Zakat and Tabung Haji

Setup Zakat & Tabung Haji

-

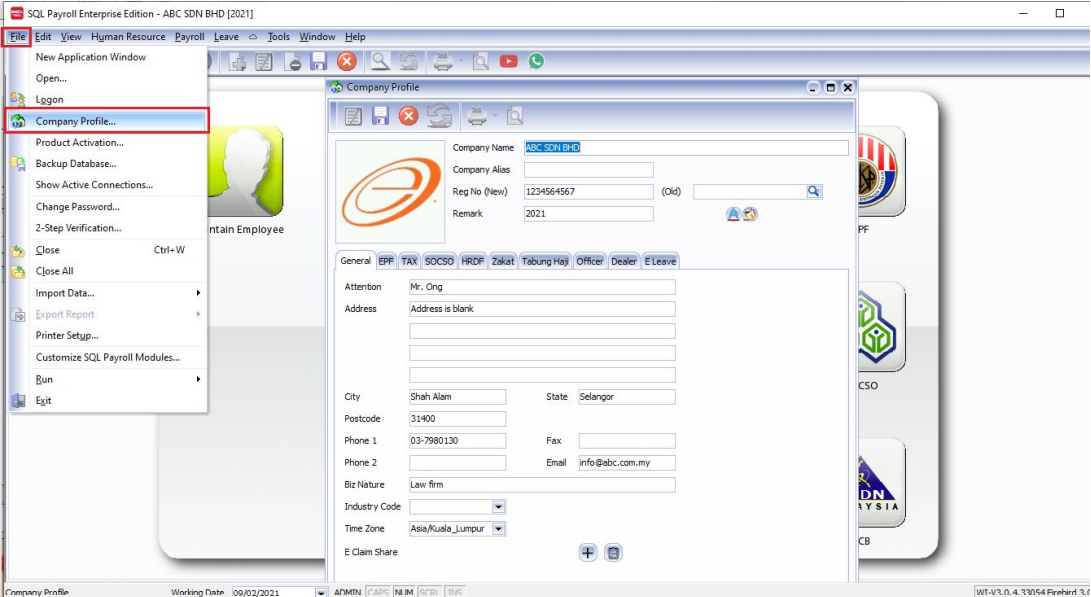

Go to File > Company Profile

-

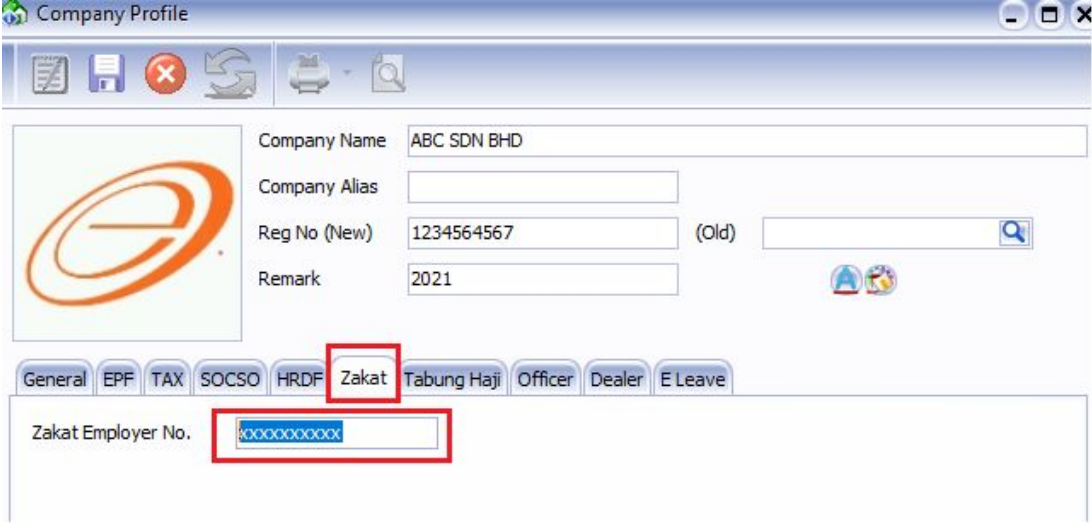

Click Zakat and key in Zakat Employer Number :

