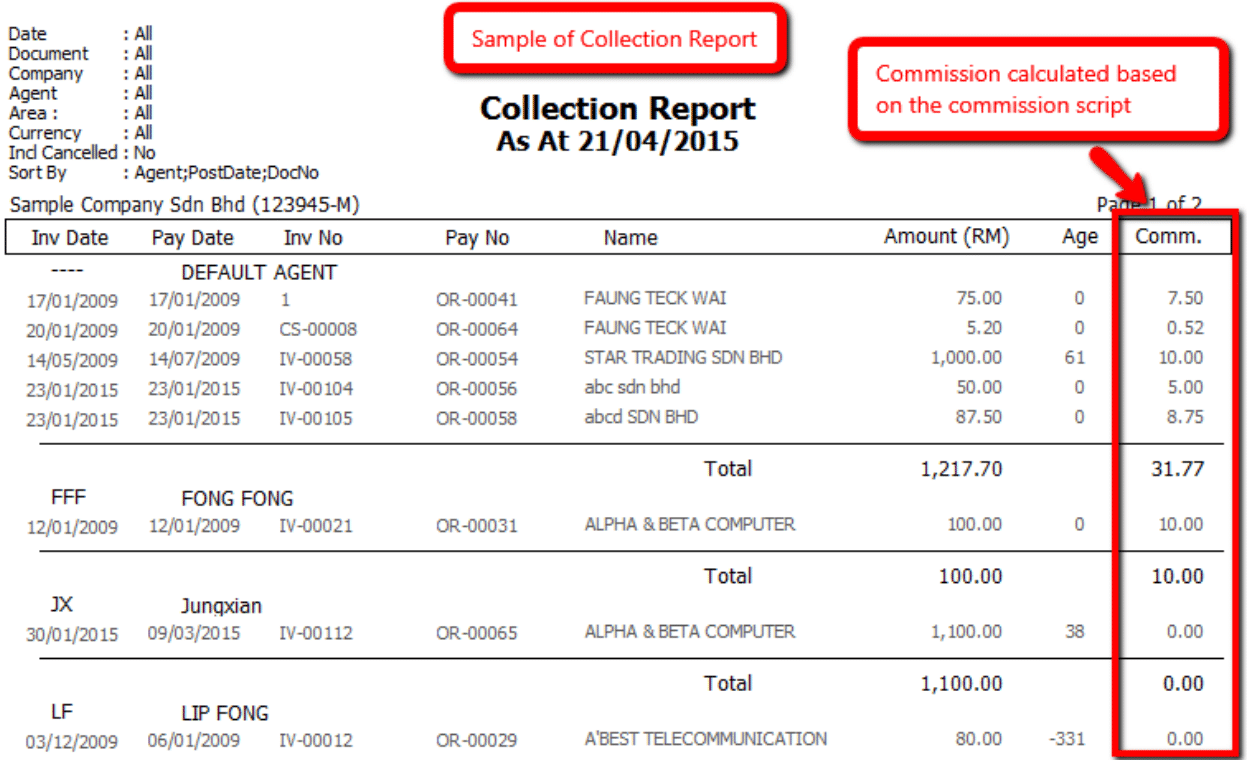

Sales Commission Reports

Setting Up Commission Scripts

-

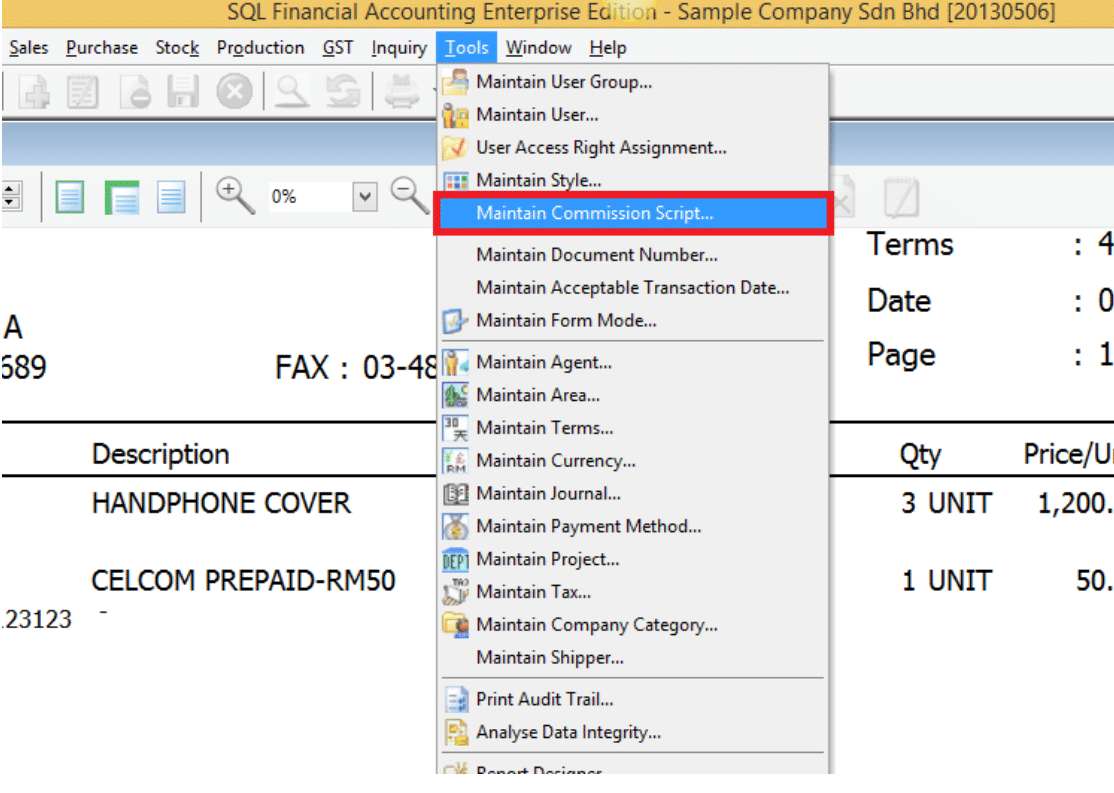

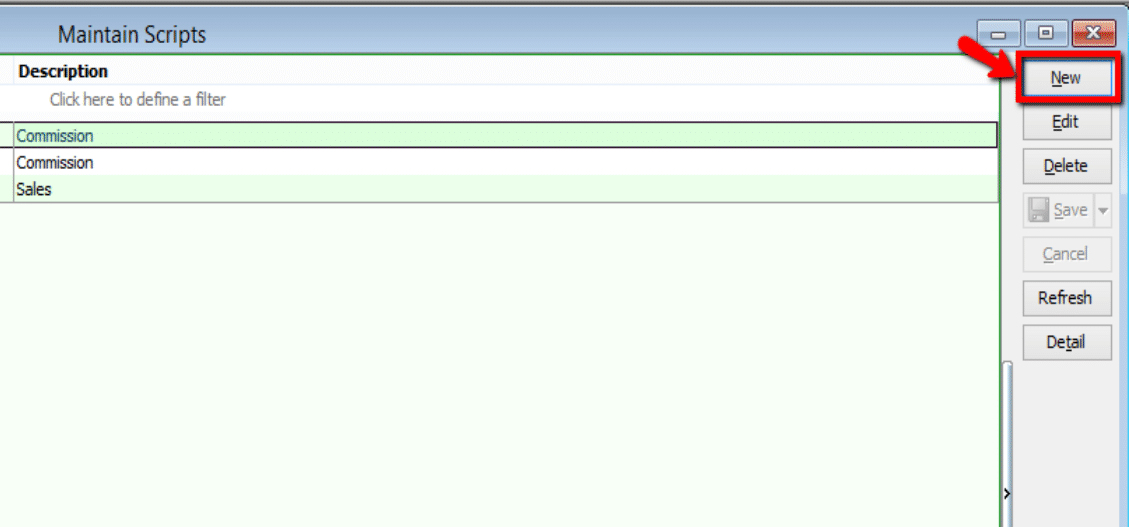

