GST

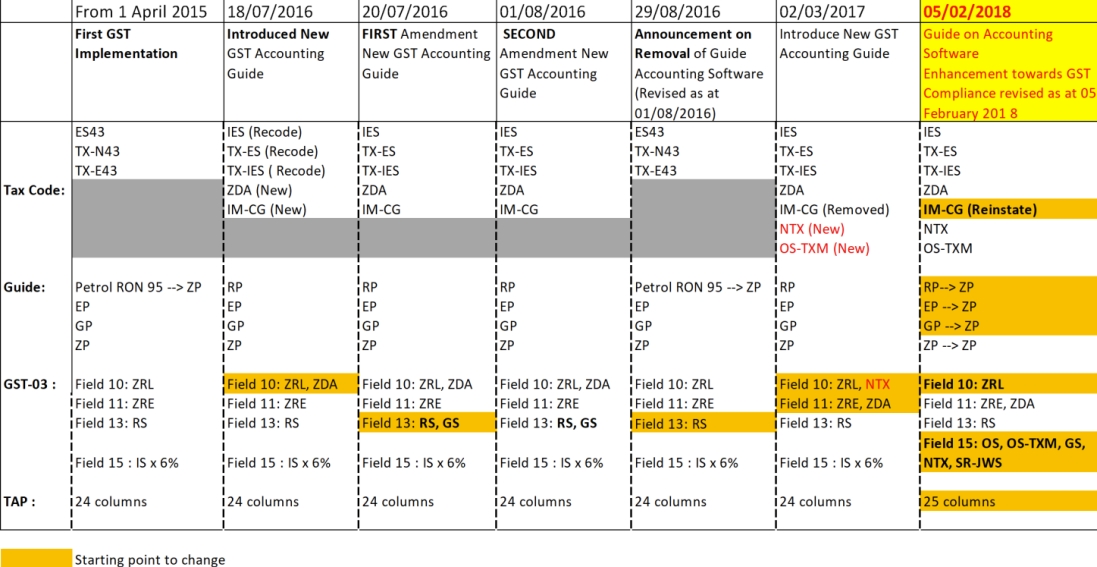

History of GST

Historical changes in GST Accounting Guideline.

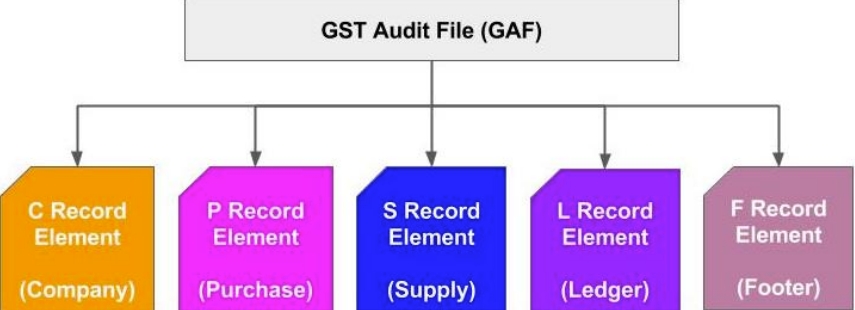

GST Audit File (GAF)

-

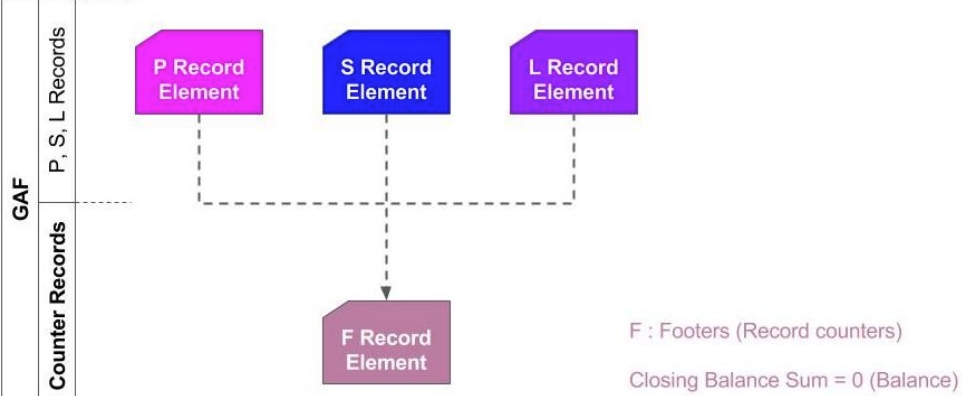

GAF is constructed from 5 records elements.