-

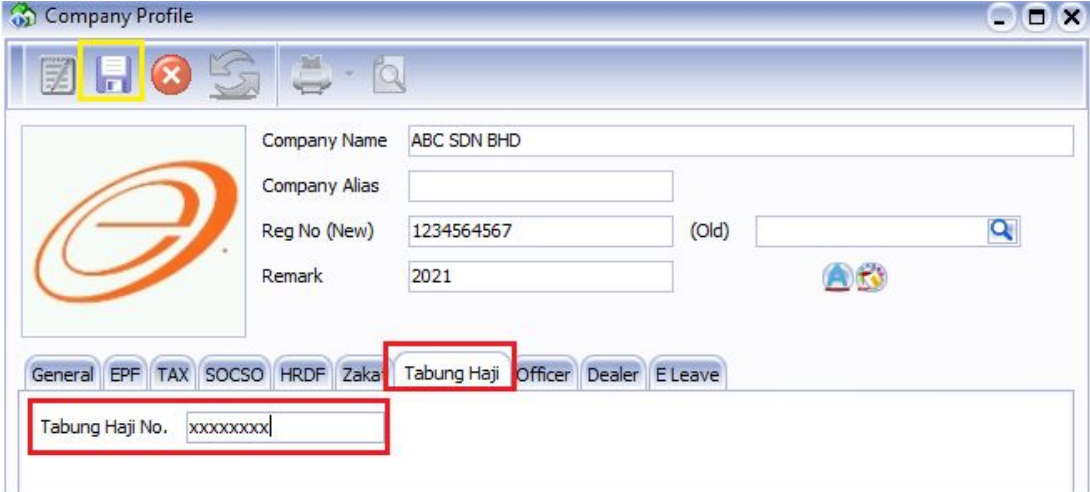

Click Tabung Haji and key in your company's Tabung Haji Number. Press SAVE once you have keyed in.

