Bad Debt

Bad debt refers to outstanding amount of sales tax from a person who is insolvent, and is irrecoverable from the person.

Insolvent person is:

-

For individual, adjudged bankrupt.

-

For company, ordered by the court to be wound up and a receiver is appointed.

Payment deemed to be irrecoverable whole or parts of the payment has been provided in the account as:

-

Doubtful debt, or

-

Written off in the person’s account as bad debt.

-

Bad Debt Claim

Refund of sales tax in relations to Bad Debts:

-

Can be claimed by a registered manufacturer or a person who ceased to be registered manufacturer.

-

Shall claim within 6 years from the date the taxable goods is sold.

-

Subject to conditions & satisfaction of the Direct General (DG).

-

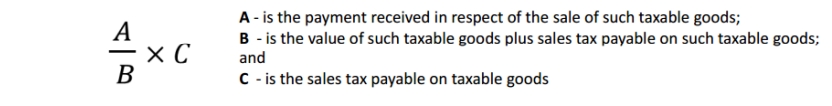

May claim according to the formula below.

-

-

Bad Debts Recovery

Repayment of sales tax in relation to Bad Debts refunded:

-

Has claimed and received the sales tax refund.

-

Payment received from the debtor after bad debts claimed.

-

Repay to DG in his return.

-

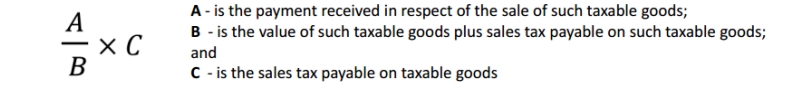

Repay according to the formula below.

-