Tax Code

Tax Code and SST-02 Mapping

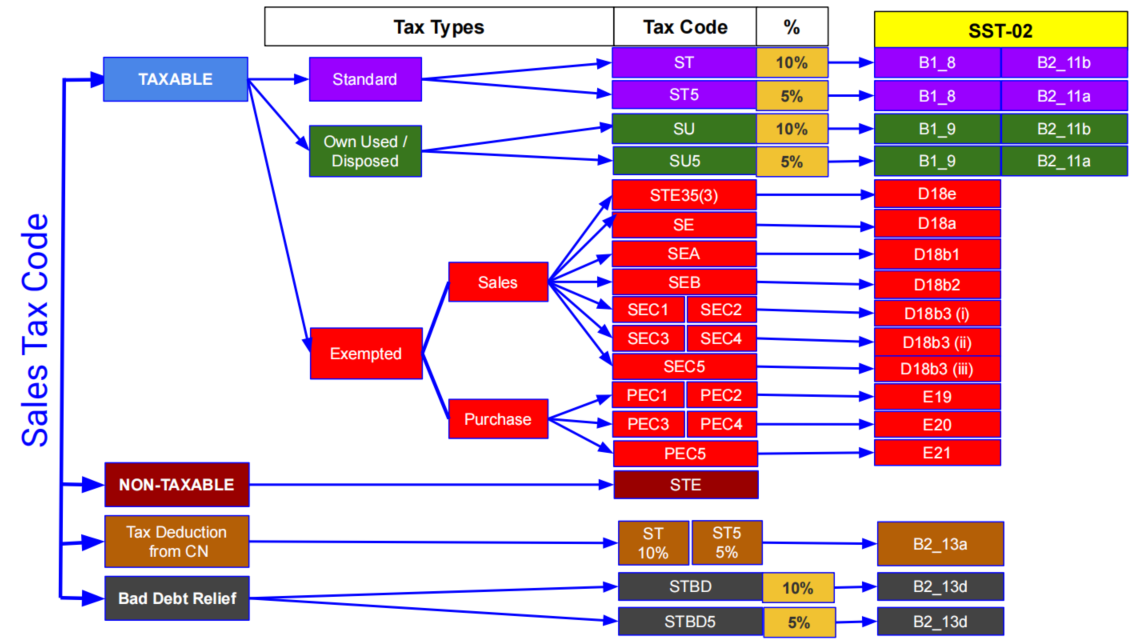

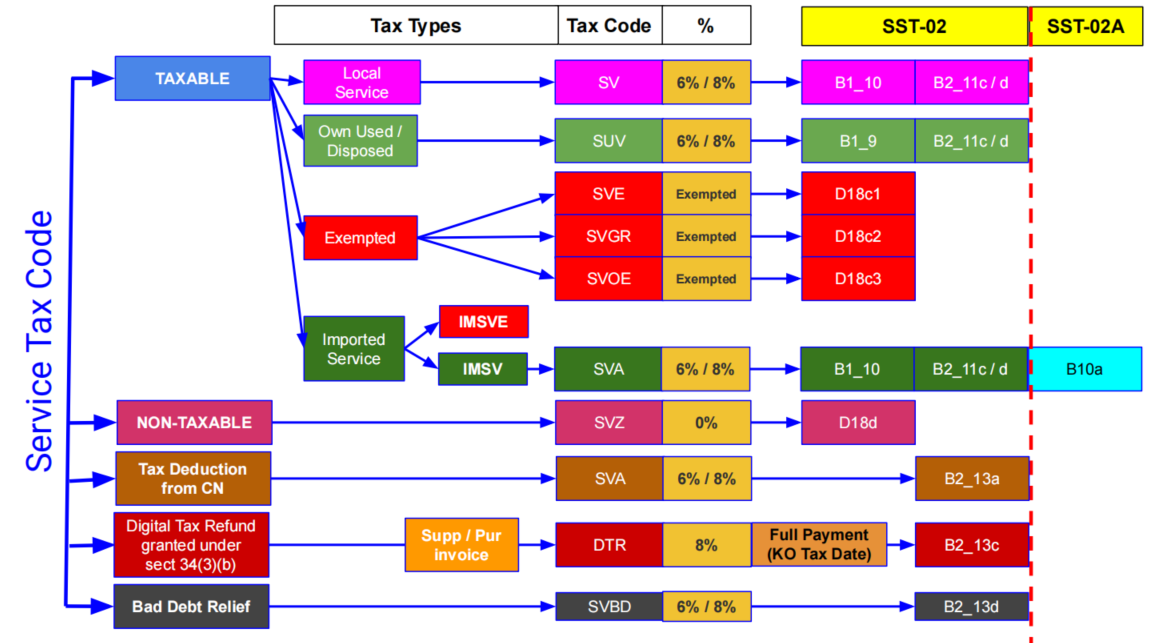

The images below show SST tax code structures and mapping to SST-02:

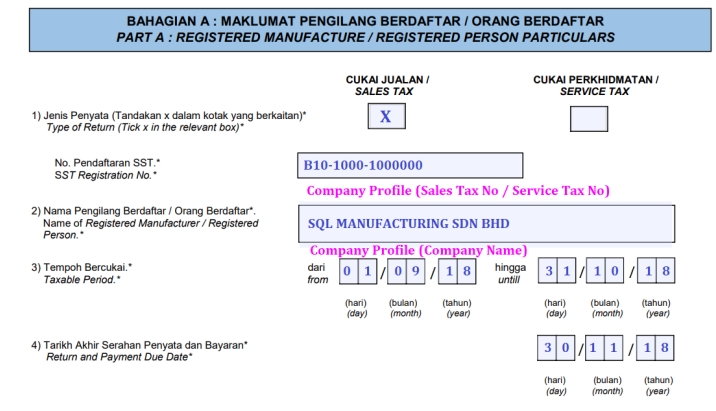

Part A:

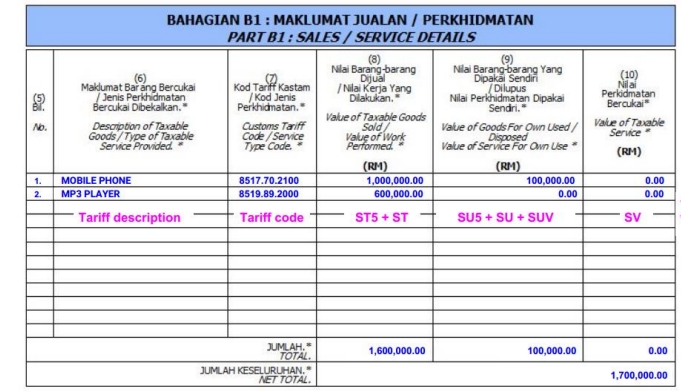

Part B1:

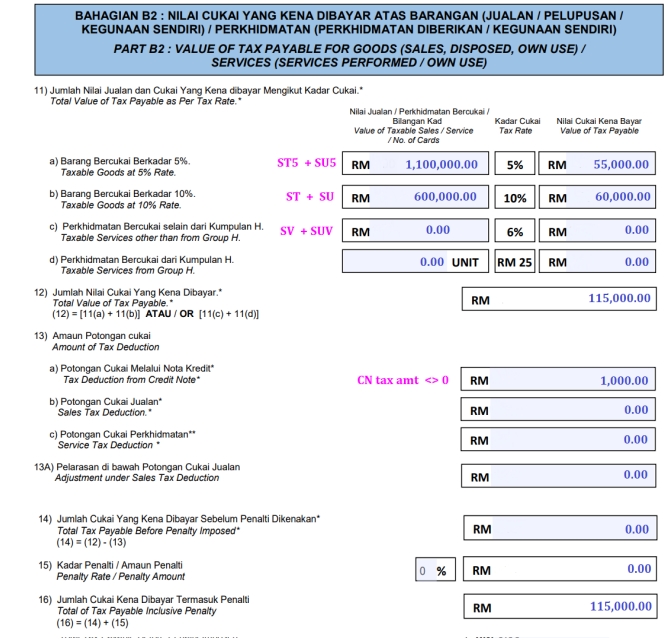

Part B2:

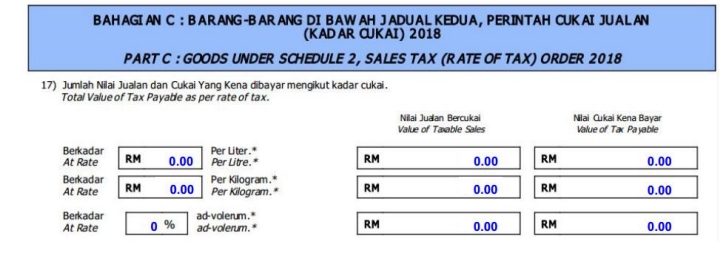

Part C:

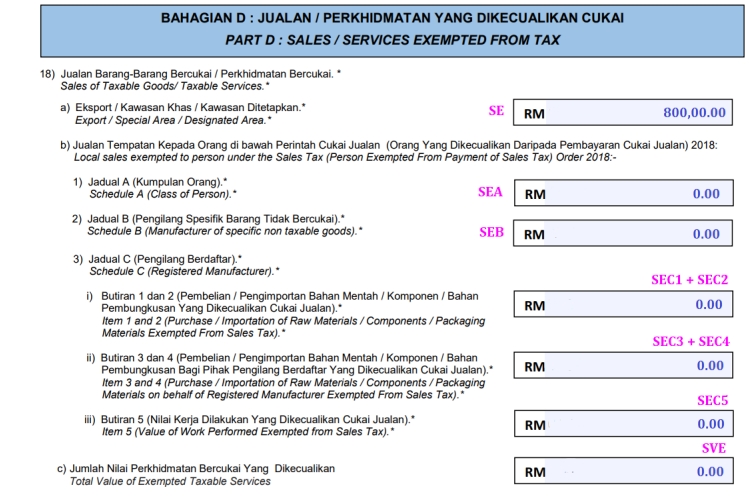

Part D:

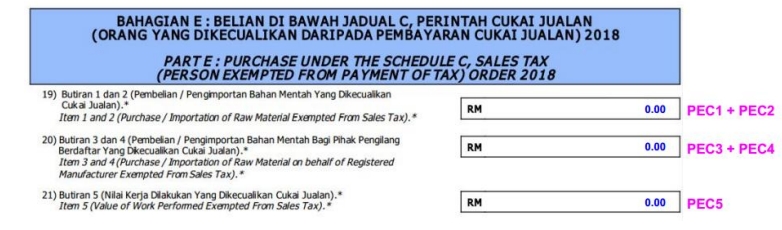

Part E:

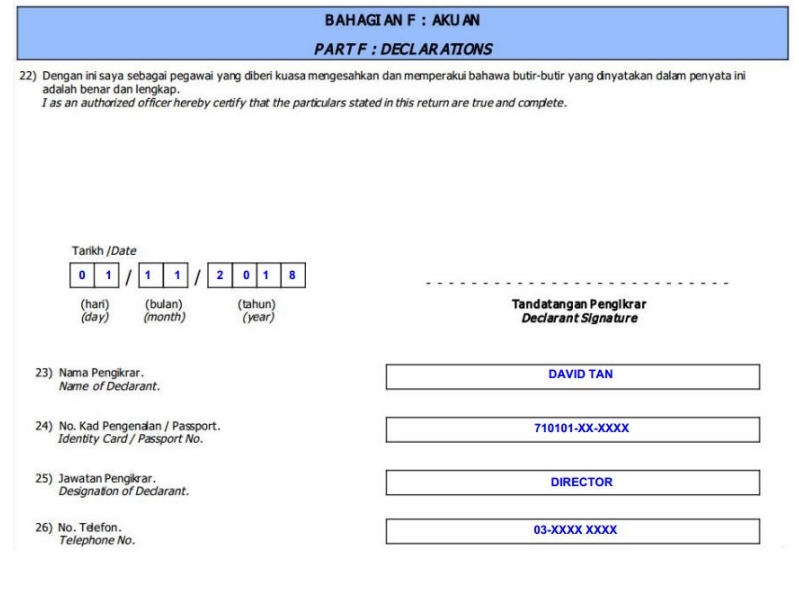

Part F:

Part G:

Sales Tax Code

-

Standard

No Tax Code Description Tax Rate SST-02 01 ST Sales Tax 10% charged to the taxable goods based on accrual/billing basis 10% B1_8, B2_11B 02 ST5 Sales Tax 5% charged to the taxable goods based on accrual/billing basis 5% B1_8, B2_11A -

Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 01 SU Goods Own Used/Disposed deemed taxable and charged at 10% based on accrual/billing basis 10% B1_9, B2_11B 02 SU5 Goods Own Used/Disposed deemed taxable and charged at 5% based on accrual/billing basis 5% B1_9, B2_11A -

Sales - Exempted

No Tax Code Description Tax Rate SST-02 01 STE Sales Tax Exempted on goods as prescribed in the Sales Tax (Goods Exempted From Tax) Order 2018 02 SE Sales Tax Exempted to Export, Special Area (SA), e.g. Free Zone, LMW and Designated Area (DA), e.g. Langkawi, Tioman, Labuan D18_A 03 SEA Sales Tax Exempted-Sch A (Class of Person), e.g. Government, Local Authority Dept. Detail refer to Schedule A in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 D18_B1 04 SEB Sales Tax Exempted-Sch B (Manufacturer of specific non-taxable goods), e.g. control products, medical. Detail refer to Schedule B in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 D18_B2 05 SEC1 Sales Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials excluding PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer D18_B3 (i) 06 SEC2 Sales Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products D18_B3 (i) 07 SEC3 Sales Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials excluding PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer D18_B3 (ii) 08 SEC4 Sales Tax Exempted-Sch C (Item 4) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETROLEUM products D18_B3 (ii) 09 SEC5 Sales Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcontractor to a reg. manufacturer after completion of subcontract work D18_B3 (iii) -

Purchase - Exempted

No Tax Code Description Tax Rate SST-02 01 PEC1 Purchase Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials excluding PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer E19 02 PEC2 Purchase Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products E19 03 PEC3 Purchase Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials excluding PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer E20 04 PEC4 Purchase Tax Exempted-Sch C (Item 4) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETROLEUM products E20 05 PEC5 Purchase Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcontractor to a reg. manufacturer after completion of subcontract work E21

Service Tax Code

-

Standard

No Tax Code Description Tax Rate SST-02 01 SV Service Tax 6% charged to the taxable services based on payment basis 6% B1_10, B2_11C 02 SVA Service Tax 6% charged to the taxable service based on accrual/billing basis. It is used in IMSV tax code to report in SST-02A 6% B1_10, B2_11C -

Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 01 SUV Service Own Used charged at 6% on accrual/billing basis 6% B1_9, B2_11C -

Service Exempted

Applicable to same service provider under:

- Group G to Group G (all except Employment and Guards protection service provider).

- Group I to Group I (ie. advertising service provider).

No Tax Code Description Tax Rate SST-02 01 SVE Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 D18C -

Imported Service

- For non-Service Tax Registered must declare using SST-02A.

- For Service Tax Registered must declare using SS-02.

No Tax Code Description Input Tax Output Tax SST-02 SST-02A (for imported service) 01 IMSV Imported Service Tax, any company in Malaysia who acquire the taxable service from company outside Malaysia. Non-SST & Sales Tax reg. must report in SST-02A. Service tax reg. remains report in SST-02 PSV (6%) SVA (6%) B1_10 B2_11C B10a 02 IMSVE Imported Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 PSVE SVE D18C

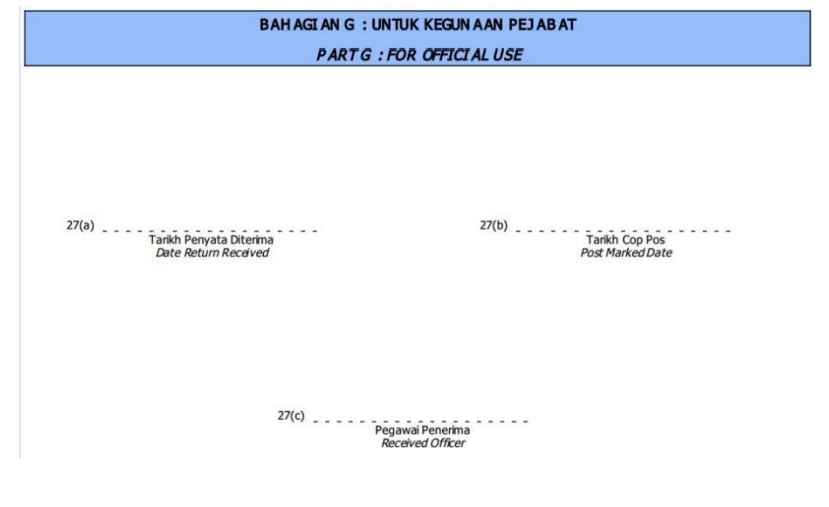

Tariff Code

- Tariff classification is a complex yet extremely important aspect of cross-border trading.

- Goods imported from or to Malaysia are classified by the Harmonized Tariff Schedule (HTS) or commonly referred to as HS Codes.

- The codes, created by World Customs Organization (WCO), categorize up to 5,000 commodity

- HS Codes are made of 6-digit numbers that are recognized internationally, though different countries can extend the numbers by two or four digits to define commodities at a more detailed level.

- Click this link here to search the tariff code list from Kastam system.

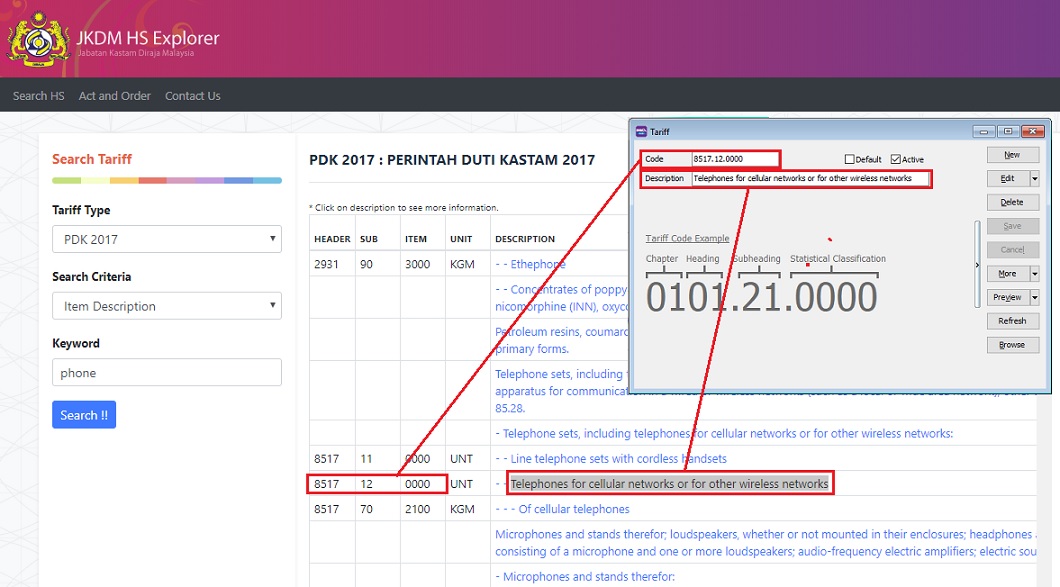

Quick Setup for Tariff Code

-

Create the tariff code applicable to your product at Maintain Tariff.

-

Pick a tariff code for an items at Maintain Stock Item.

-

For exemption certificate case (under Schedule A, B, C), a tariff and tax code (SEA, SEB, SEC1, SEC2, SEC3, SEC4, SEC5) should set in Maintain Customer and Maintain Supplier (Tariff code setting under Tax Tab).