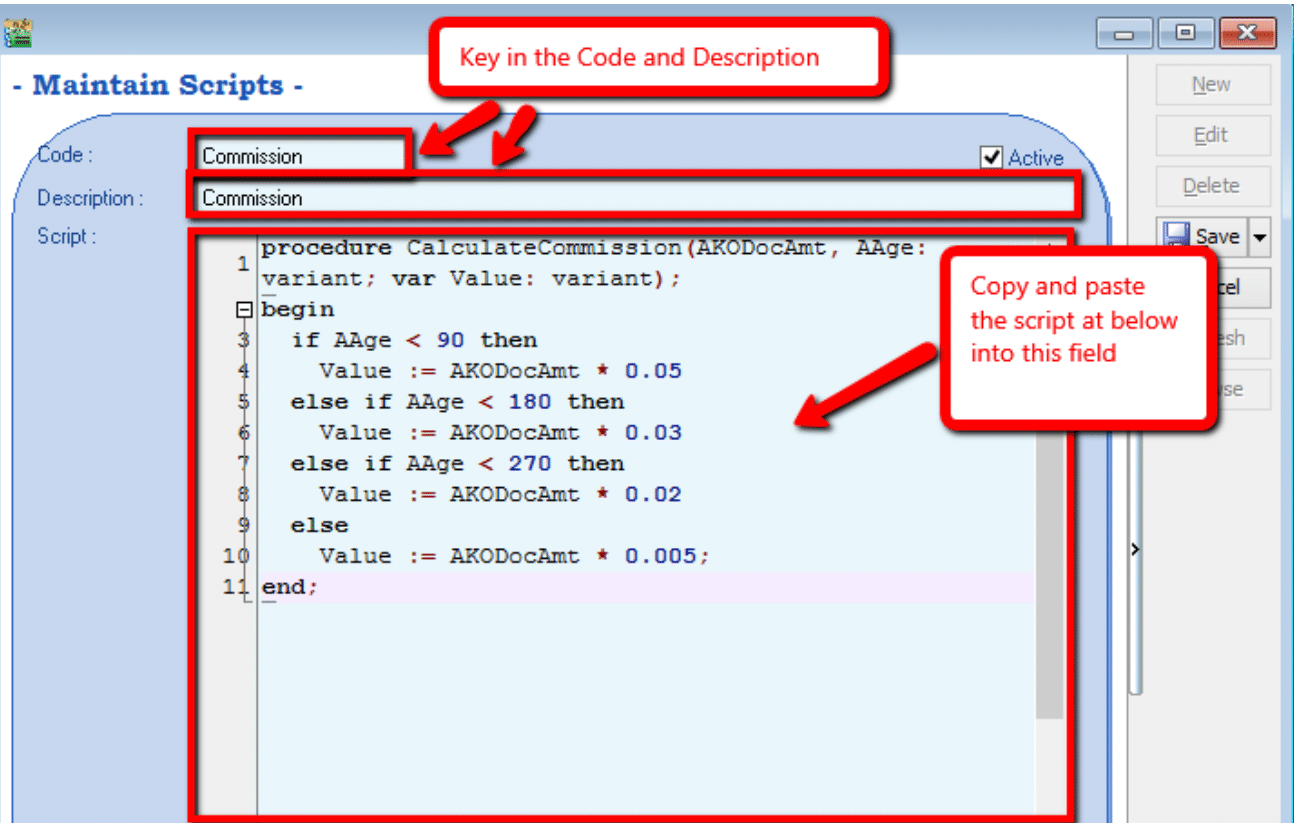

Go to Tools → Maintain Commission Script → New. Enter a Code and Description.

noteThis feature requires the Maintain Commission Script module.

