Daily Pay Method

info

This guide explains how to set daily payment for your employees. Given the below example:

- Pay rate per day = RM 16.00

- Normal working hour = 8 hours

Setup

-

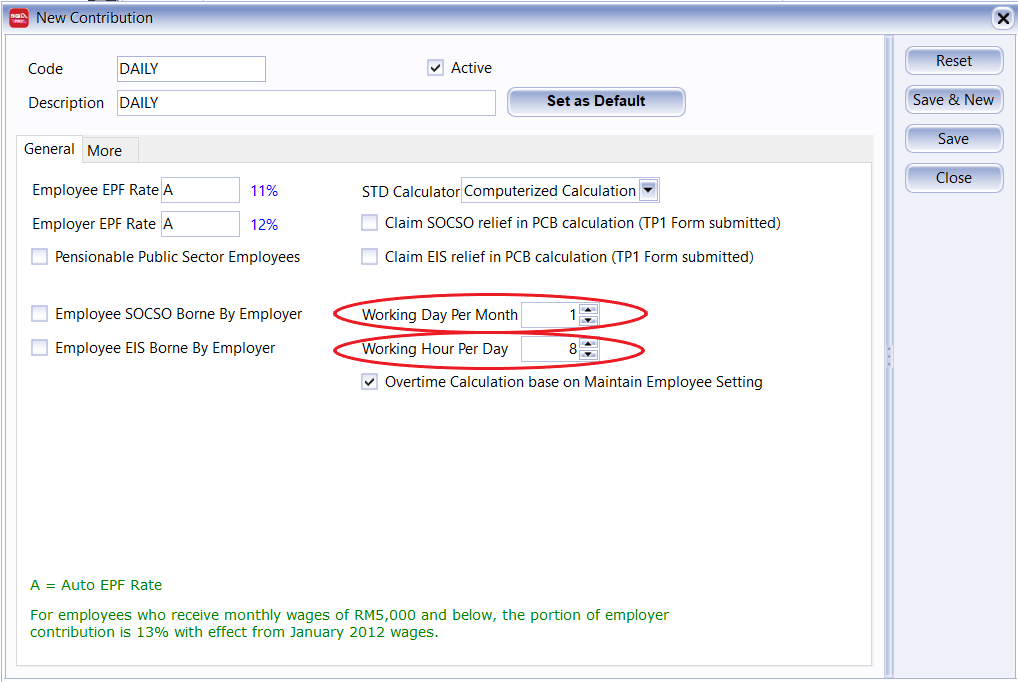

Define the contributions settings

- Navigate to Payroll > Maintenance > Maintain Contribution

- Create new contribution, let said the contribution code is “DAILY.”

- Define the following items:

- Working Day Per Month = 1

- Working Hour Per Day = 8

-

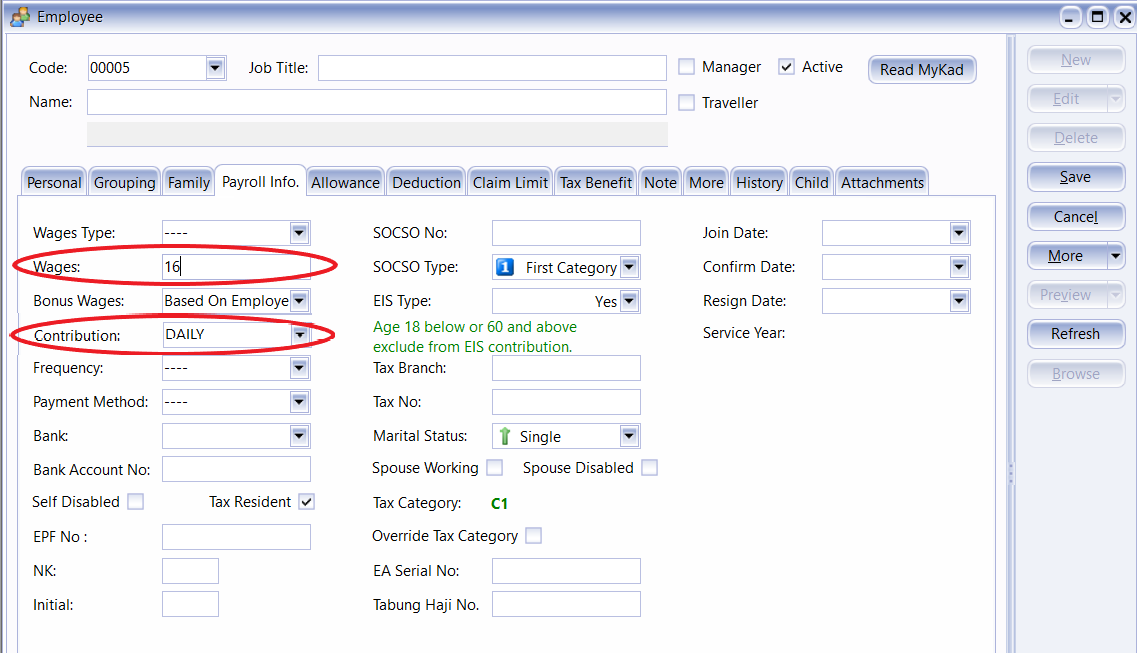

Input the daily rate in maintain employee

- Navigate to Human Resource > Maintain Employee

- Input the daily rate (RM16.00 per day) in the Wages field.

- Set the contribution to “DAILY”.

-

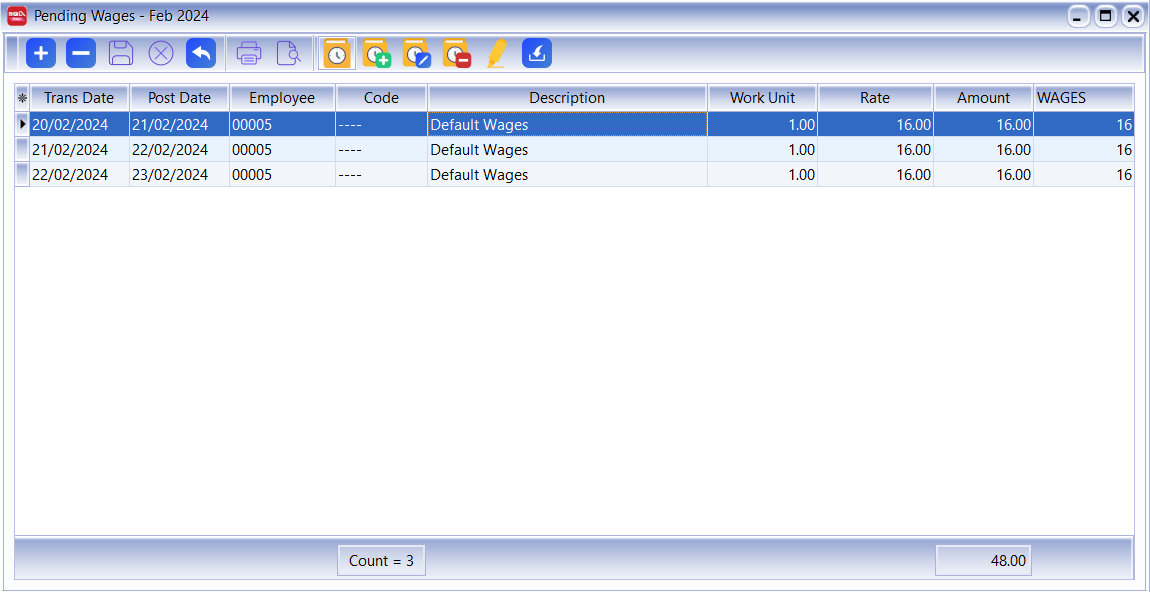

Open pending payroll – Wages

- Navigate to Payroll > Open Pending Payroll

- Go to Wages Pending.

- Key-in the daily working records for an employee.

