Double Entry

Posting

-

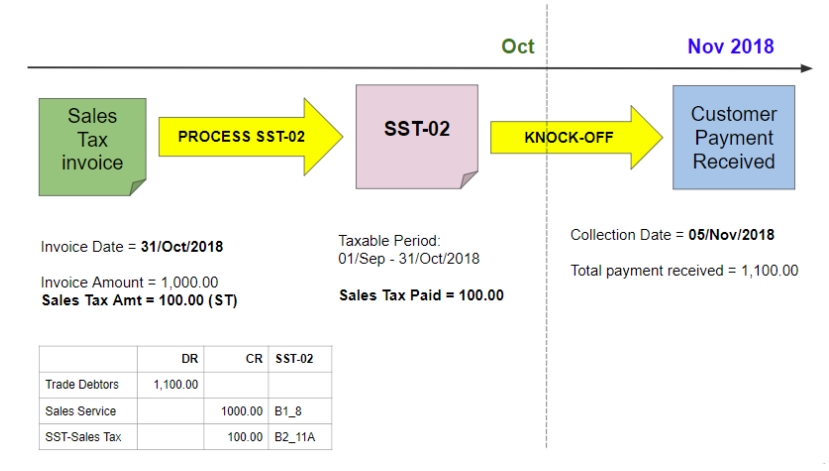

Sales Tax (Accrual Basis)

-

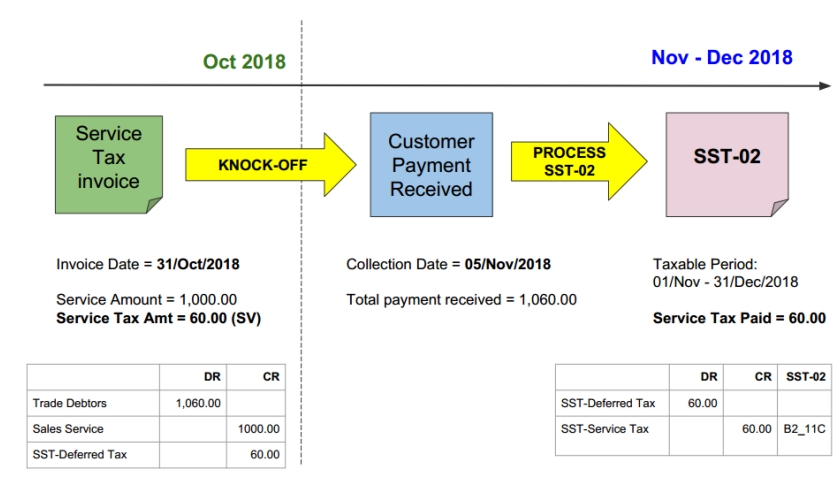

Service Tax (Payment Basis)

In SST 2.0, the service tax is due and payable when payment is received for any taxable service.