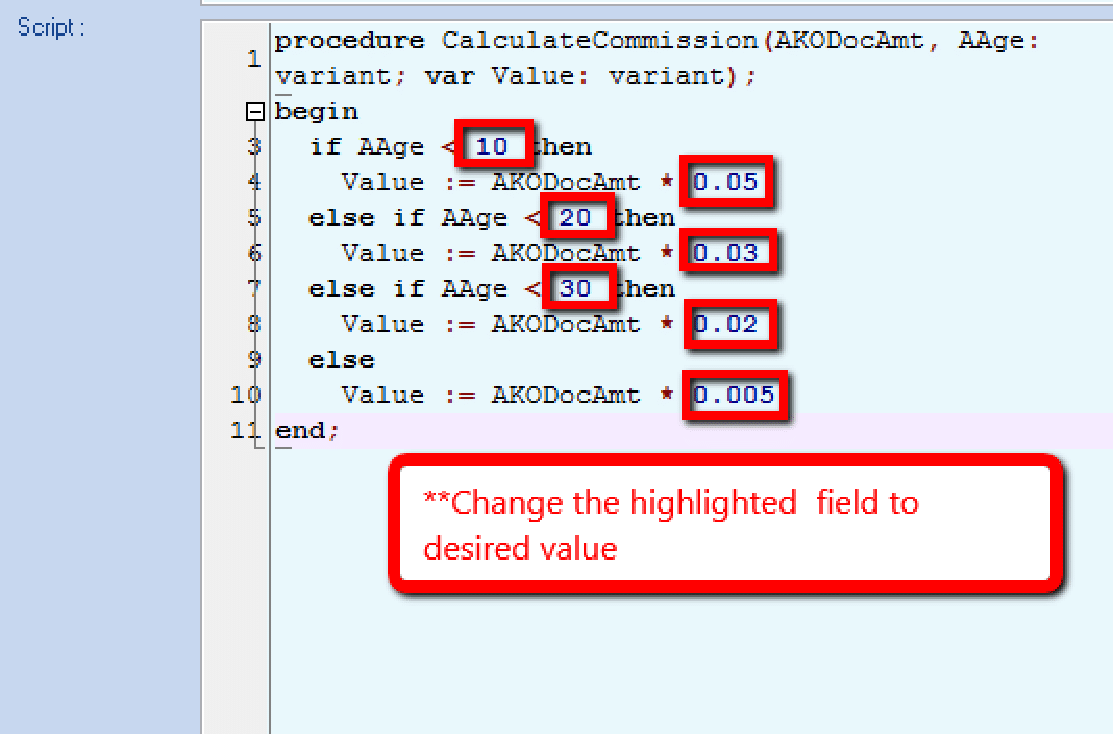

Default Commission Script Example:

procedure CalculateCommission(AKODocAmt, AAge: variant; var Value: variant);

begin

if AAge < 10 then

Value := AKODocAmt * 0.05

else if AAge < 20 then

Value := AKODocAmt * 0.03

else if AAge < 30 then

Value := AKODocAmt * 0.02

else

Value := AKODocAmt * 0.005;

end; -

Update the commission rates and age brackets in the script as needed, then click Save.

- Age Brackets: 10, 20, 30 days.

- Rates: 0.05 (5%), 0.03 (3%), etc.