-

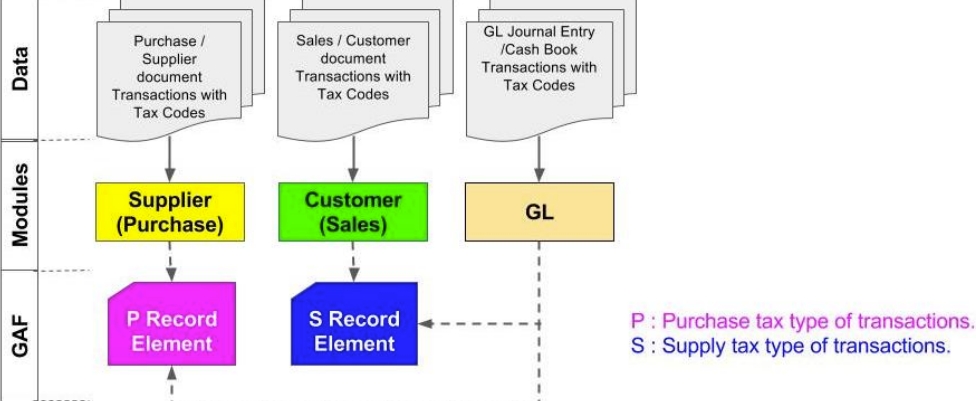

GAF – Record Elements (P, S).

-

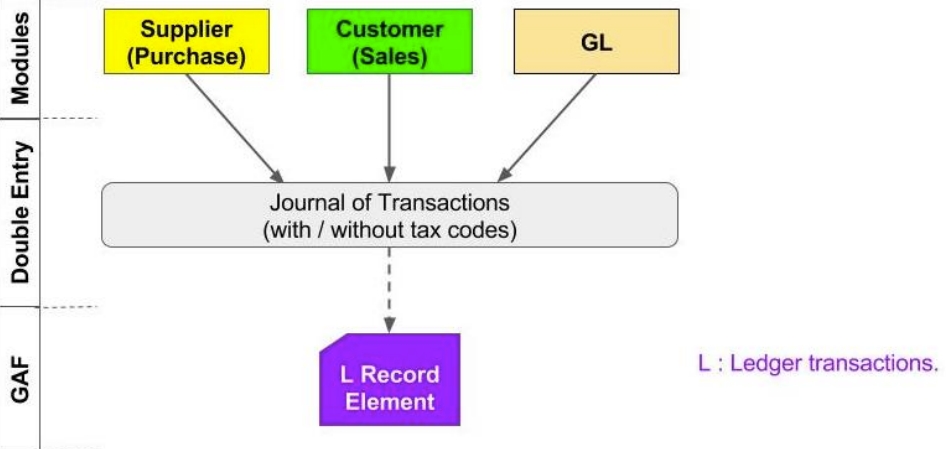

GAF – Record Elements (L).

-

GAF – Record Elements (F).

Generate GAF

Watch tutorial video here: Youtube

GAF = GST Audit File.

The purpose of a GAF is for Customs to audit the accuracy of your GST Return but GAF submission is only required upon request. It is not required to be submitted with GST-03.