-

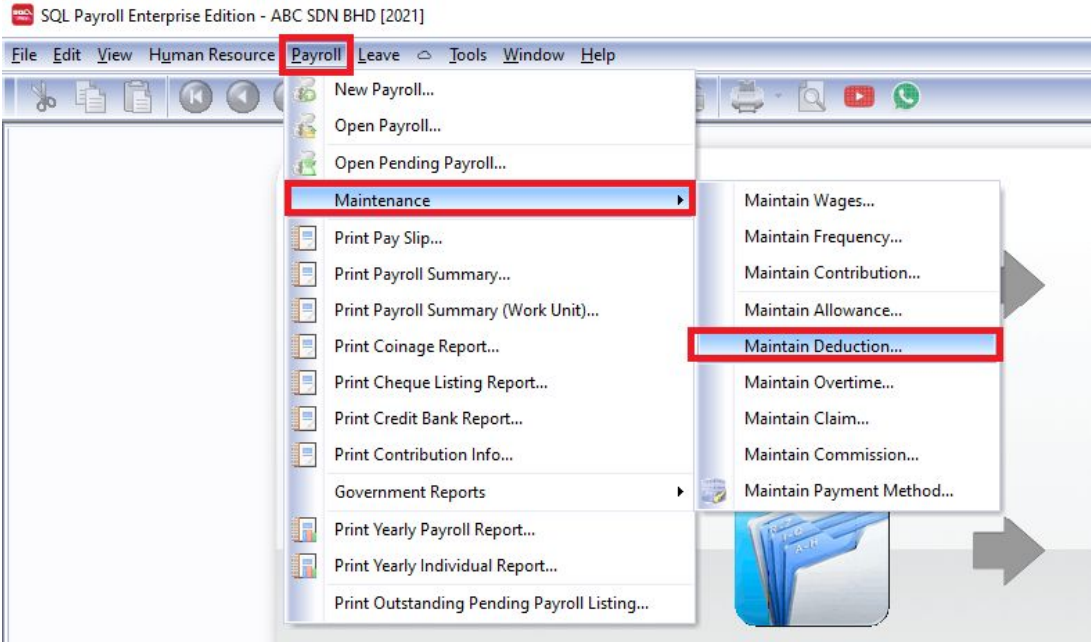

Go to Payroll > Maintenance > Maintain Deduction :

-

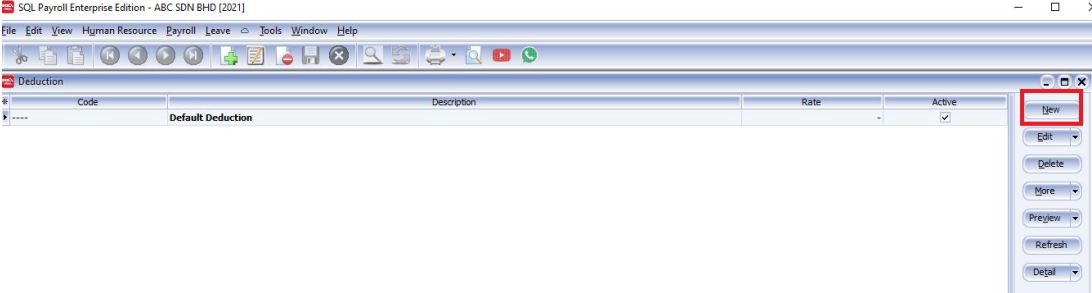

Create a new Deduction by clicking the NEW button.

-

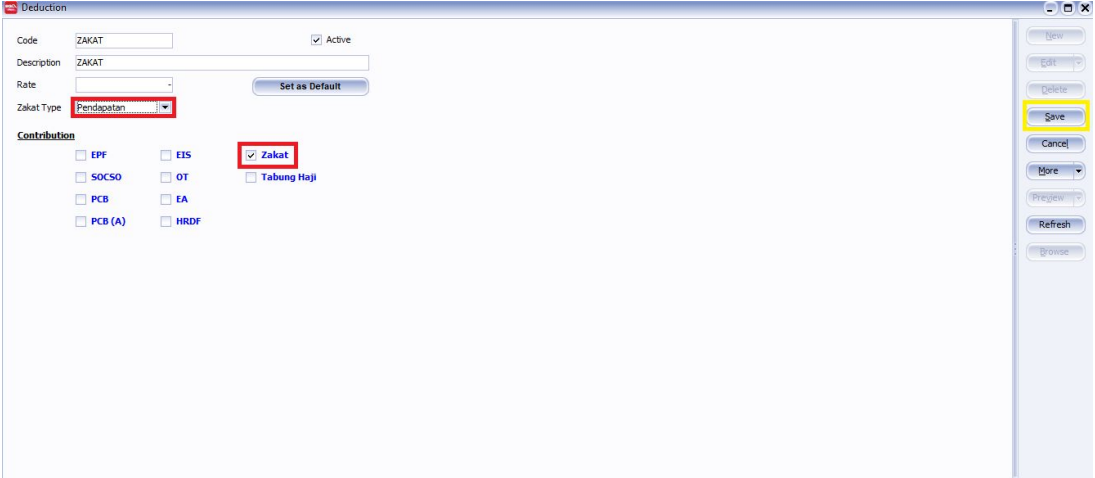

Create ZAKAT deduction following these steps, remeber to press SAVE.