-

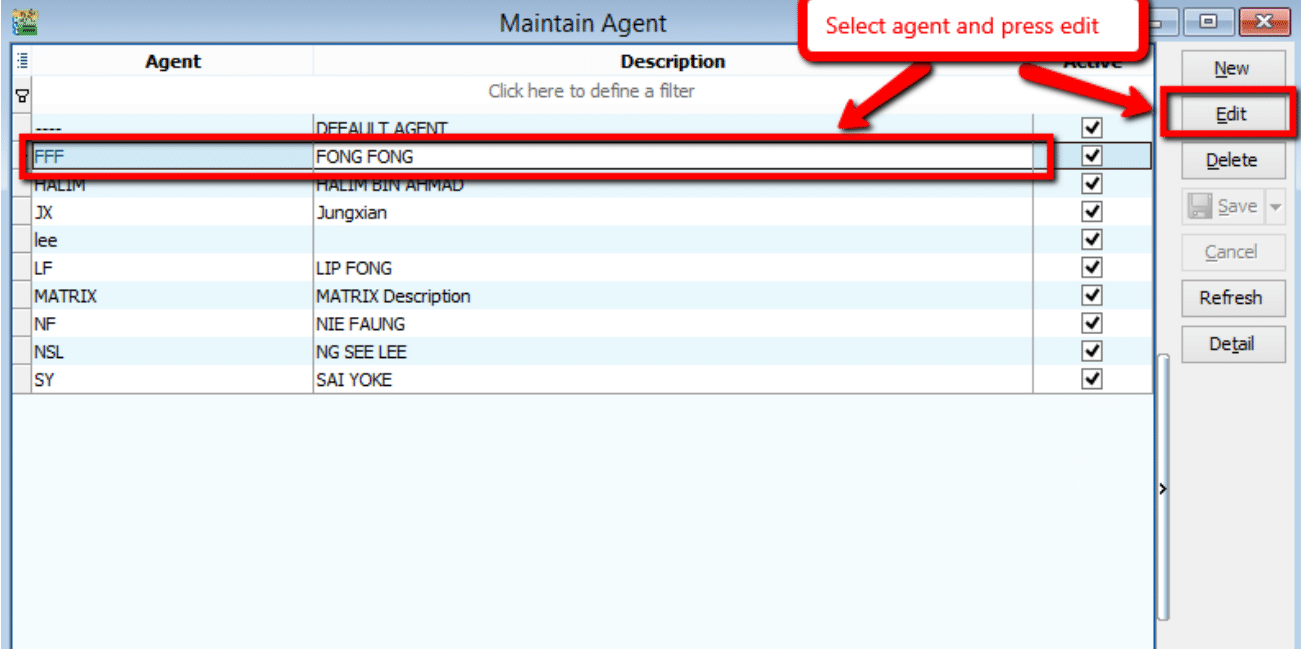

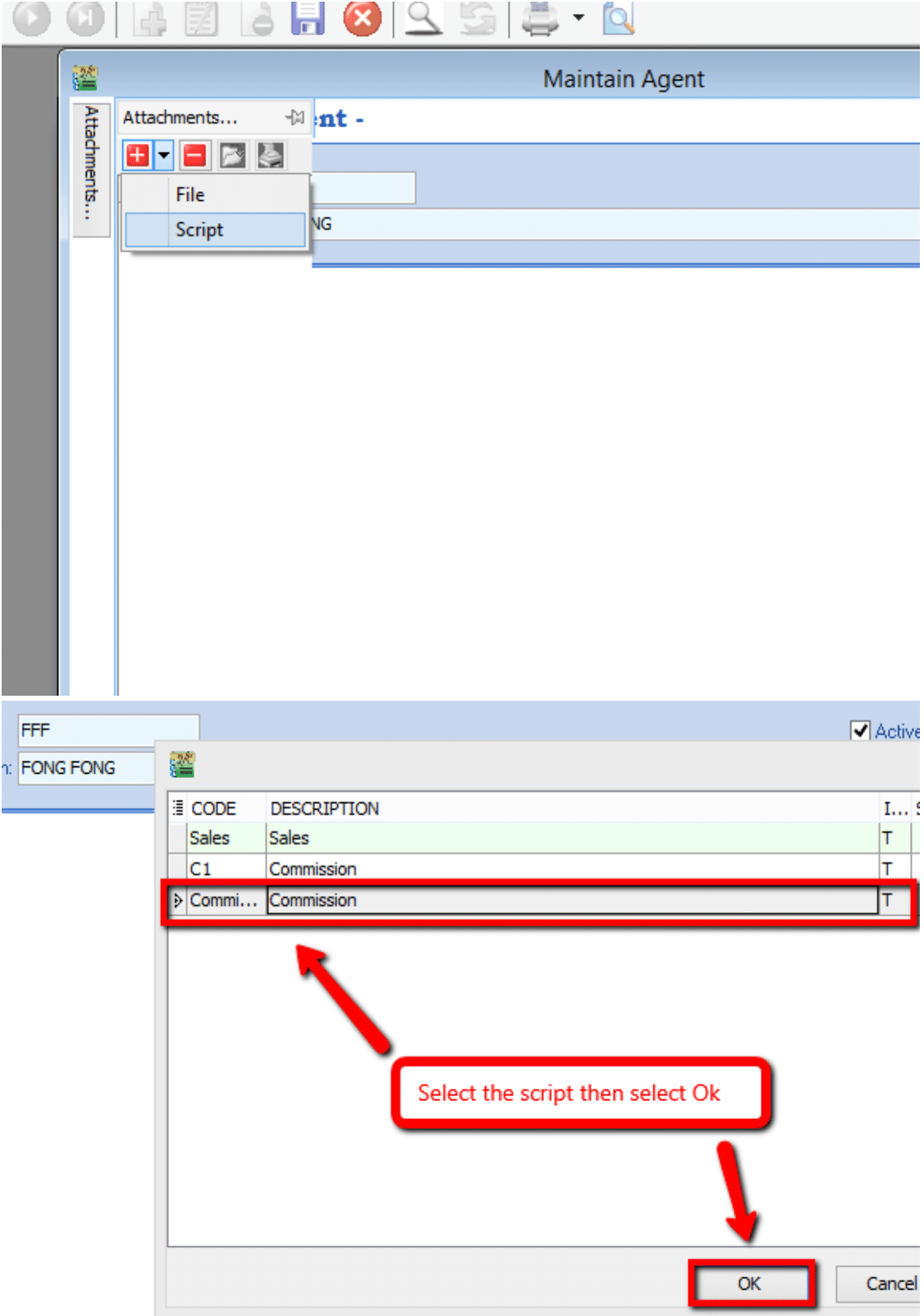

Assign the script to an agent. Go to Tools → Maintain Agent.

-

In the Attachment tab, select the commission script and click Save.