-

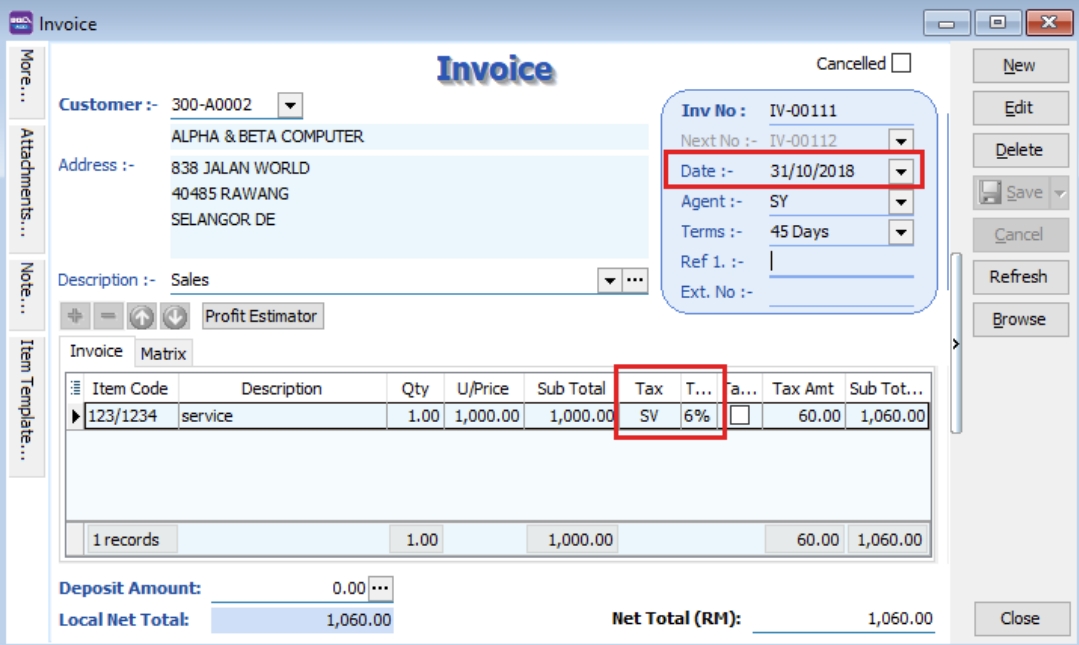

Issue sales invoice with service tax 6%, date 31/10/2018, Amount RM 1,000.00 & Tax Amount RM 60.00.

-

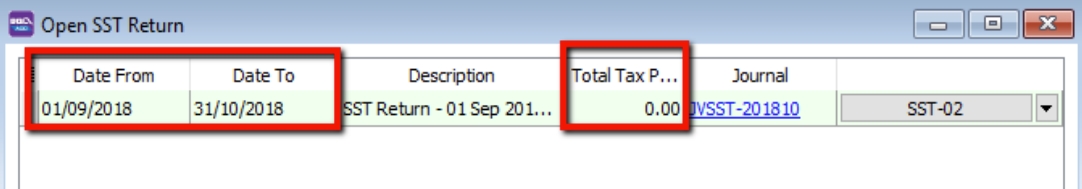

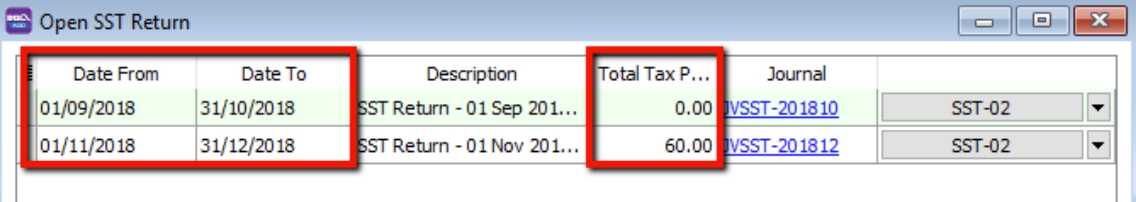

Process SST Return from 01/09/2018 to 31/10/2018. Total Tax Payable is RM 0. Due to no payment is receive for the invoices issued.