-

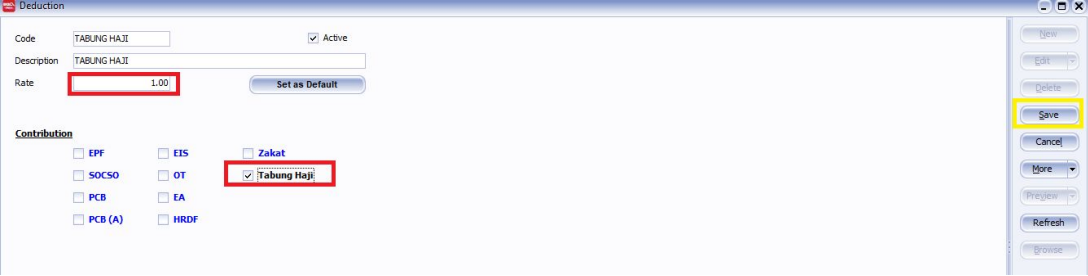

Create Tabung Haji deduction by Pressing the NEW button and follow the image. Remember to press SAVE.

-

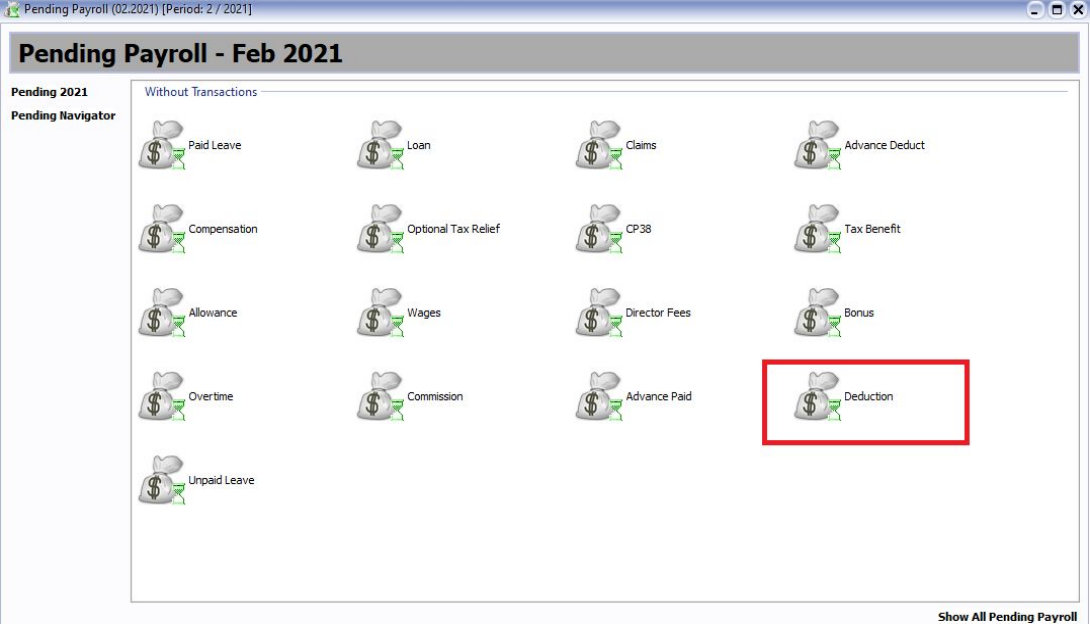

Once you have created the 2 new deduction, please go to Payroll -> Open pending payroll and key in your deduction.