-

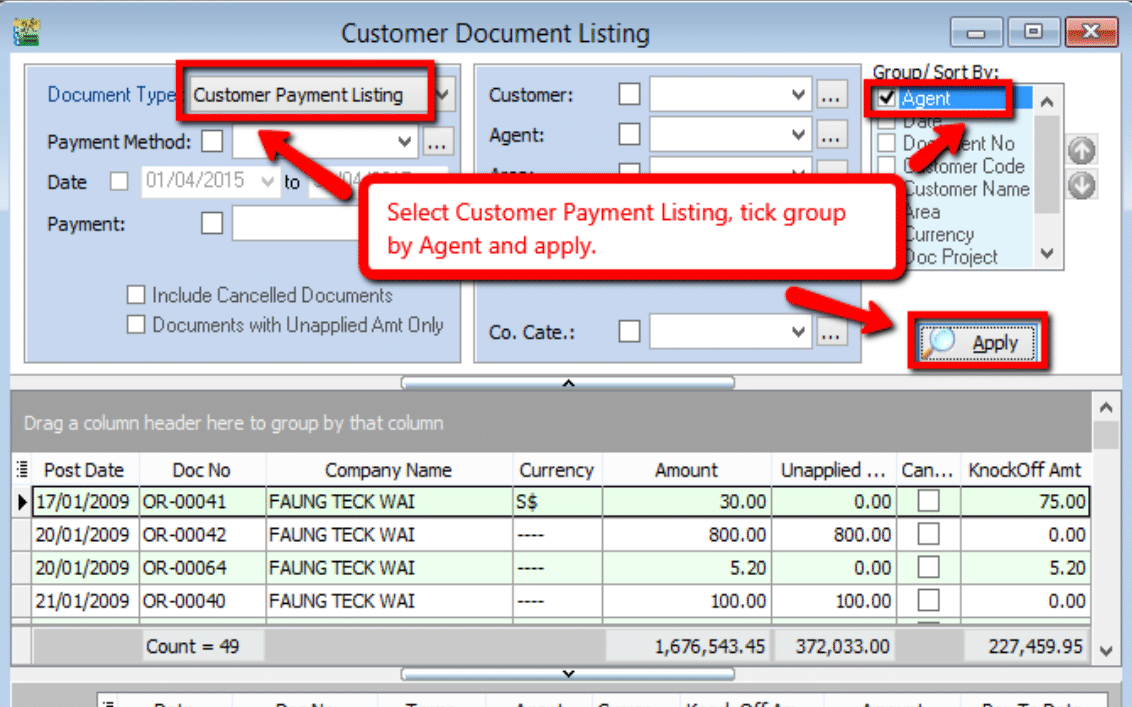

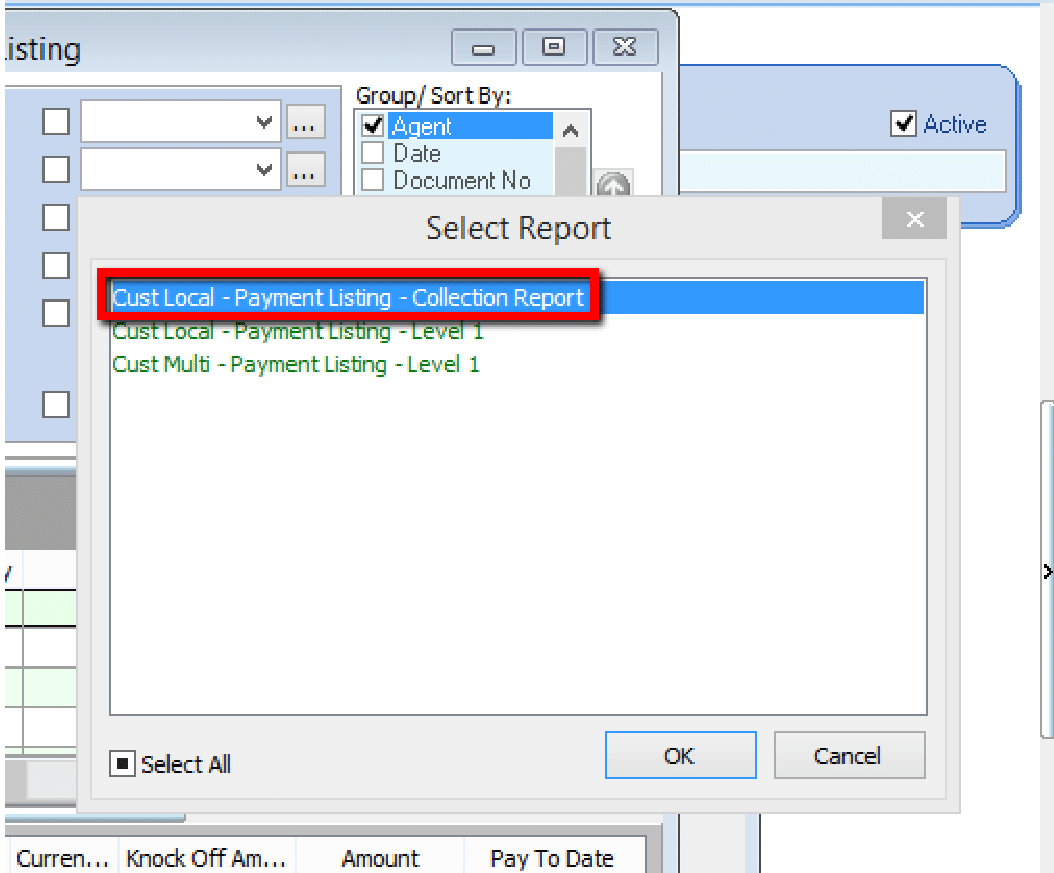

Generate the report. Go to Customer → Print Customer Document Listing.

- Select Document Type: Customer Payment Listing.

- Group By: Agent.

- Click Apply.

- Preview using the Cust Local - Payment Listing - Collection Report format.

Post-Dated and Bounced Cheques

Post-Dated Cheques (PDC)

A post-dated cheque is written for a future date.

