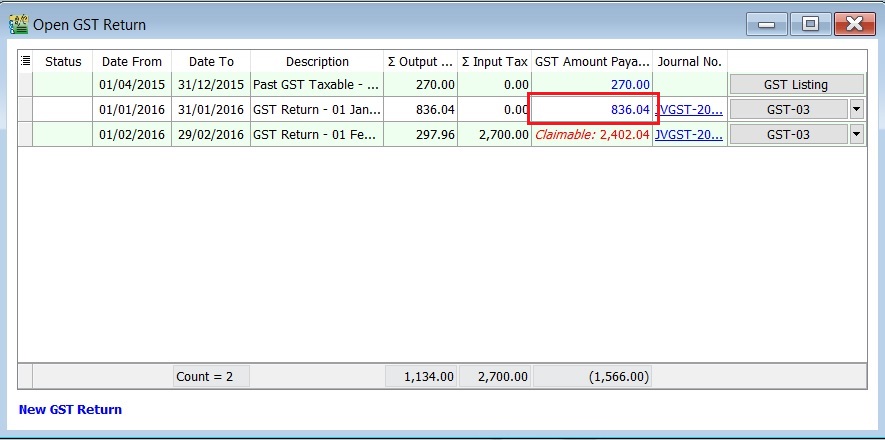

Settlement with RMCD

- Net GST Payable is the total GST amount to be paid to RMCD.

- Net GST Claimable is the total GST amount to be claimed or refund from RMCD.

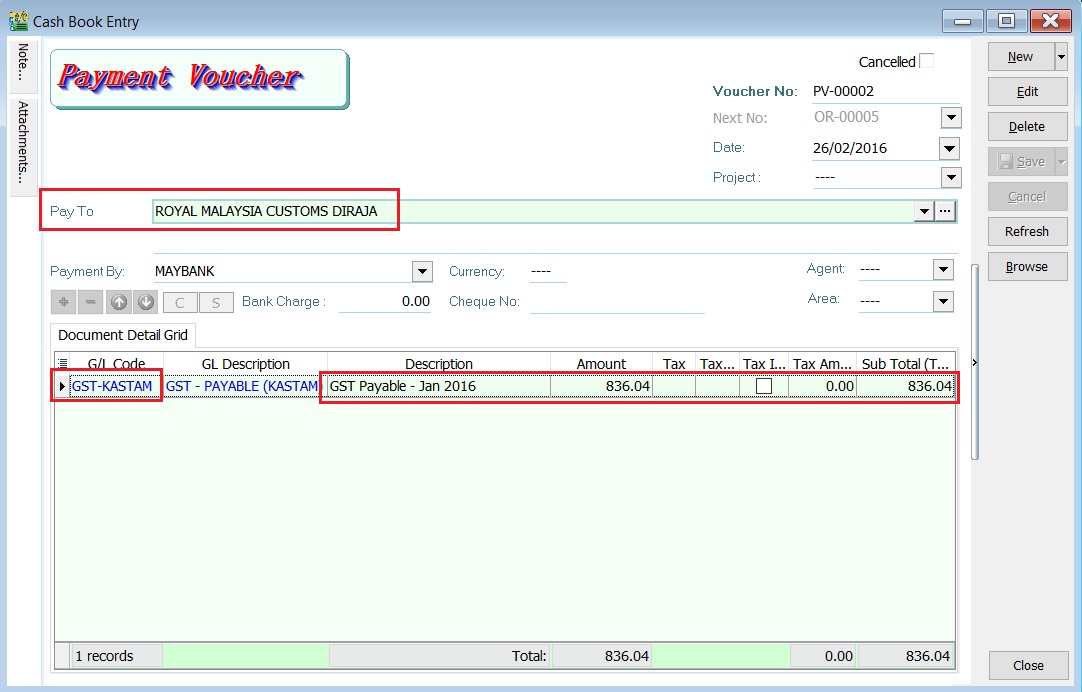

Payment to RMCD

-

Click on the New followed by selecting Payment Voucher.

-

Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Pay To field.

-

At the detail, select GL Code: GST-KASTAM.

-

Enter the description to describe the GST Payable for the period, eg. GST Payable - Jan 2016.

-

Based on the GST Returns, enter the GST amount payable (Rm836.04) into the Amount column.

-

Save it. See the screenshot below.