- Work unit = 1 day

- Rate = RM16.00 per day

-

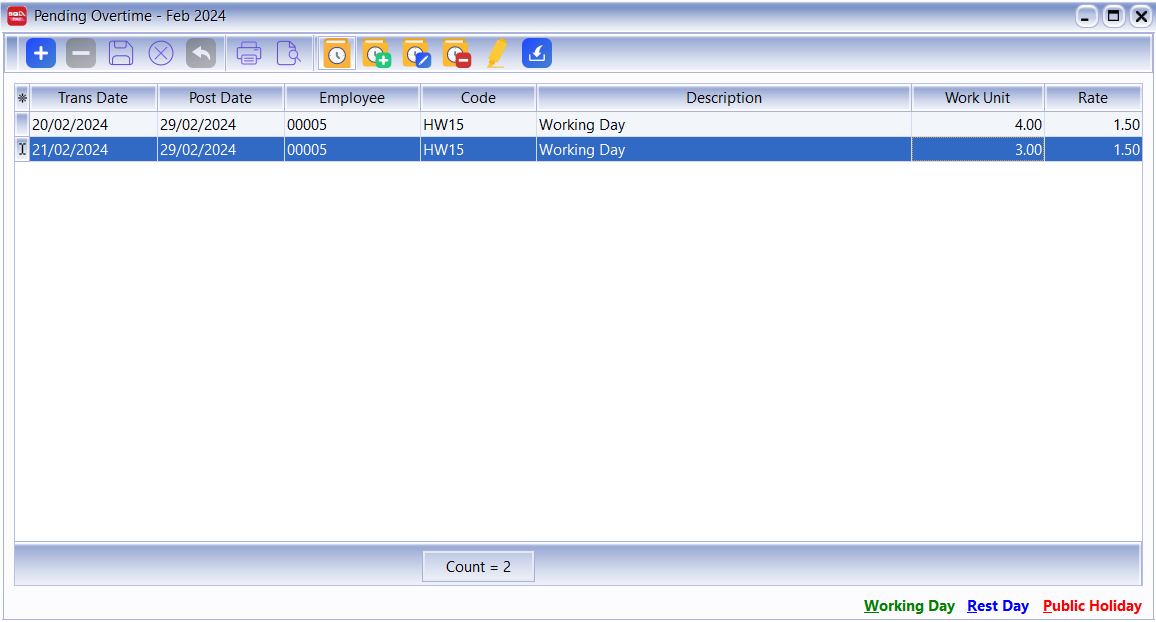

Open pending payroll – Overtime

- Navigate to Payroll > Open Pending Payroll

- Go to Overtime Pending.

- Key-in the daily working records for an employee.

- Code = HW15 (OT Hourly Rate)

- Work Unit = No.of hours (OT)

- Rate = 1.5 rate per hour (OT)