-

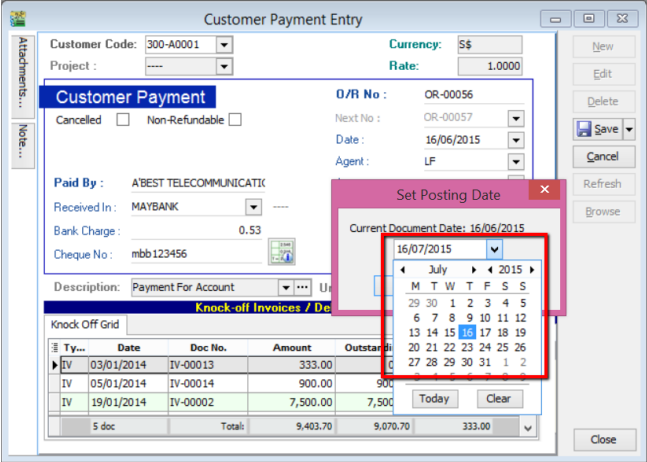

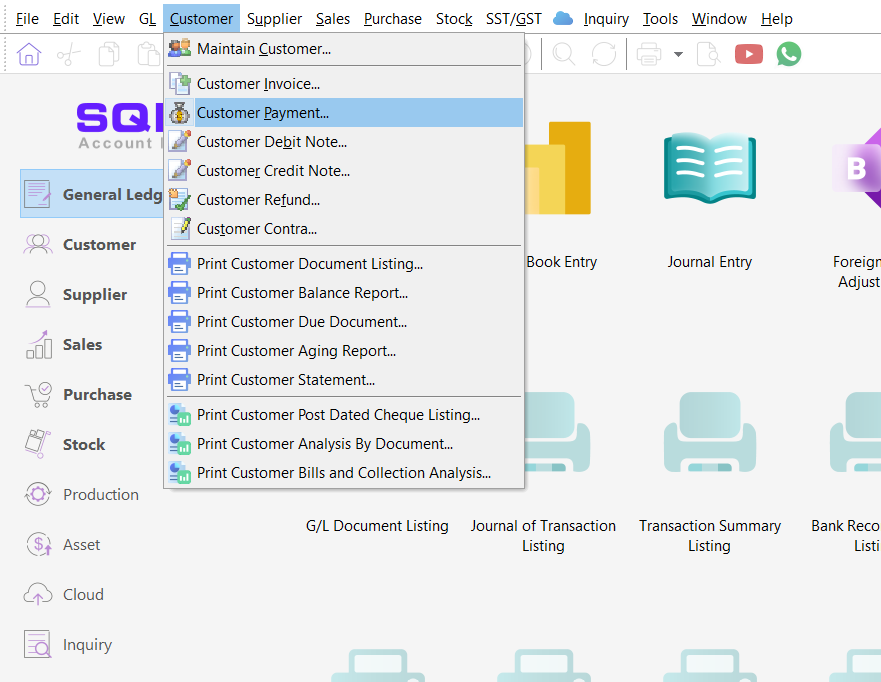

Go to Customer → Customer Payment.

-

Click New.

-

Create the payment and knock off the corresponding invoice. Ensure the bank account and amount are correct.

-

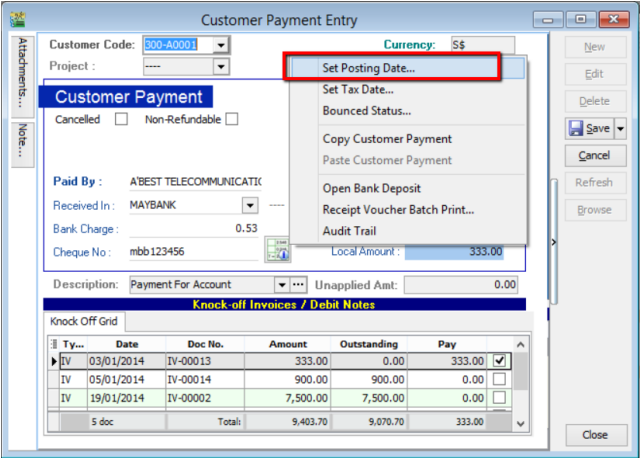

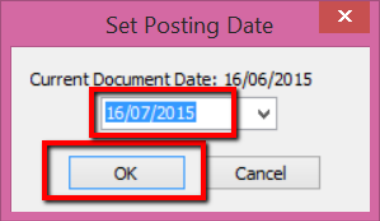

Right-click in the blank space next to the Customer Payment header and select Set Posting Date.

-

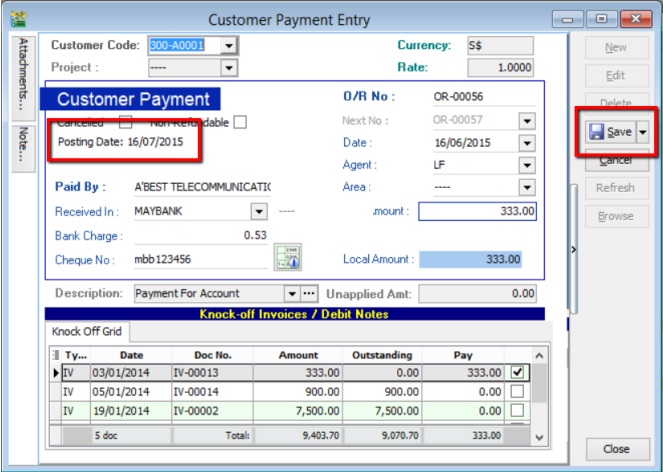

Select the actual Posting Date of the cheque and click OK.

-

The posting date will now be displayed. Click Save.