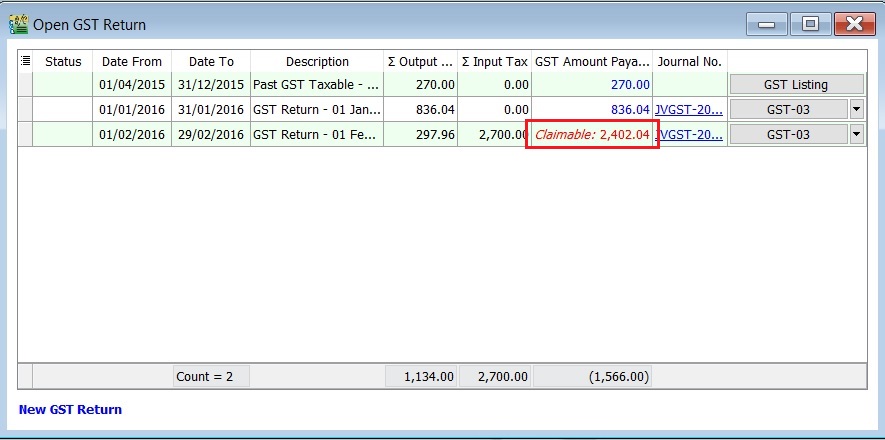

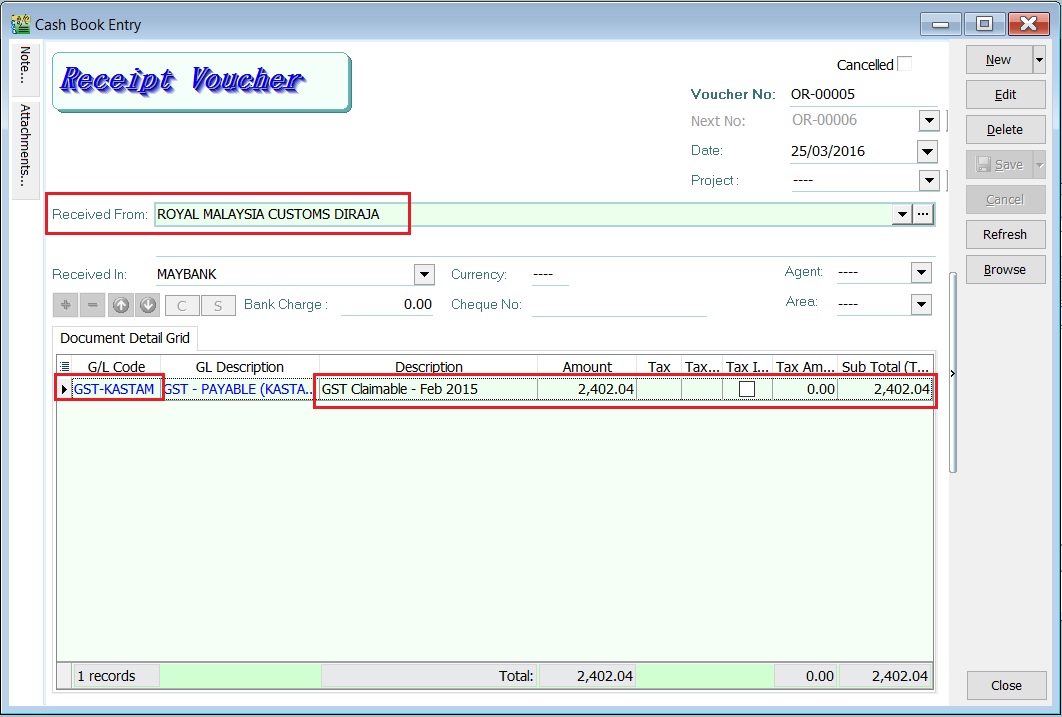

Refund From RMCD

-

Click on the New follow by select Official Receipt.

-

Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Received From field.

-

At the detail, select GL Code: GST-KASTAM.

-

Enter the description to describe the GST Claimable for the period, eg. GST Claimable - Feb 2016.

-

Based on the GST Returns, enter the GST amount claimable (Rm2,402.04) into the Amount column.

-

Save it. See the screenshot below.

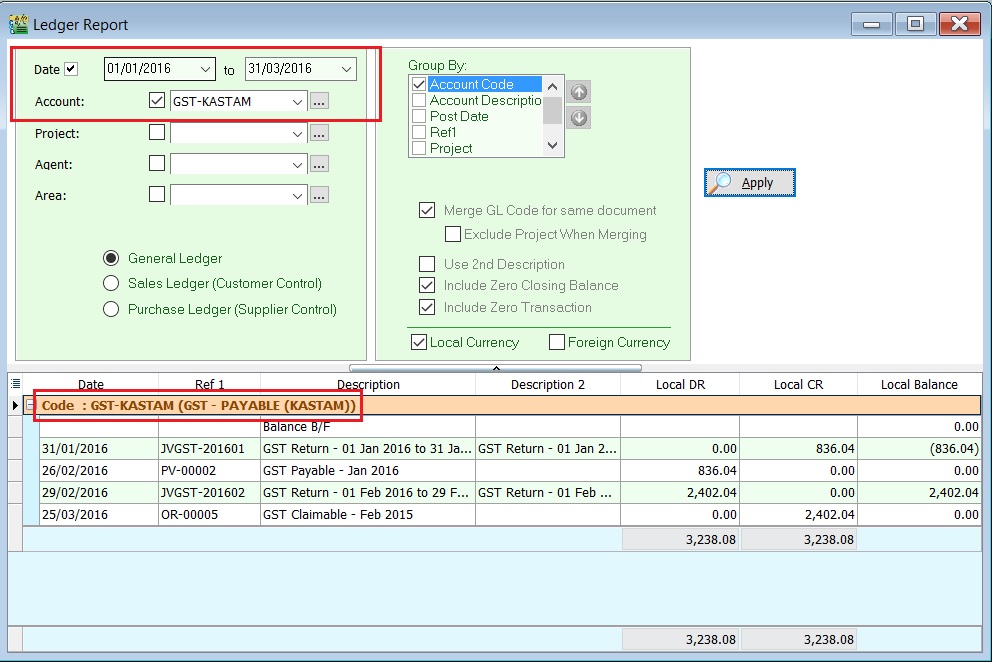

GST - Kastam Account Inquiry

-

Select the date range.

-

Select the GL Account code : GST-KASTAM.

-

Click Apply.

-

RMCD outstanding transactions will be display as below.