-

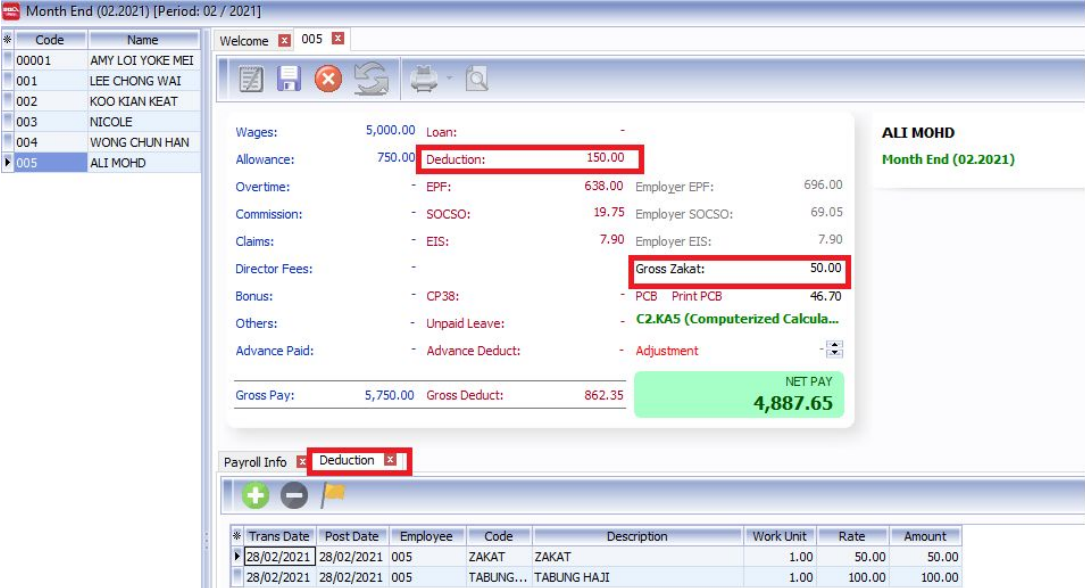

Select the employee name, and key in the deduction amount for Zakat and Tabung Haji. Press Save

-

When you process your month end, you will see the Deduction amount as well as the gross Zakat that you keyed in Pending Payroll

Print Zakat Report

-

Navigate to Payroll > Government Reports > Print Zakat

-

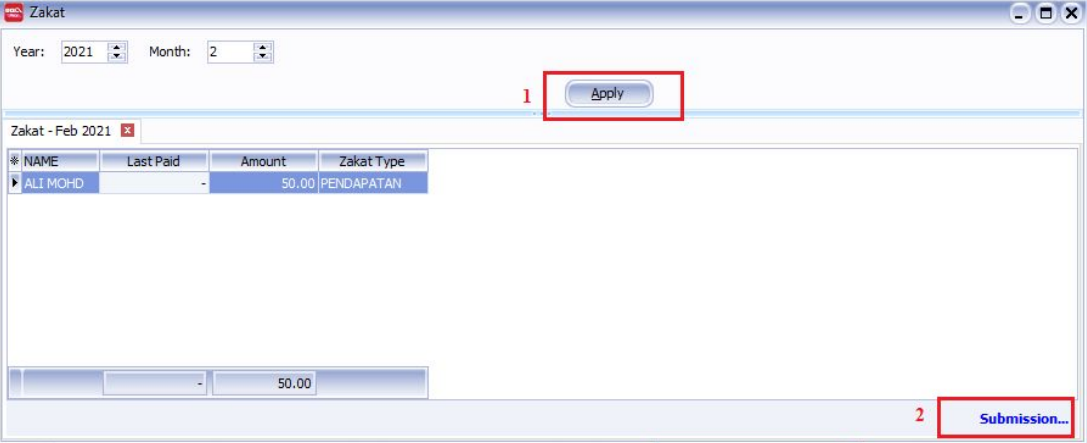

Select the Year and Month, press the Apply button. Once you see the employee name, press the word "Submission..":