-

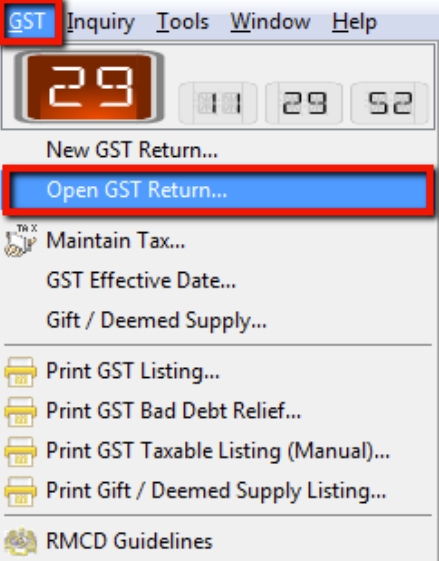

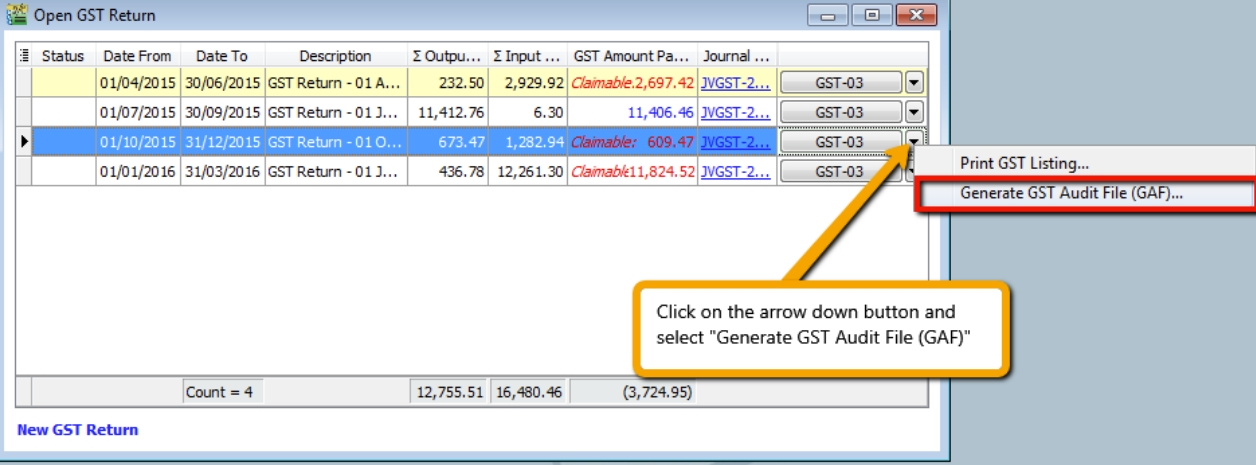

Click on GST | Open GST Return.

-

Select the cycle for the GAF that you want to generate. Then click on the arrow down button and select Generate GST Audit File(GAF).