-

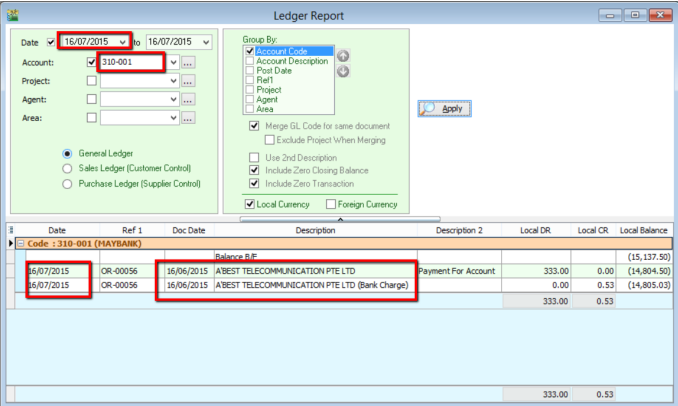

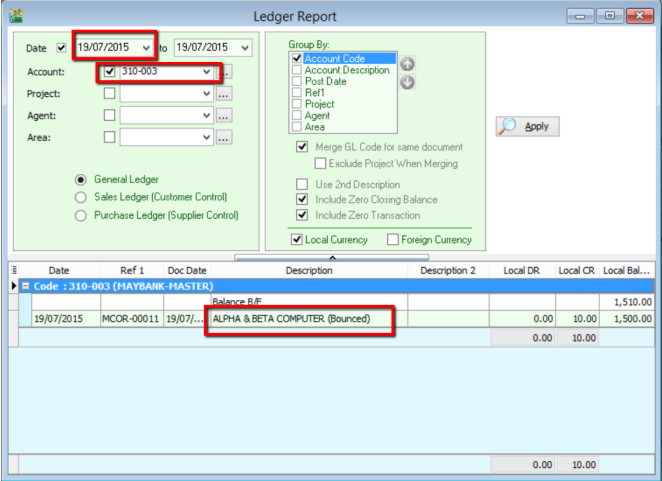

In the Ledger Report, the transaction will appear under the specified posting date.

-

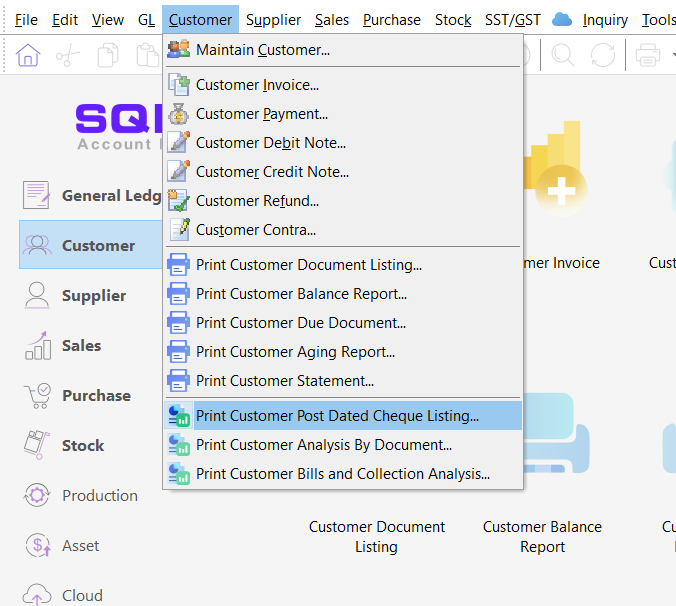

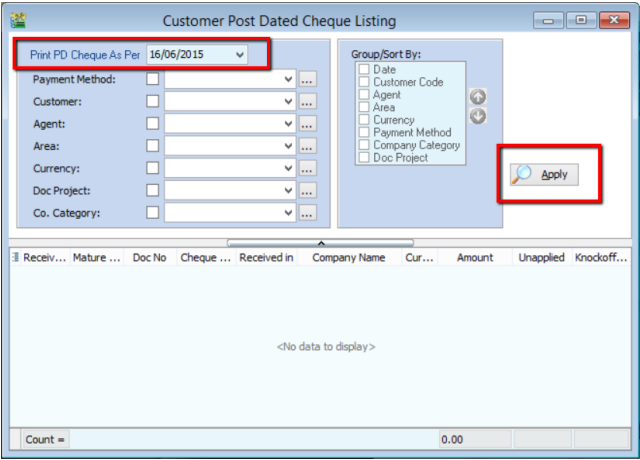

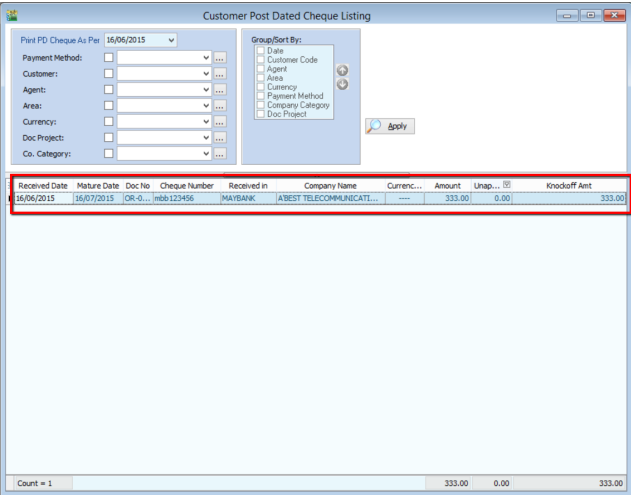

To view all PDCs, go to Customer Reports → Print Customer Post Dated Cheque Listing.

-

Select the Payment Date (not the posting date) and click Apply.

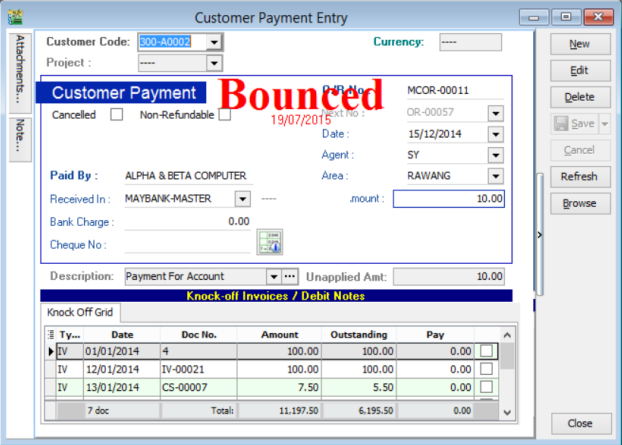

Bounced Cheques

A bounced cheque is one that cannot be processed due to insufficient funds or errors.