-

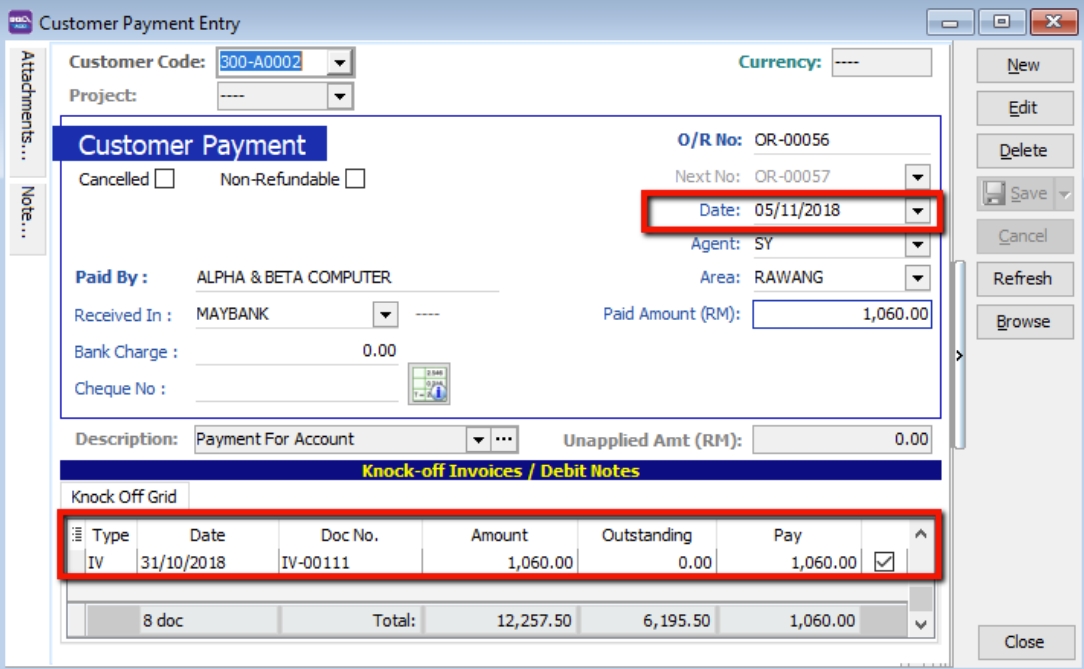

Payment is received on 05/11/2018, knocked-off on IV-00111.

-

Process second cycle of taxable period, the tax payable will be capture as payment is received.

-

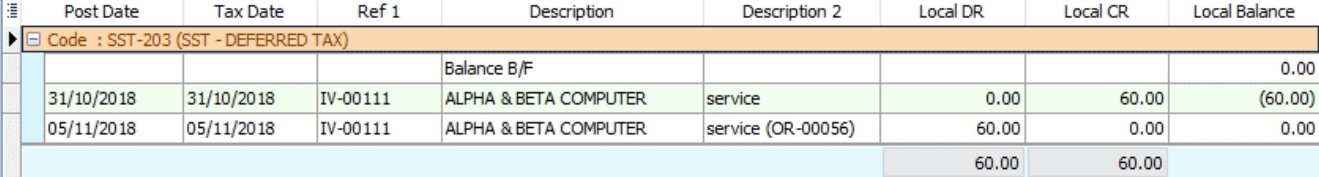

SQL Account will auto Credit to SST- Deferred Tax account during invoice issue but no payment. Once payment is received, a Debit will be auto reversed at SST-Deferred Tax Account.

-

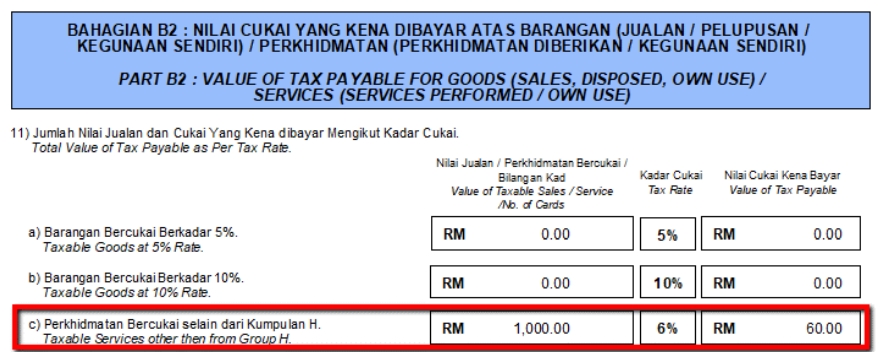

the taxable amount of RM 1,000.00 and Tax Amount of RM 60.00 will also capture in SST-02 Part B2, number 11c.

-