-

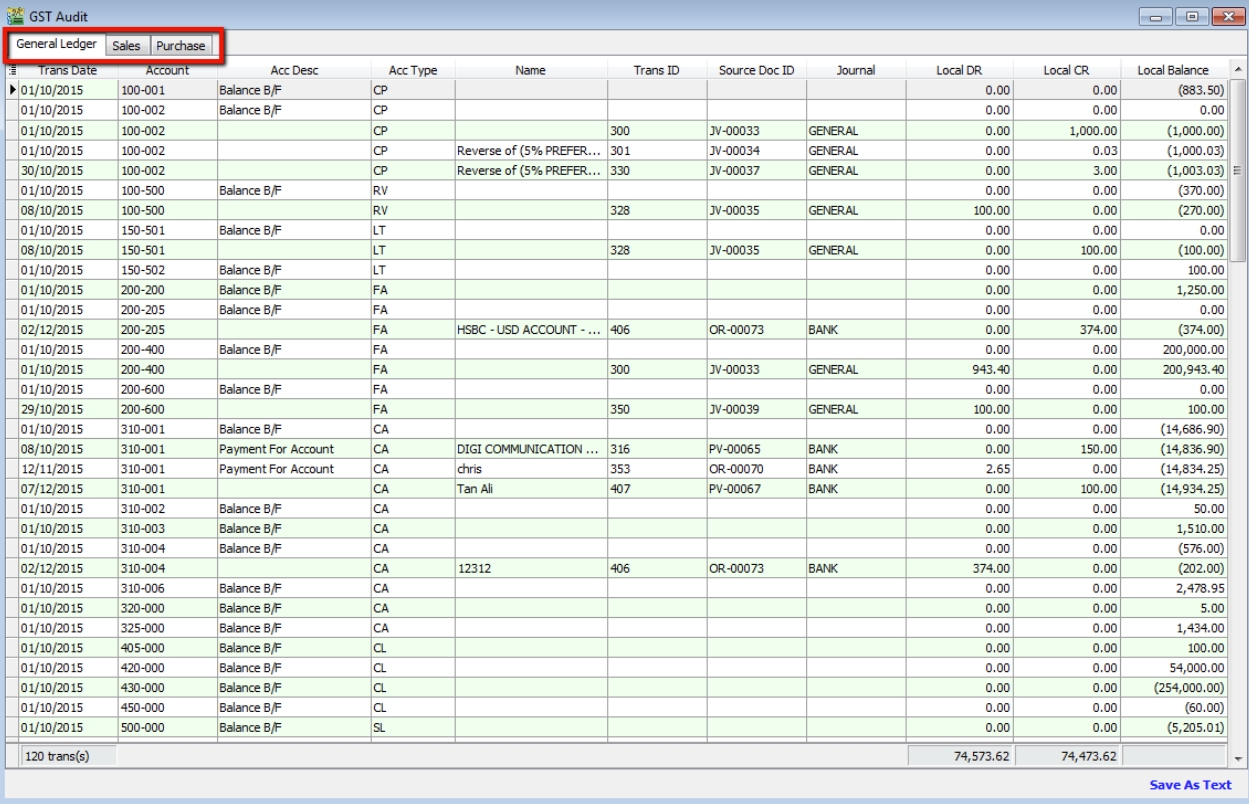

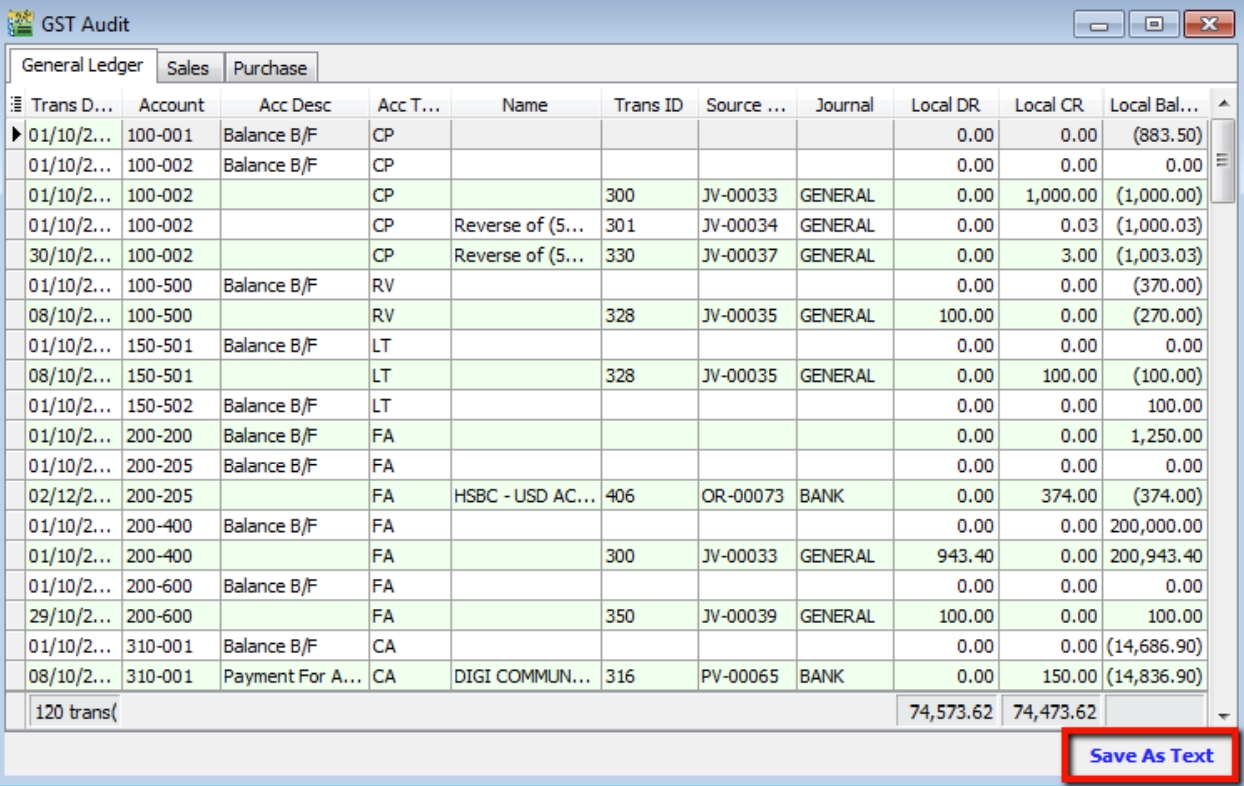

The result is generated based on General, Sales & Purchase Ledger for you to check your transactions before submitting to Customs for auditing purposes.

