Witholding Tax

Withholding Tax Account

Go to GL > Maintain Account

| GL Account | Description | Remark |

|---|---|---|

| 460-XXX | Witholding Tax Payable | Under Current Liabilities |

GL Account not compulsory to be the same.

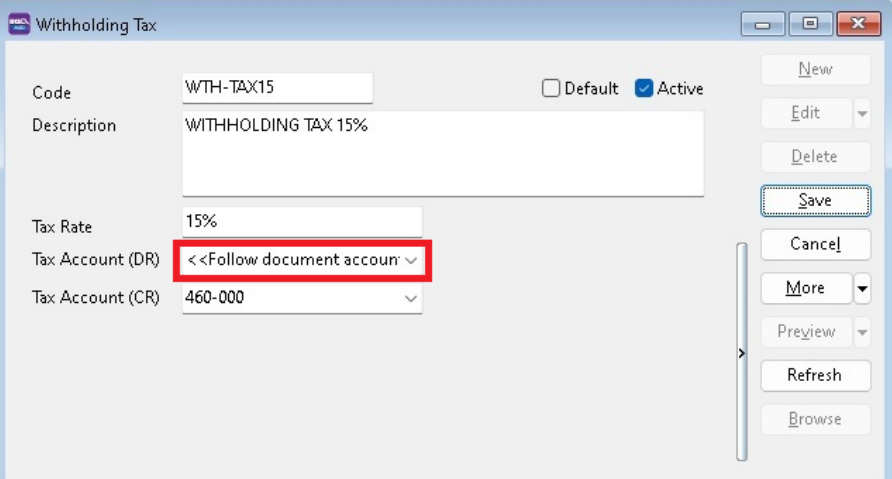

Maintain Withholding Tax

Go to Tools > Maintain Withholding Tax

-

Click New.

-

Input the following data:

Field Name Explanation Remark Code Set a code WTH-TAX15 Description Describe the meaning/usage of this code Withholding Tax 15% Tax Rate Witholding Tax Rate 15% Tax Account(DR) Expenses Account <<Follow document accounts>> if leave blank here Tax Account(CR) Set to Withholding Tax Payable account At GL\Maintain Account, create the Withholding Tax Payable account under Current Liabilities  note

noteTax Account (DR) leave blank

-

Click on Save.

Withholding Tax Purchase Entry

Available in multiple menus:

| Purchase | Supplier |

|---|---|

| Purchase Invoice | Supplier Invoice |

| Cash Purchase | Supplier Invoice |

| Purchase Debit Note | Supplier Debit Note |

| Purchase Returned | Supplier Credit Note |

-

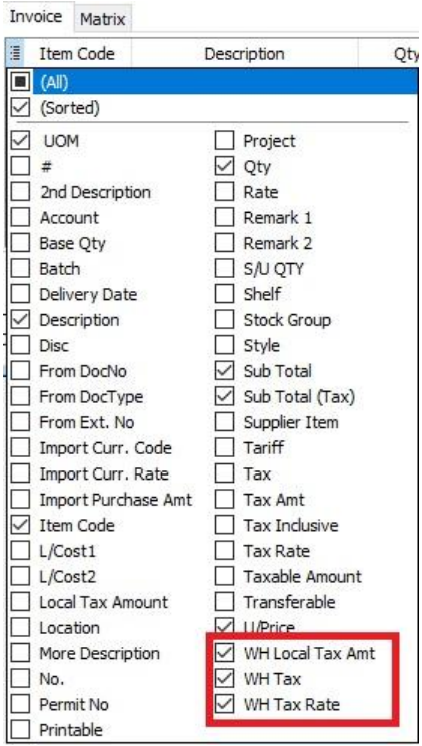

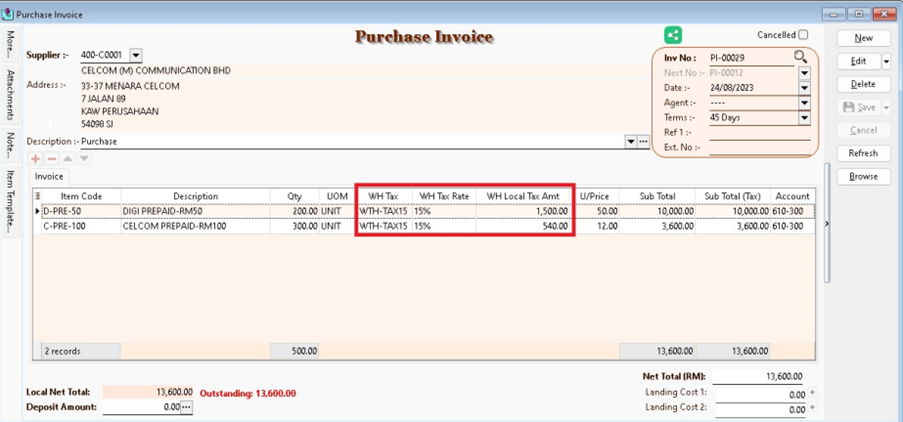

In Purchase Invoice, insert the following columns:

- WH Local Tax Amt

- WH Tax

- WH Tax Rate

-

Select the Withholding Tax Code in WH Tax column.

-

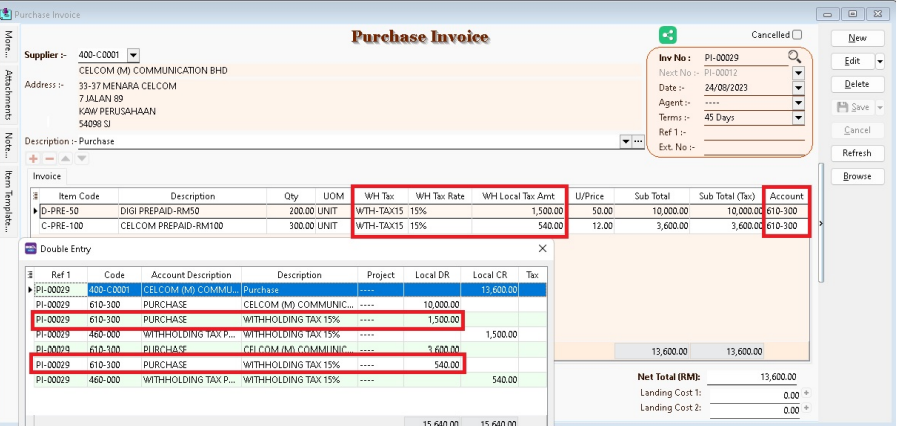

System will auto post the withholding tax double entry. Press CTRL + O to check the double entry.

GL Description Local DR Local CR Expenses Account (follow the document detail GL Account) XXX Withholding Tax Payable XXX

Withholding tax amount will not add into the purchase invoice amount.

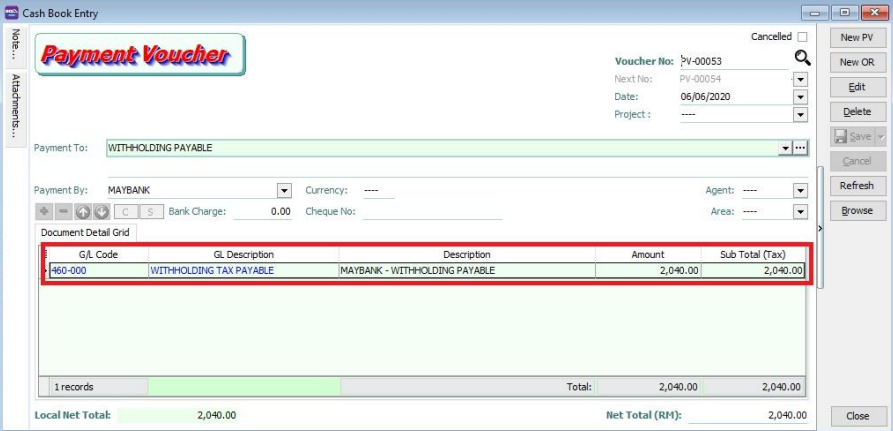

Payment of Withholding Tax

-

Go to GL > Cash Book Entry..

-

Create new PV.

-

Enter Payee name.

-

Select bank account to pay.

-

In detail grid, select the GL Account (Withholding Tax Payable).

-

Enter the withholding tax amount to be paid. Save it.

-

You can check the ledger report for Withholding Tax Payable outstanding balance