-

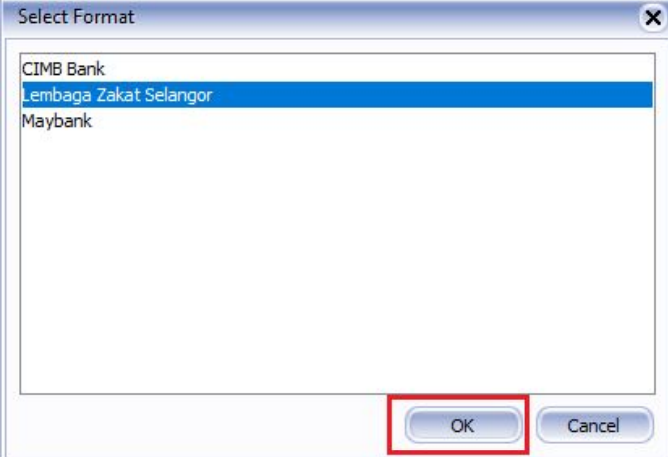

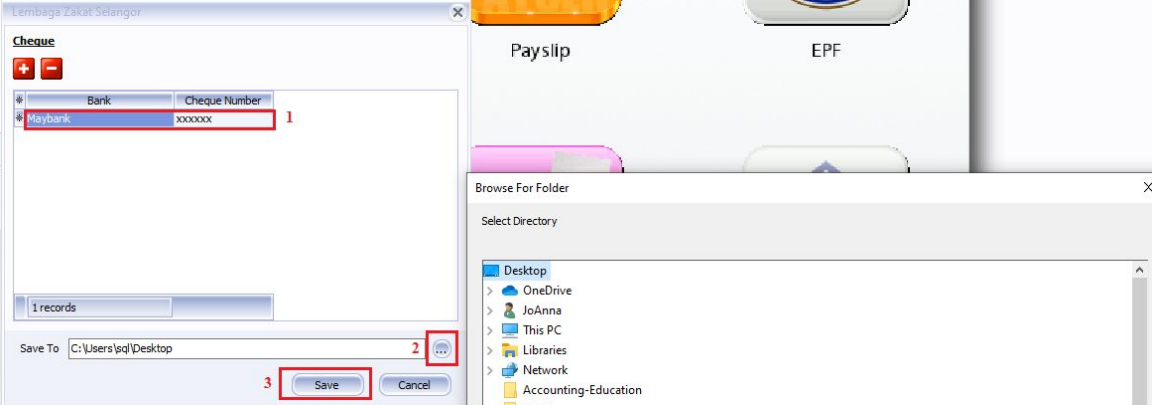

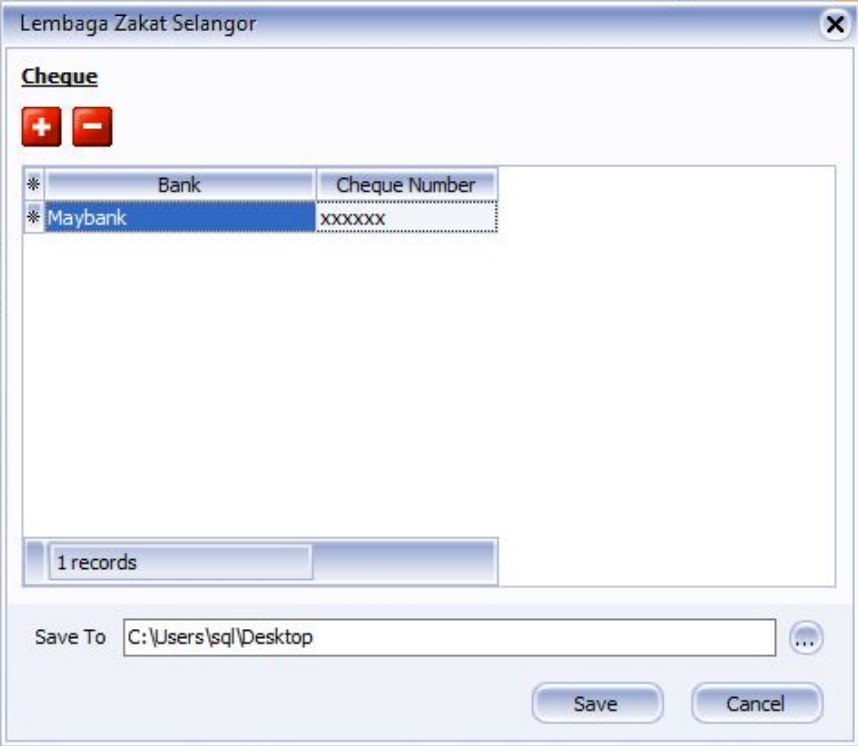

Select the payment format:

-

If you selected Lembaga Zakat Selangor, you have to key in the Bank account and the cheque number. Once that is done, You can save the text file to your desktop.