-

You may check the report.

-

Click on Save as Text.

-

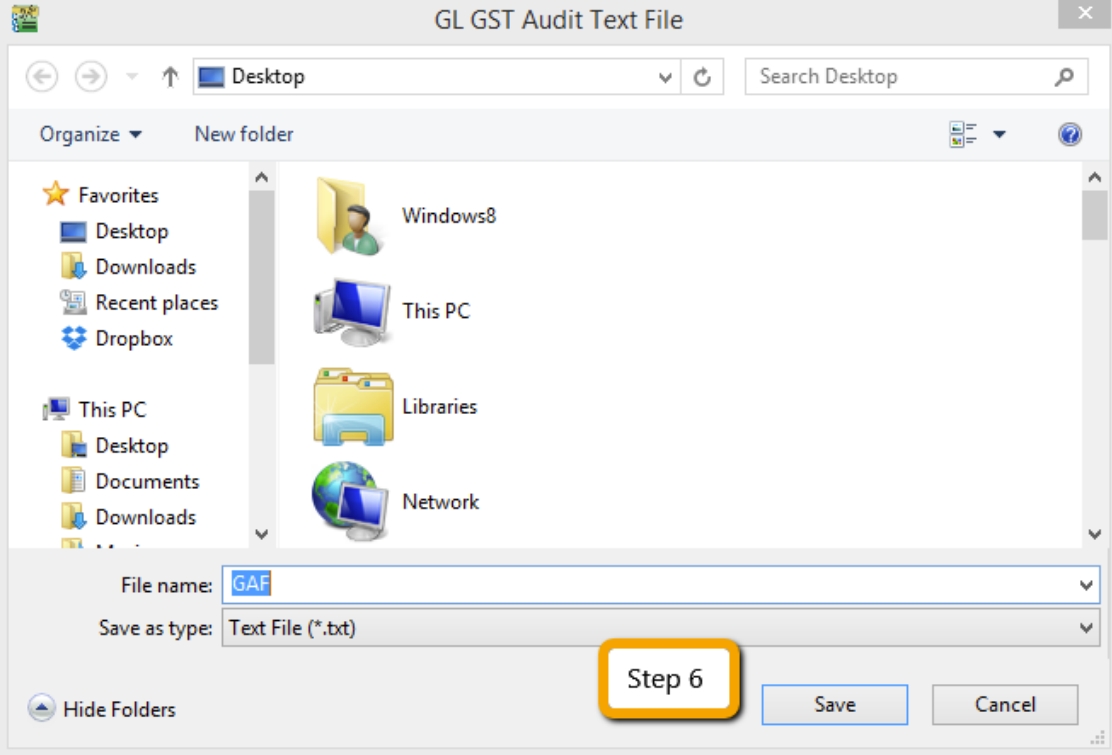

Save your GAF text file to desktop.

-

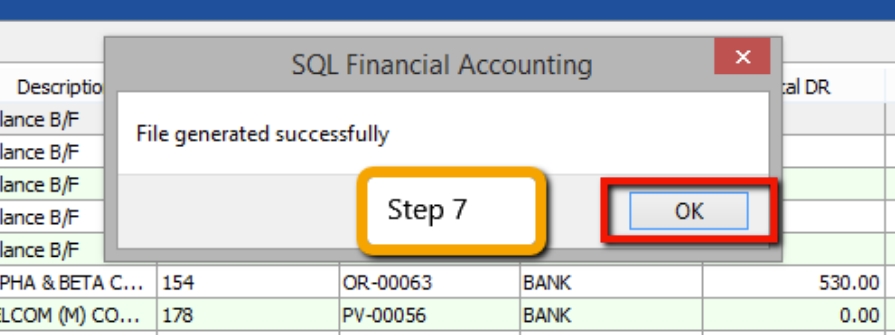

After saving, the message “File generated successfully” will automatically pop-up, just click OK.