-

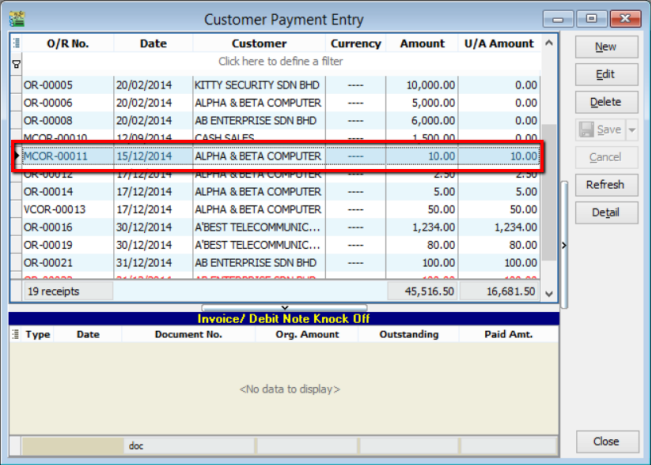

Go to Customer → Customer Payment.

-

Locate and double-click the bounced payment document.

-

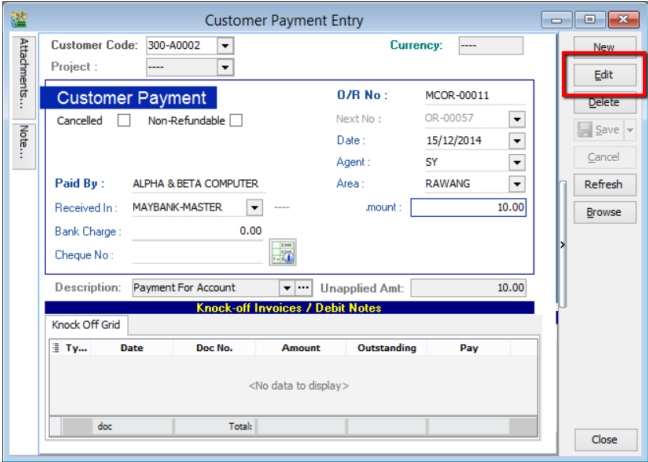

Click Edit.

-

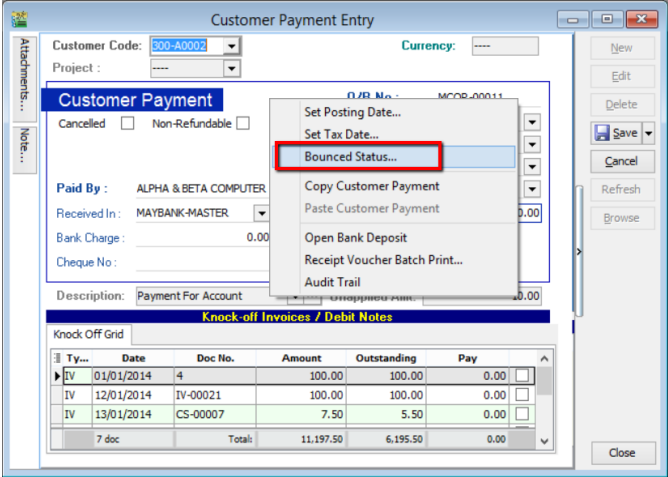

Right-click in the blank space next to the Customer Payment header and select Bounced Status.

-

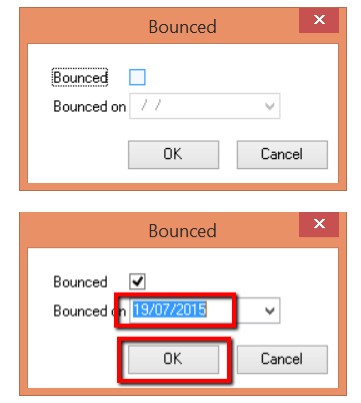

Check the Bounced box and set the Bounce Date (must be on or after the posting date). Click OK.

-

The document will be labeled as bounced. Click Save.

-

The Ledger Report will reflect the bounced transaction on the specified date.

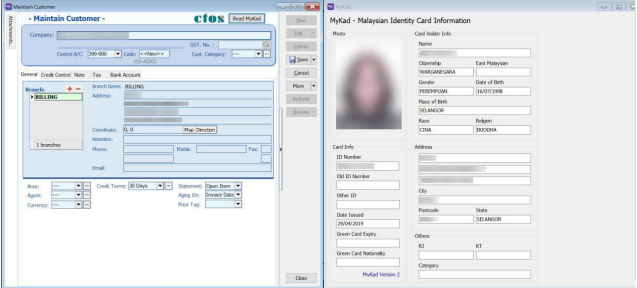

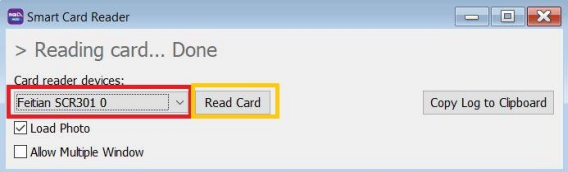

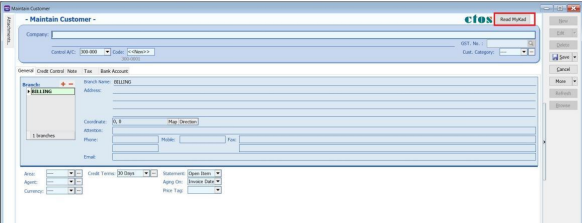

MyKad Integration

Reading Customer Info via MyKad

-

Connect your Smart Card Reader to your computer. The reader will show a red light when connected.

-

Insert the MyKad into the reader. A blue light indicates a successful read.

-

In SQL Account, go to Customer → Maintain Customer → New.

-

Click Read MyKad.

-

Select the Reader Device and click Read Card.

-

Click Read MyKad.

-

The system will automatically populate the Name, Address, and ID Number.