-

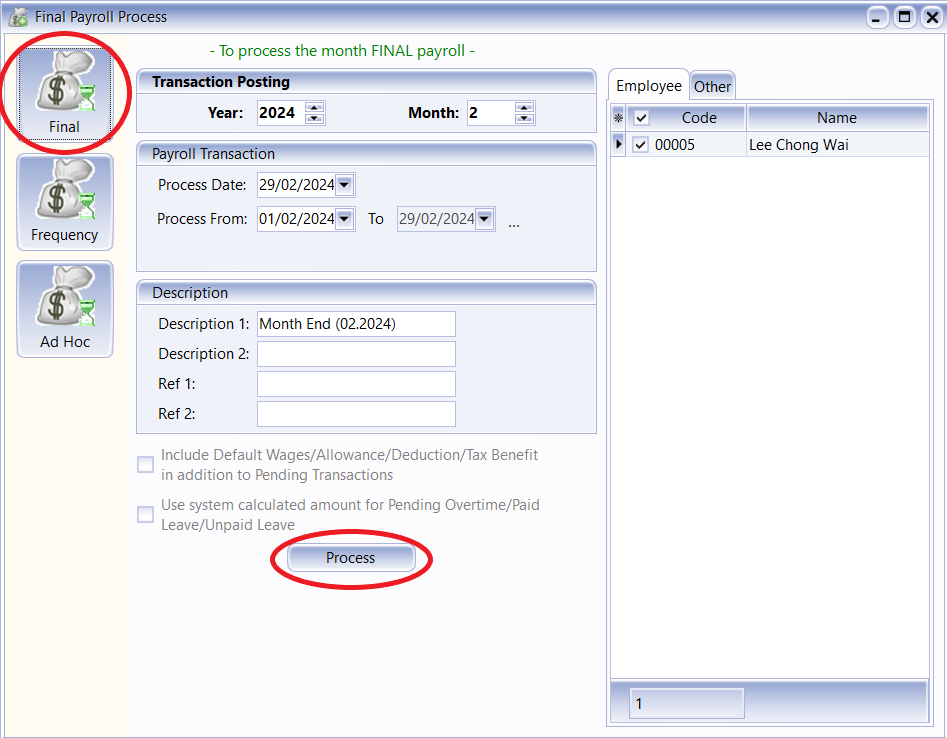

Final payroll process

- Navigate to Payroll > New Payroll

- Click on Final followed by Process button.

-

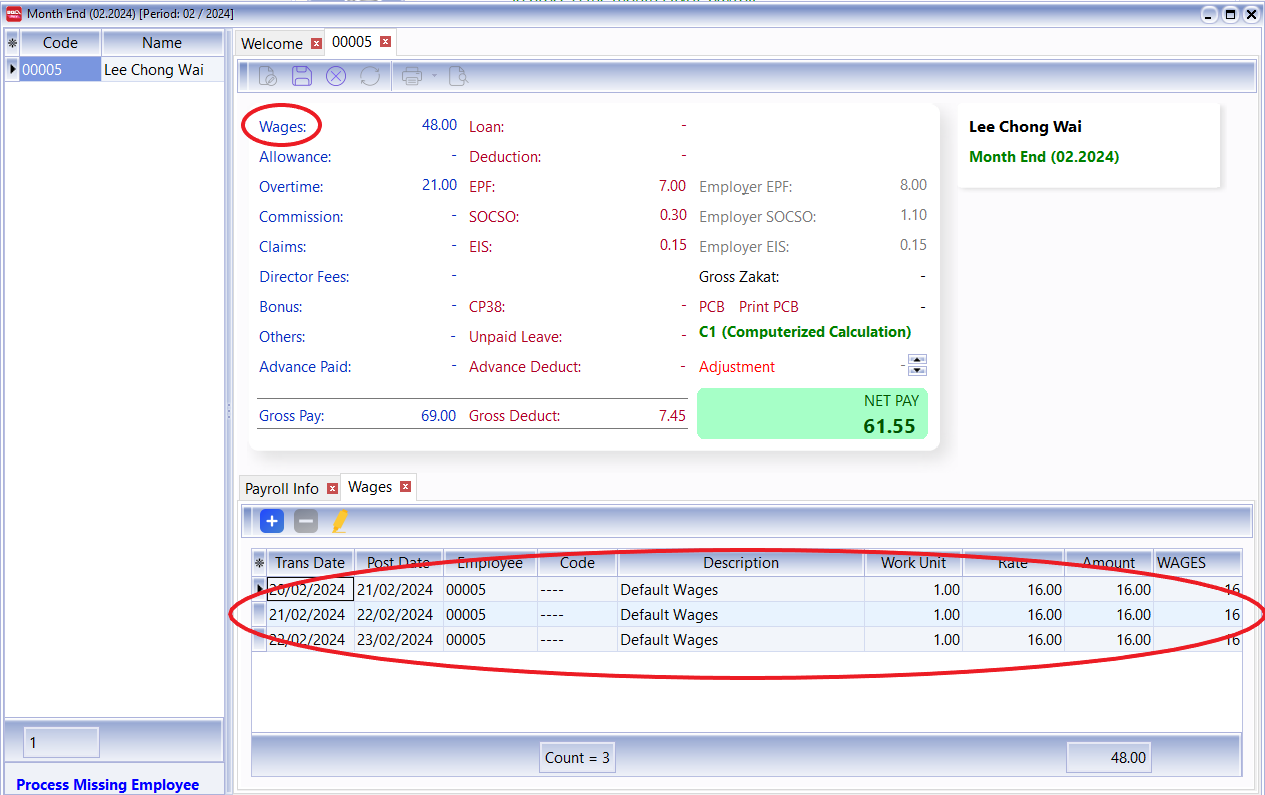

Check the wages records

- Click on the Wages to retrieve the detailed wages records.

- You will see the records are posted from wages pending for the month.

-

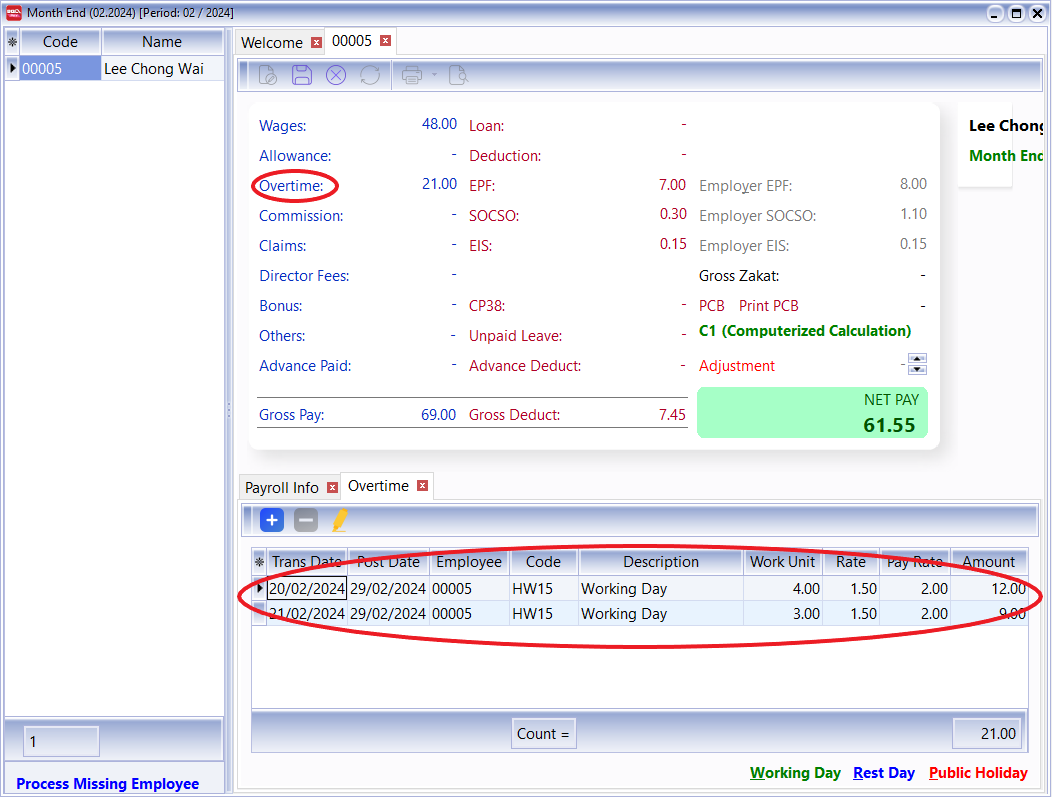

Check the overtime records

- Click on the Overtime to retrieve the detailed wages records.

- You will see the records are posted from Overtime pending for the month.

- Working Day Per Month = 1 (from Maintain Contribution)

- Working Hour Per Day = 8 (from Maintain Contribution)

- Wages = RM16.00 (from Maintain Employee)

Based on the above information,

- Daily Pay Rate = RM16.00 / 1 day = RM16.00 per day

- Hourly Pay Rate = RM16.00 / 8 hrs = RM2.00 per hour

Therefore, the overtime calculation is

Code Work Unit Rate Pay Rate OT Pay Rate Amount HW15 4hrs 1.5 2.00 RM2.00 x 1.5 = RM3.00 RM3.00 x 4 hrs = RM12.00 HW15 4hrs 1.5 2.00 RM2.00 x 1.5 = RM3.00 RM3.00 x 3 hrs = RM9.00