-

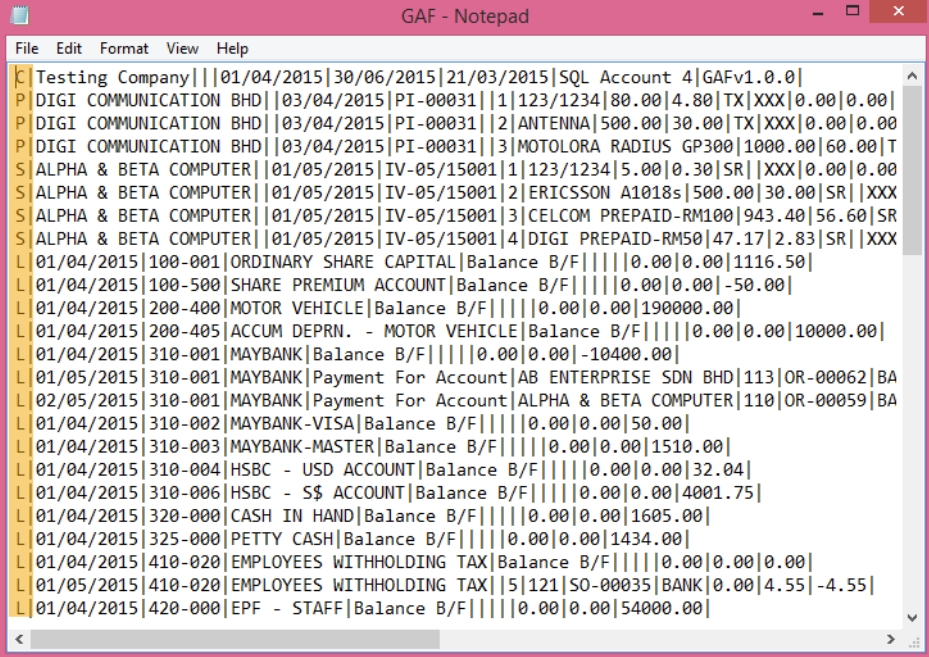

Go to desktop to select the GAF.txt file. The output will be similar to the image below:

The above is the exported file that has fulfilled all requirements by Customs, you may submit to Customs Department

C= Company Name

P = Purchase Transaction

S = Sales Transaction

L = General Ledger transaction

You have to submit GAF File upon request by Customs.

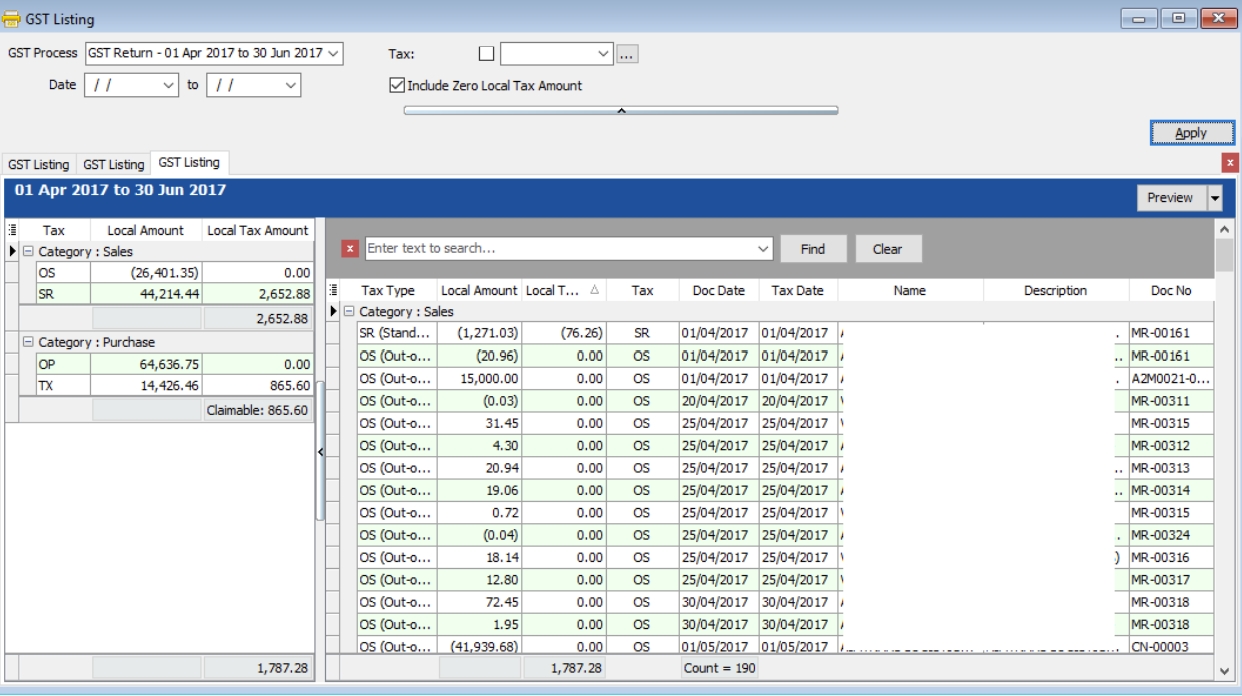

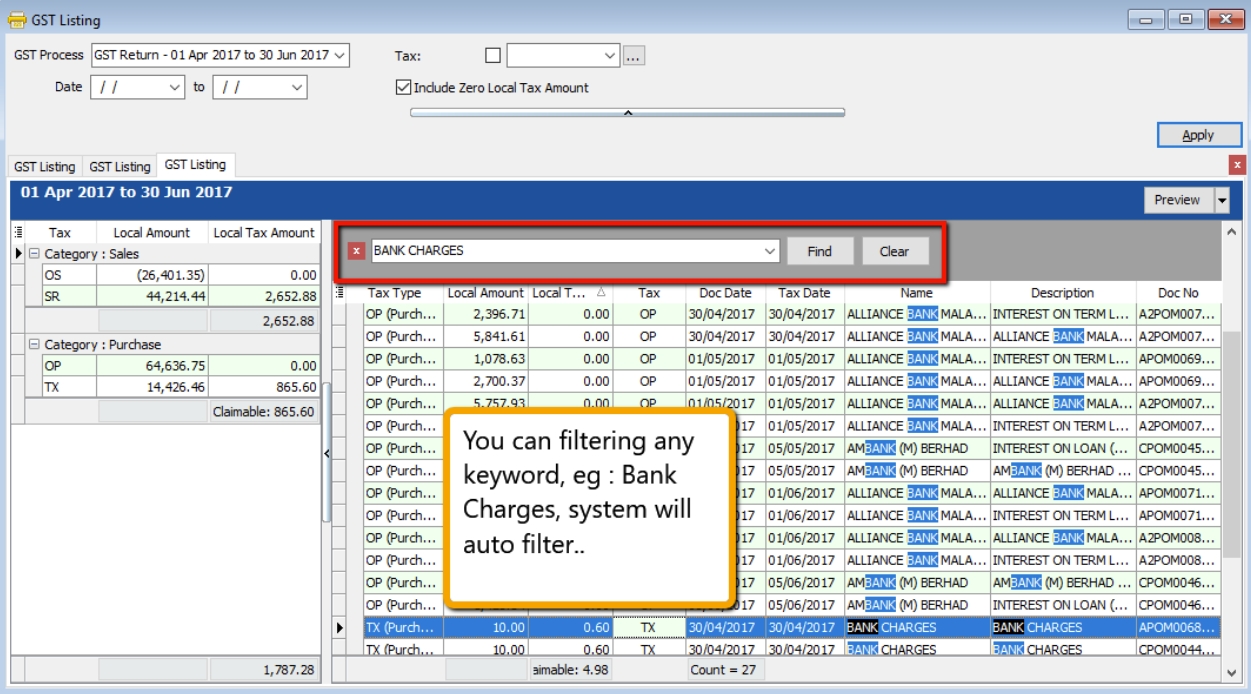

GST Listing Report

This report is to analyse the detail of GST transactions grouped by tax type. It can be used to check against GST-03.

-

GST | Print GST Listing.

-

Filter the date range that you want to apply or you can filter by GST Process, tax code.

-

Click Apply.