Print Tabung Haji Report

-

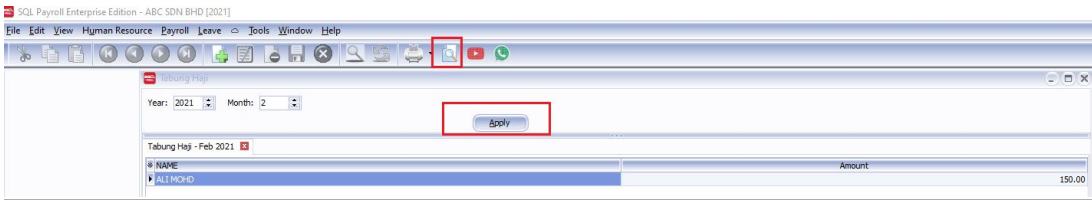

Navigate to Payroll > Government Reports > Print Tabung Haji

-

Select the Year and Month, press Apply. Press the Preview button.

-

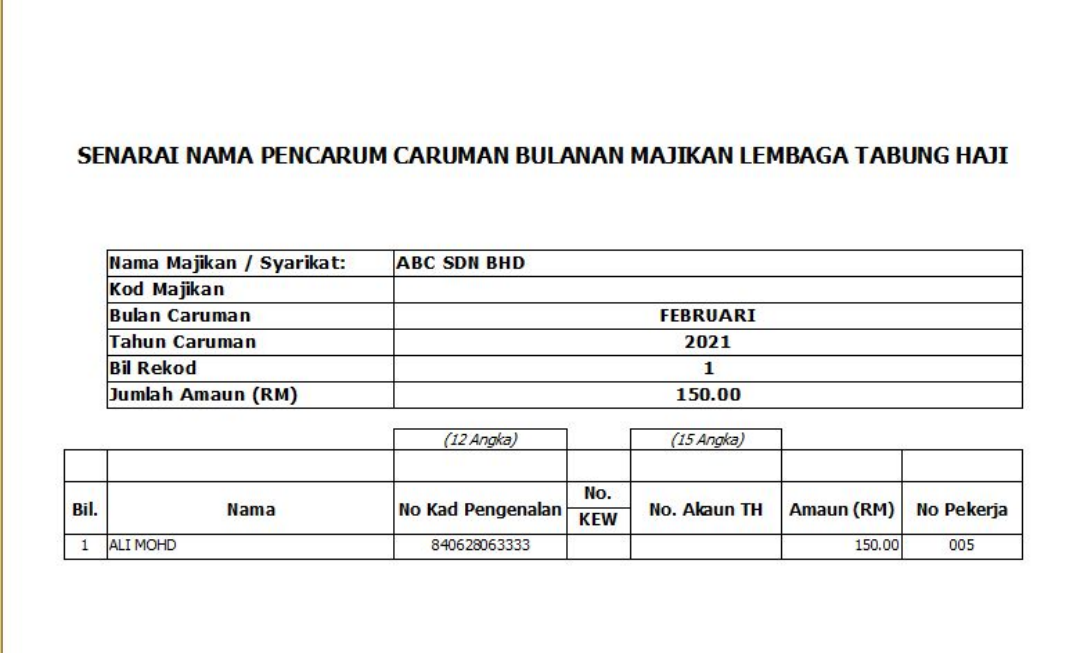

You will see this report. You may print it out or export it as a PDF file :