Overview

SST Introduction

Introduced in September 2018, SST replaced the former 6% Goods and Services Tax (GST) system. SST consists of two parts: Sales Tax and Service Tax. Sales Tax is a single-stage tax applied to all taxable goods manufactured in or imported into Malaysia, while Service Tax is a single-stage tax imposed on taxable services provided in Malaysia by a registered business. Certain designated areas in Malaysia such as Langkawi Island, Tioman Island, and the Federal Territory of Labuan, are exempt from Service Tax.

Sales and Service Tax 2018 Model and Scope

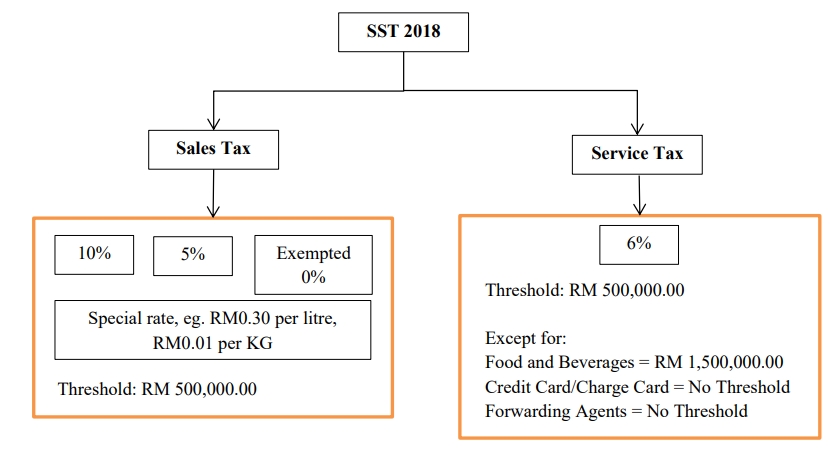

Sales and Service Tax model are structured as below: