Mandatory Fields

Before issuing an E-Invoice or self-billed E-Invoice, you need to make sure some mandatory fields are updated correctly.

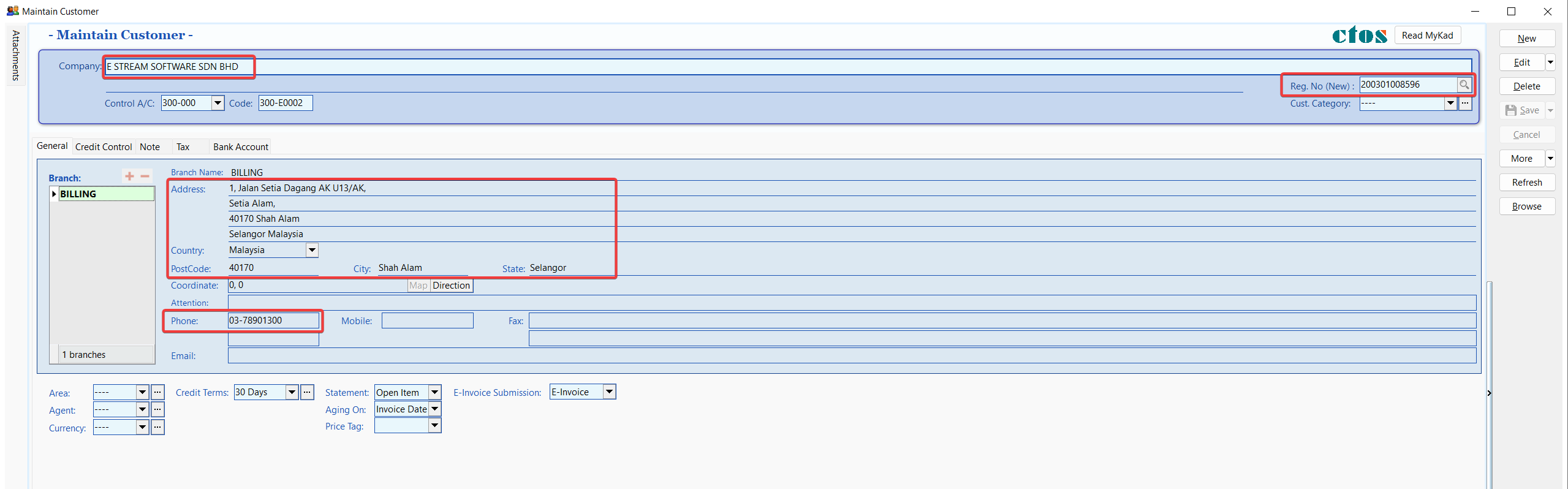

Update Customer Info

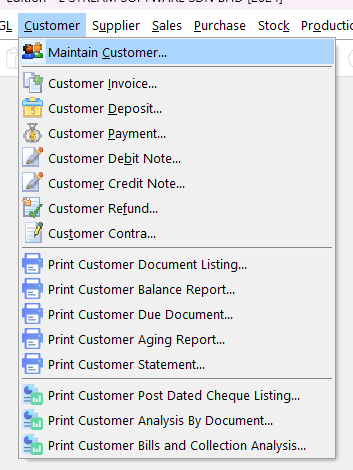

Customer info will be used for issuing E-Invoice.

-

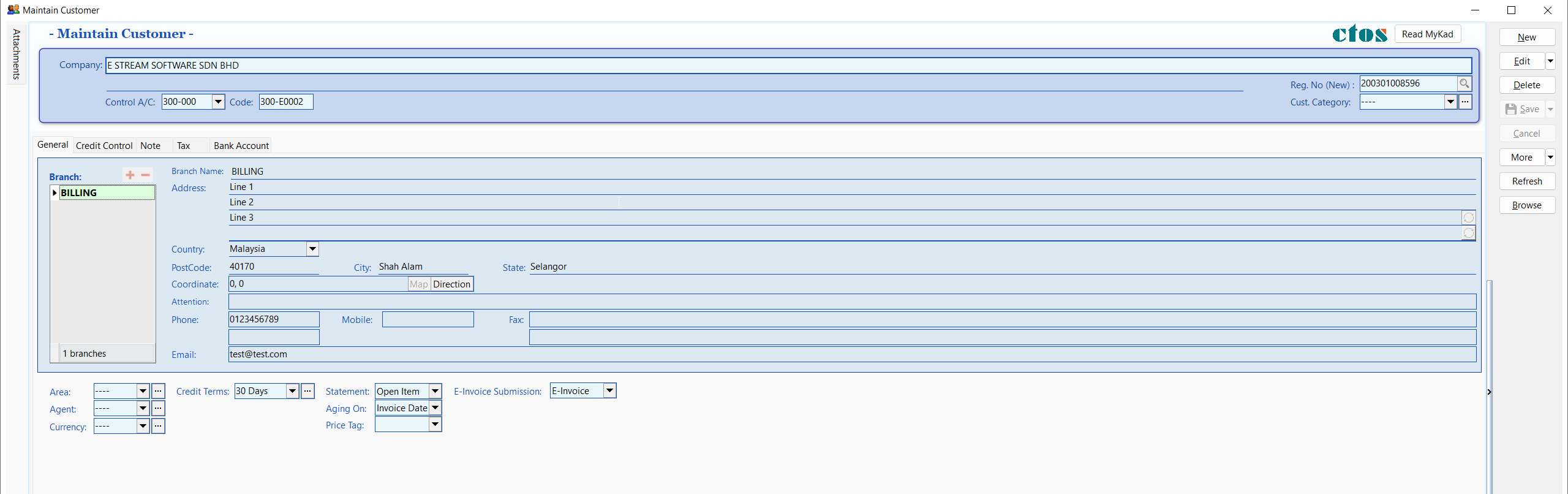

Go to Customer > Maintain Customer > New or Edit an existing customer.

-

Fill in the mandatory fields as shown below.

-

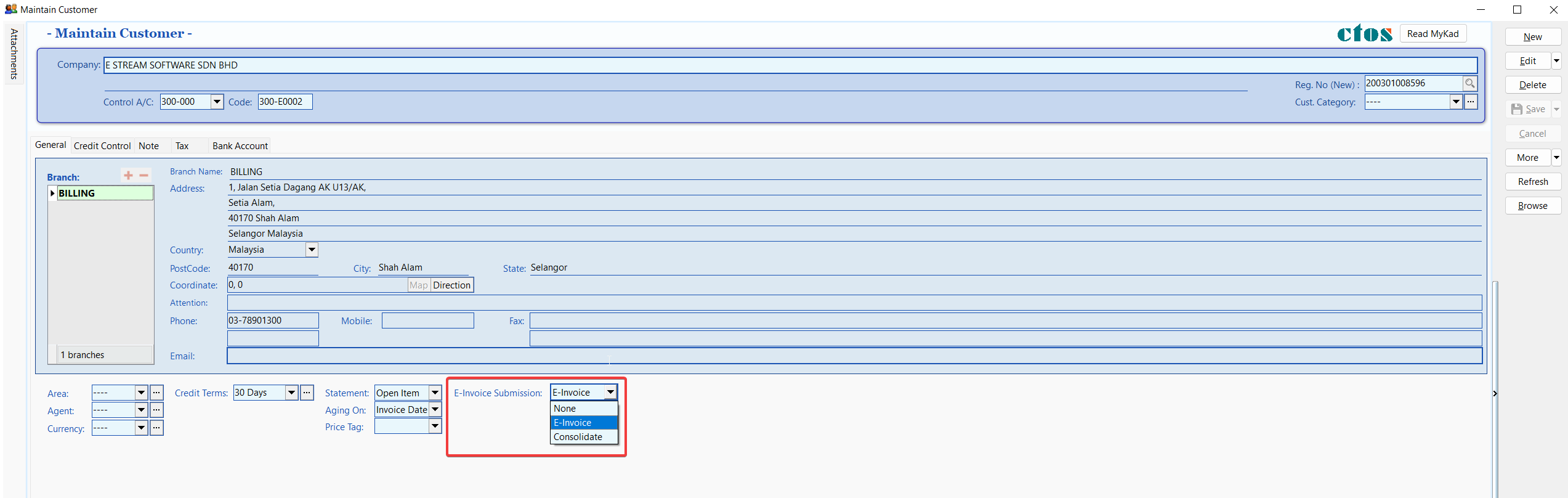

Select the default submission type to be used when issuing a document. This can be modified at the time of document creation if needed.

SUBMISSION- None – Documents created for this customer will be excluded from E-Invoice submission by default.

- E-Invoice – Documents created for this customer will be submitted as E-Invoice by default.

- Consolidate – Documents created for this customer will be submitted as consolidated E-Invoice by default.

-

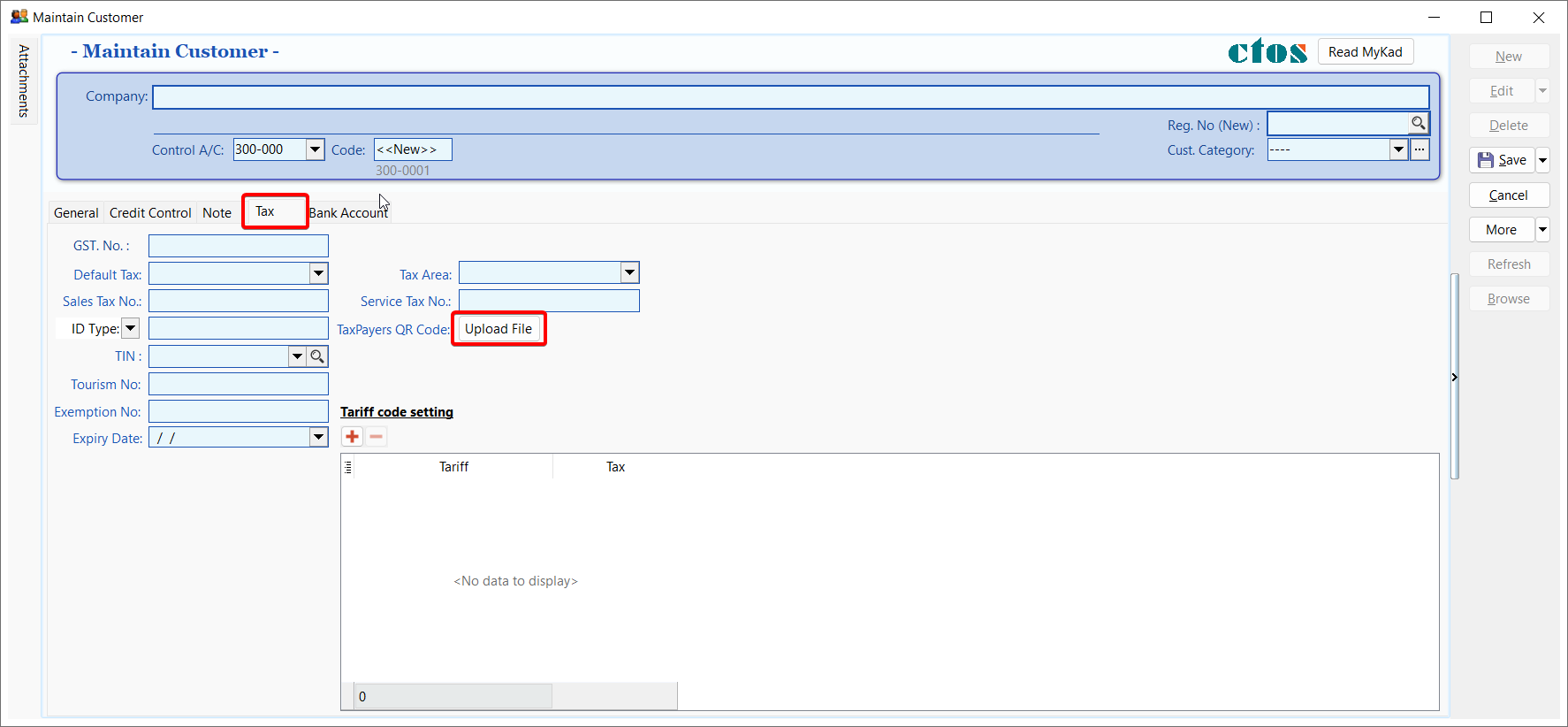

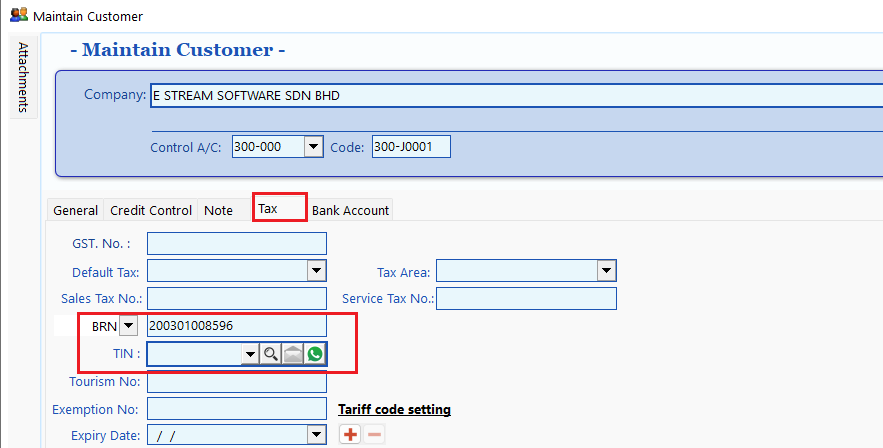

Click on Tax tab, and fill in the customer tax info according to guide.

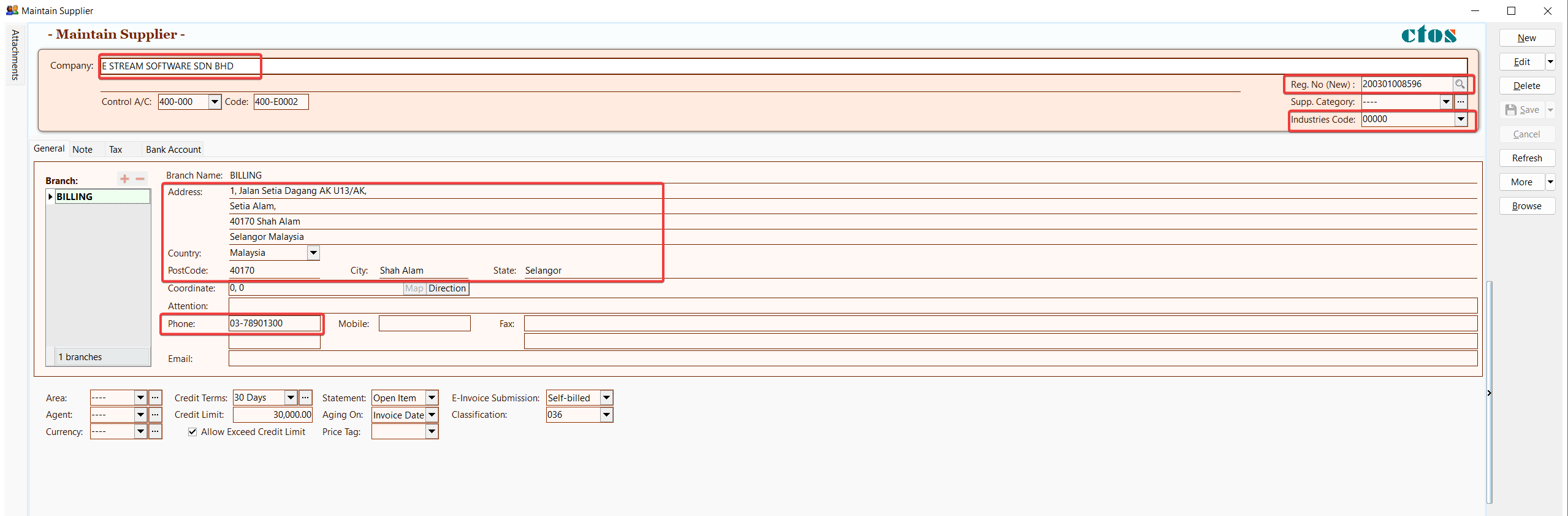

Update Supplier Info

Supplier info will be used for issuing self-billed E-Invoice.

-

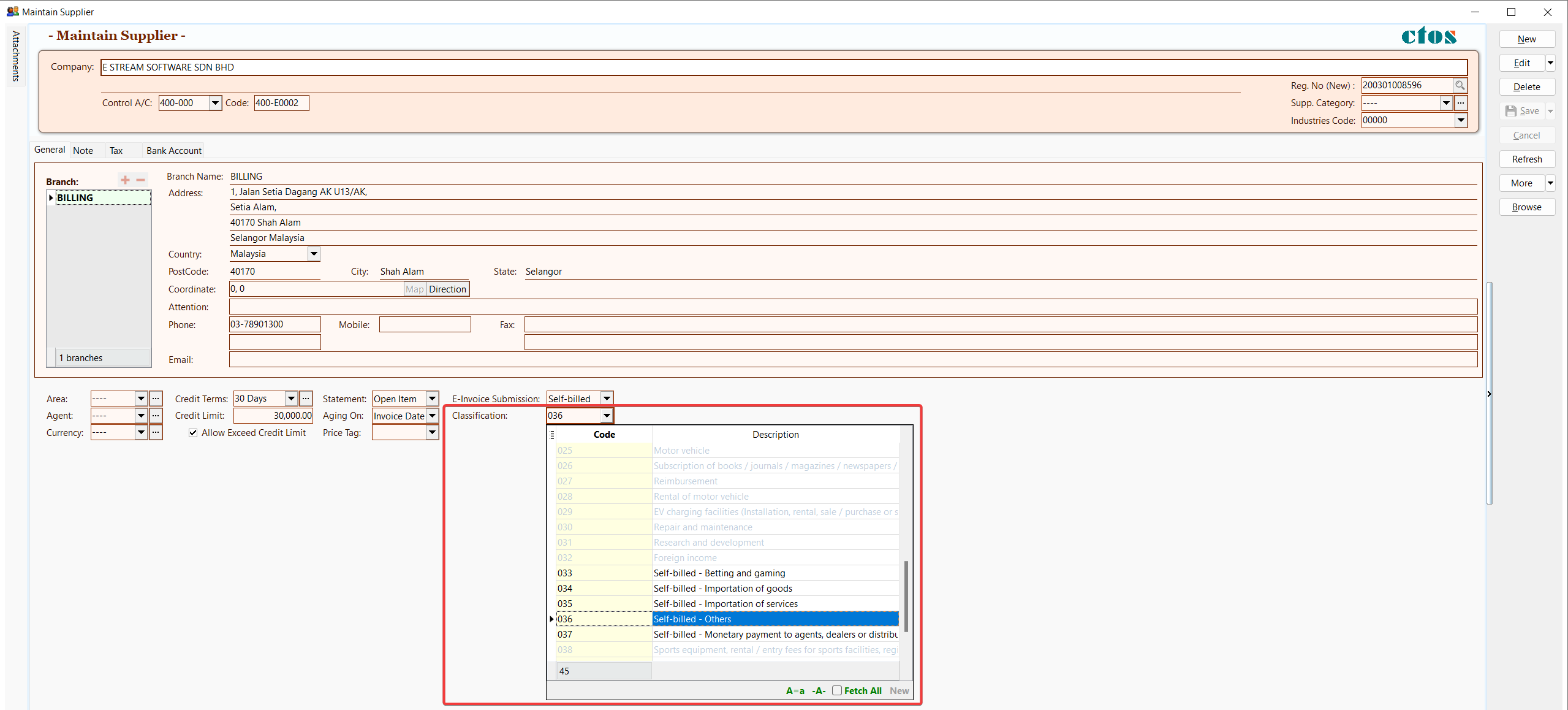

Go to Supplier > Maintain Supplier > New or Edit an existing supplier.

-

Fill in the mandatory fields as shown below.

-

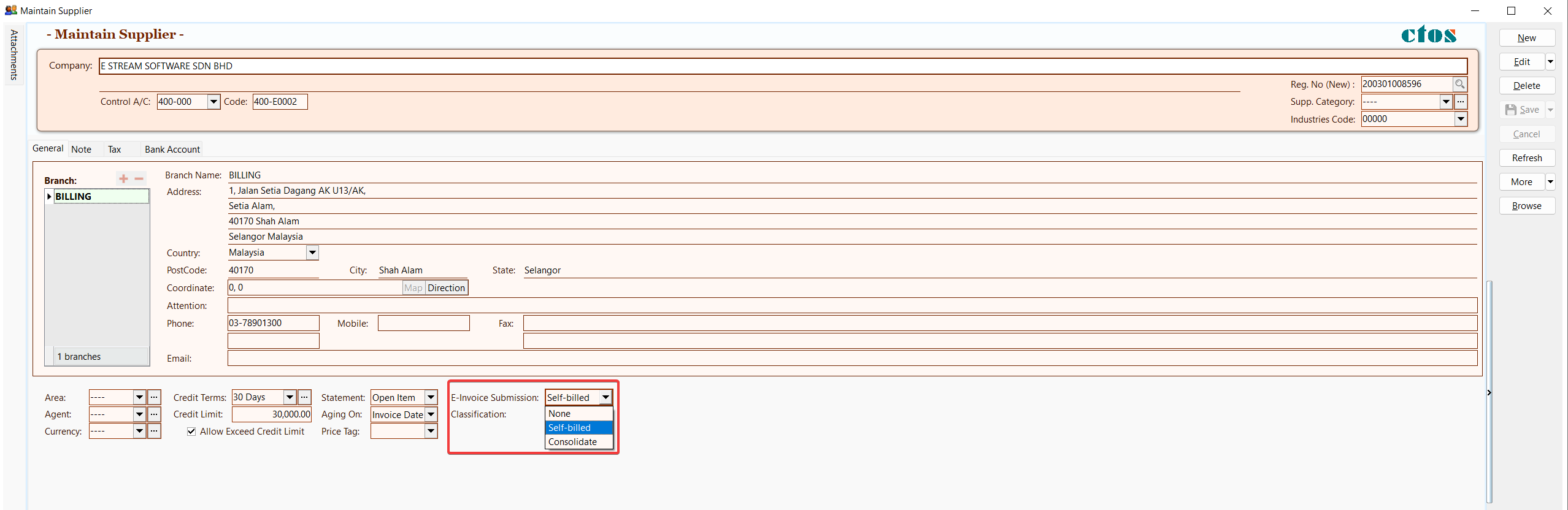

Select the default submission type to be used when issuing a document. This can be modified at the time of document creation if needed.

SUBMISSION- None – Documents created for this customer will be excluded from self-billed E-Invoice submission by default.

- Self-billed – Documents created for this customer will be submitted as self-billed E-Invoice by default.

- Consolidate – Documents created for this customer will be submitted as consolidated self-billed E-Invoice by default.

-

Select the default classification to be used for item detail when issuing a document.

-

Click on Tax tab, and fill in the supplier tax info according to customer/supplier tax info.

Info Request in Maintain Customer/Supplier

The Info Request feature makes it easy to collect accurate company details from customers or suppliers, especially for E-Invoice submissions. It generates a secure link you can share by email, allowing recipients to enter their information directly.

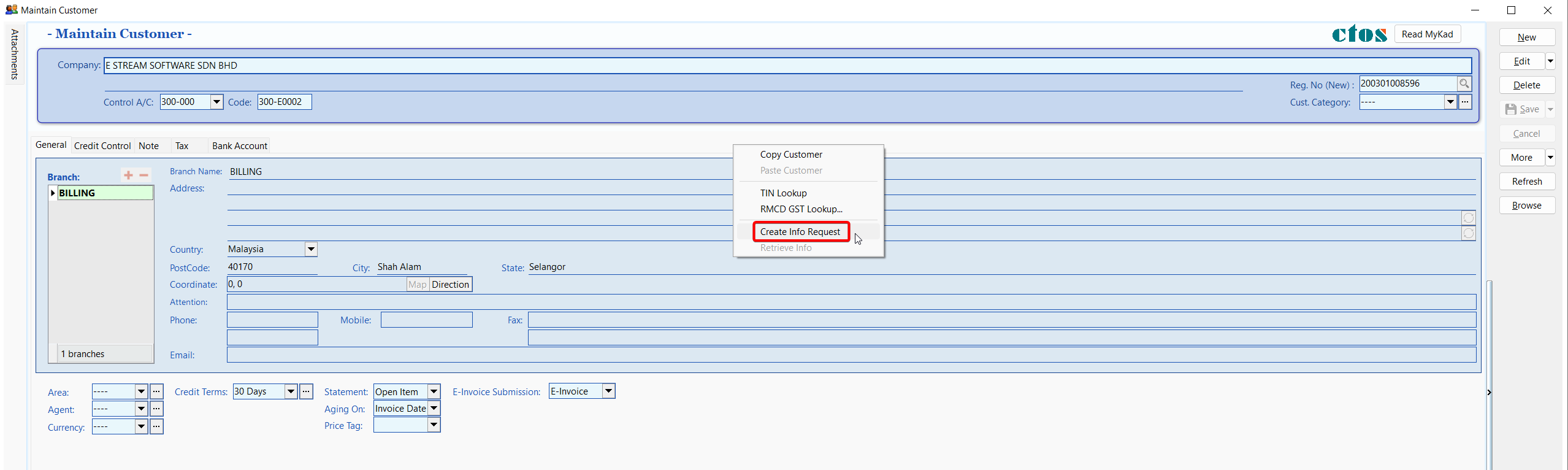

Create Info Request

To generate an Info Request that allows customers or suppliers to submit their company information

-

Go to detail mode for the selected customer or supplier

-

Right click on an empty space, click on Create Info Request

-

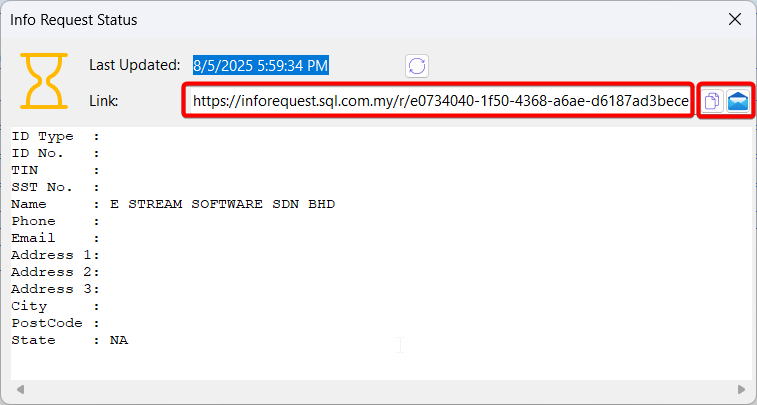

A dialog will appear showing a unique link. You can copy the link and share it manually or email it directly to the customer/supplier

NOTEAn email address is required to use the email option

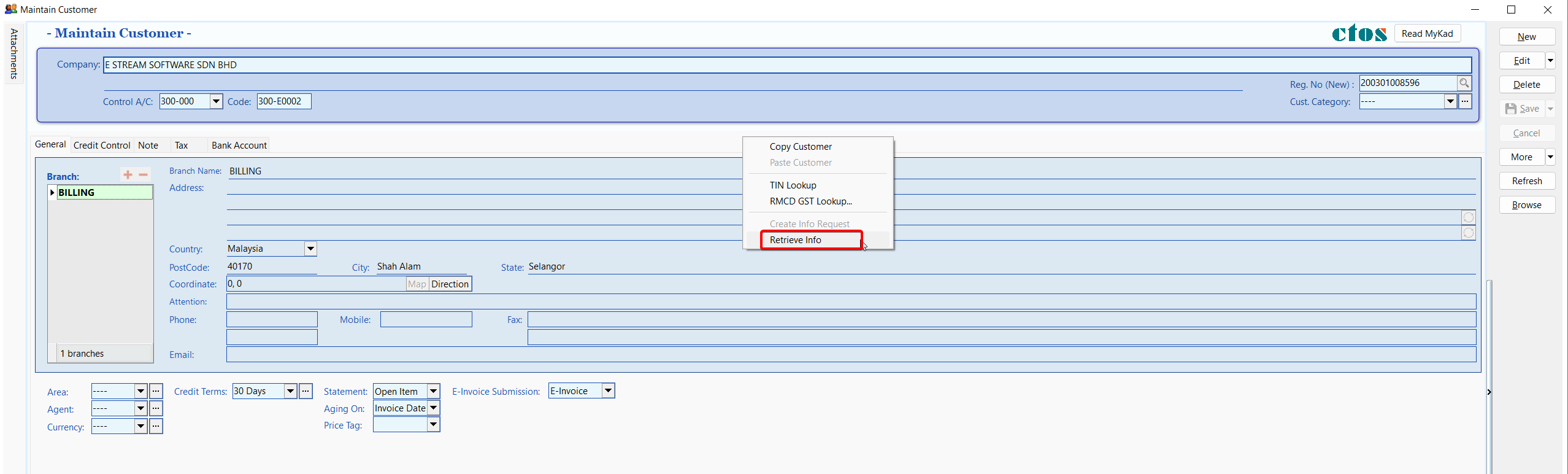

Retrieve Info

To collect the submitted data and update the customer's or supplier’s record

-

Go to detail mode for the selected customer or supplier

-

Right click on an empty space, click on Retrieve Info

-

A dialog will display the submitted details along with the original request link

-

Once you close the dialog, the record will be updated automatically with the new information

Batch Retrieve Info

To retrieve and update information for multiple customers or suppliers at once

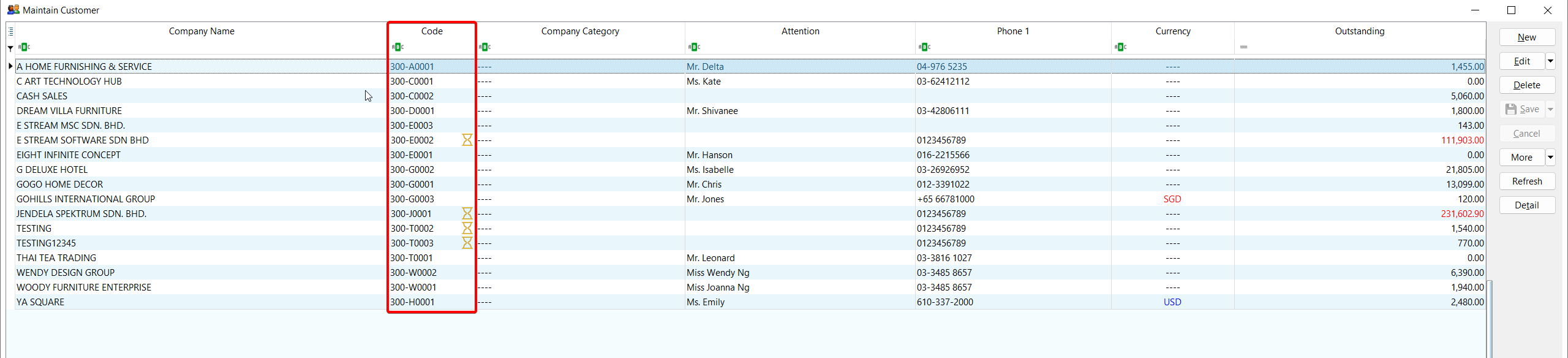

An hourglass icon will appear next to customers or suppliers who has created an Info Request

-

In the browse screen, right-click on the button panel, click on Batch Retrieve Info

-

A progress dialog will appear and automatically fetch the submitted data for all customers/suppliers

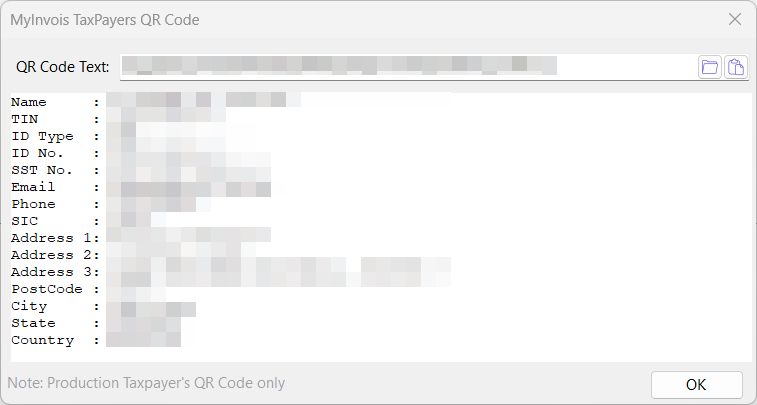

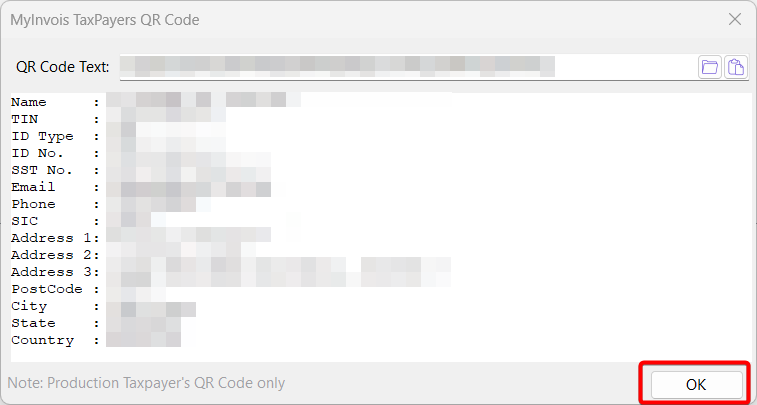

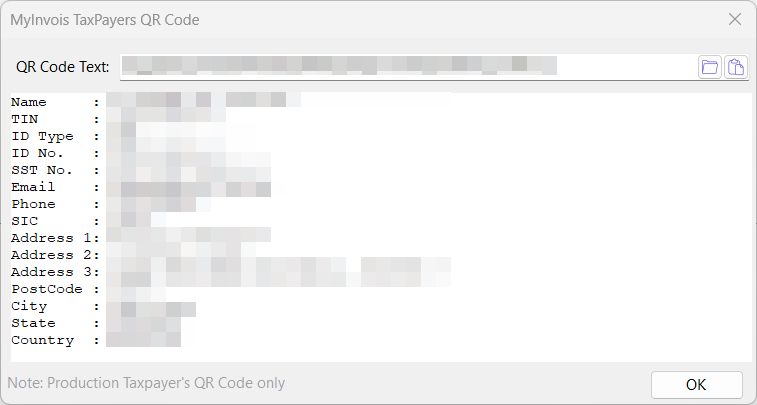

Taxpayer's QR Code

This feature allows you to upload a customer's or supplier's MyInvois Taxpayer QR Code to automatically retrieve and update their information.

Maintain Customer / Supplier

-

Enter detail mode for a new or existing customer or supplier

-

Go to the Tax tab and click on the Upload File button

-

Click the Open File icon to select a QR code image from your device or click the Paste icon to paste a QR code image from your clipboard

-

Once the QR code is uploaded, SQL Account will automatically retrieve and display the taxpayer's information in the memo field

NOTEUpload Production Taxpayer's QR Code only

-

Click the OK button to update the selected customer or supplier with the retrieved data

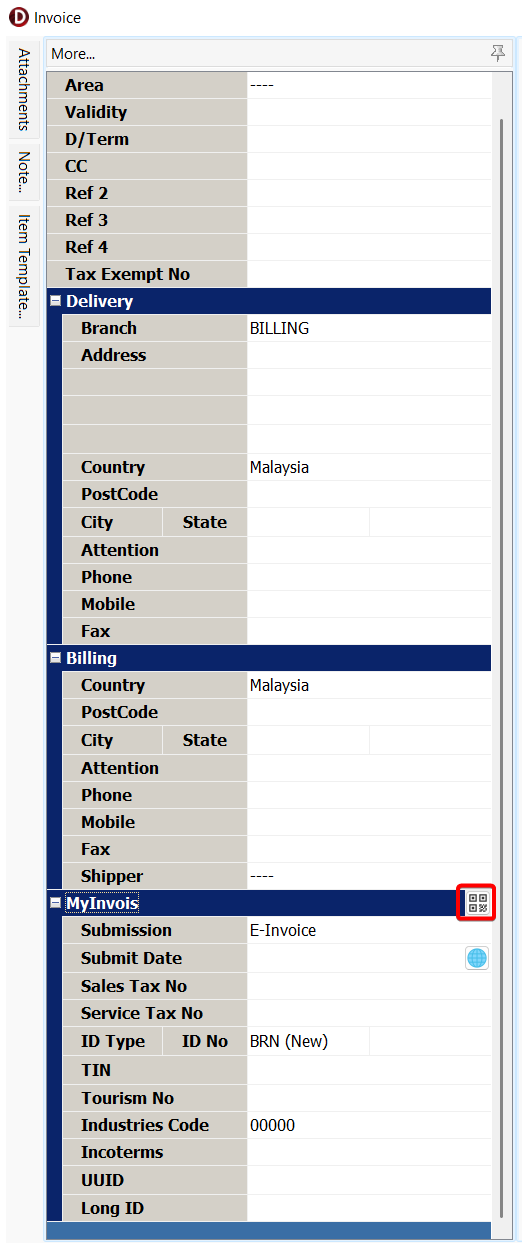

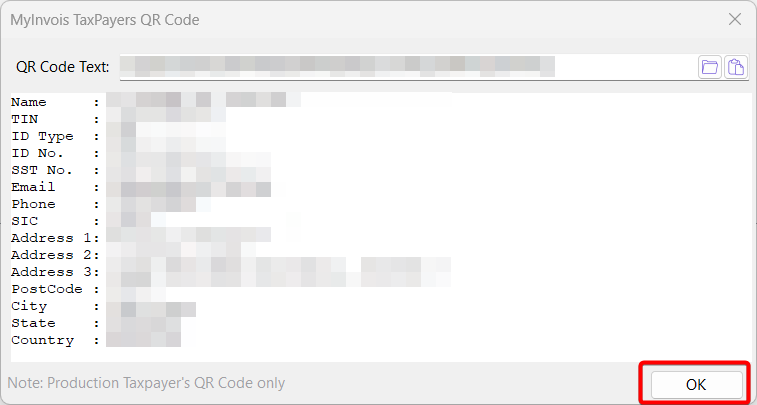

Sales / Purchase / Cashbook document

-

Enter detail mode for a new or existing document

-

Go to the More panel and click on the QR Code icon in MyInvois header

-

Click the Open File icon to select a QR code image from your device or click the Paste icon to paste a QR code image from your clipboard

-

Once the QR code is uploaded, SQL Account will automatically retrieve and display the taxpayer's information in the memo field

NOTEUpload Production Taxpayer's QR Code only

-

Click the OK button to update the selected document with the retrieved data

Customer / Supplier Tax Info

Local Business (Companies registered with local authorities)

If your customers / suppliers are a registered entity in Malaysia (e.g.: SSM registered), you must fill in the BRN & TIN of the customer in order to issue an E-Invoice / self-billed E-Invoice to the buyer / supplier.

Individual / Foreign Buyer

In facilitating a more efficient E-Invoice issuance process as well as to ease the burden of individuals in providing their Tax Identification Number (TIN) and identification number details, IRBM provides the following concession to individuals:

- For Malaysian Individuals to provide either:

- TIN only

- MyKad / MyTentera identification number only

- Both TIN and MyKad / MyTentera identification number

- For non-Malaysian individuals to provide either:

- TIN only (TIN assigned by IRBM or use General TIN EI00000000020)

- Both TIN and BRN of foreign company

- Both TIN and passport number / MyPR / MKAS identification number

For Malaysian Individuals:

| Scenario | In SQL Account |

|---|---|

| TIN only | ID Type: NRIC, ID Value: Leave Empty, TIN: Buyer / Supplier TIN |

| MyKad only | ID Type: NRIC, ID Value: Buyer / Supplier NRIC, TIN: General Public EI00000000010 |

| Both TIN & MyKad | ID Type: NRIC, ID Value: Buyer / Supplier NRIC, TIN: Buyer / Supplier TIN |

For non-Malaysian Individuals:

| Scenario | In SQL Account |

|---|---|

| TIN only | ID Type: Passport, ID Value: Leave Empty, TIN: Buyer / Supplier TIN or General TIN EI00000000020 |

| Both TIN & BRN of Foreign Company | ID Type: BRN, ID Value: Buyer / Supplier BRN, TIN: Buyer / Supplier TIN or General TIN EI00000000020 |

| Both TIN & Passport | ID Type: Passport, ID Value: Buyer / Supplier Passport Number, TIN: Buyer / Supplier TIN or General TIN EI00000000020 |

Reference:

-

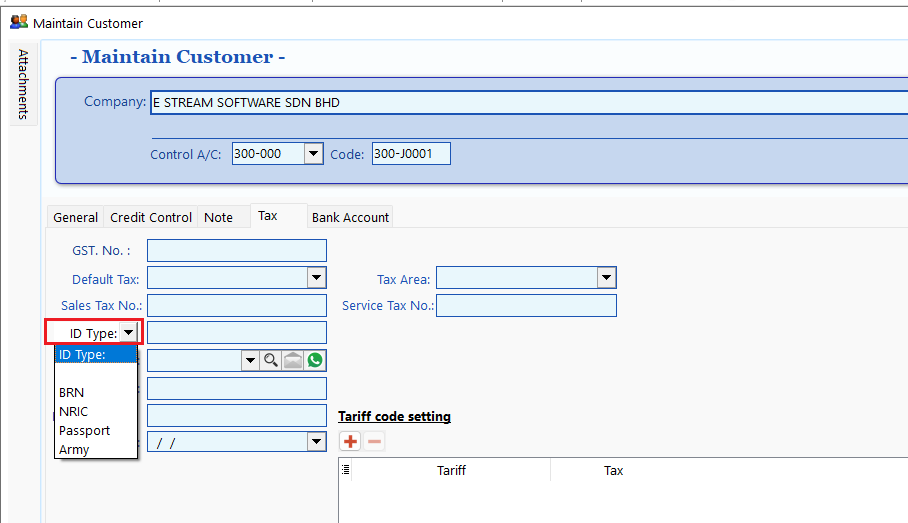

List of ID Type in Maintain Customer / Supplier:

-

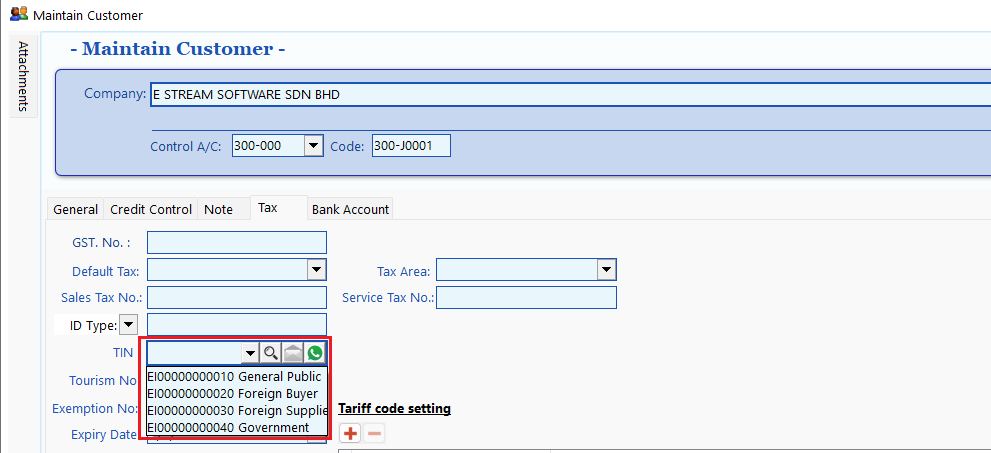

List of General TIN in Maintain Customer / Supplier:

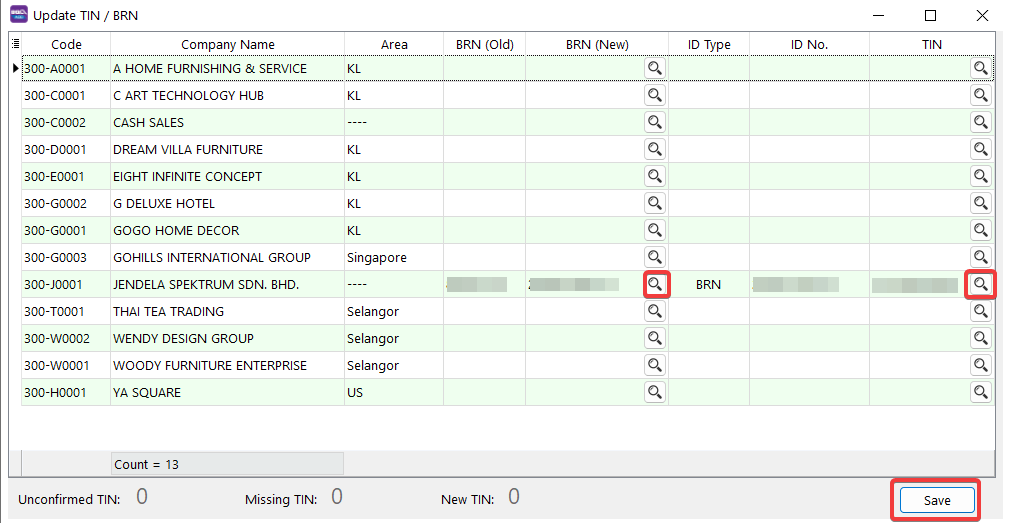

Batch TIN Lookup

This feature enables users to quickly look up missing New BRN/TIN information for customers and is exclusively available to those with an active SQL Account license

-

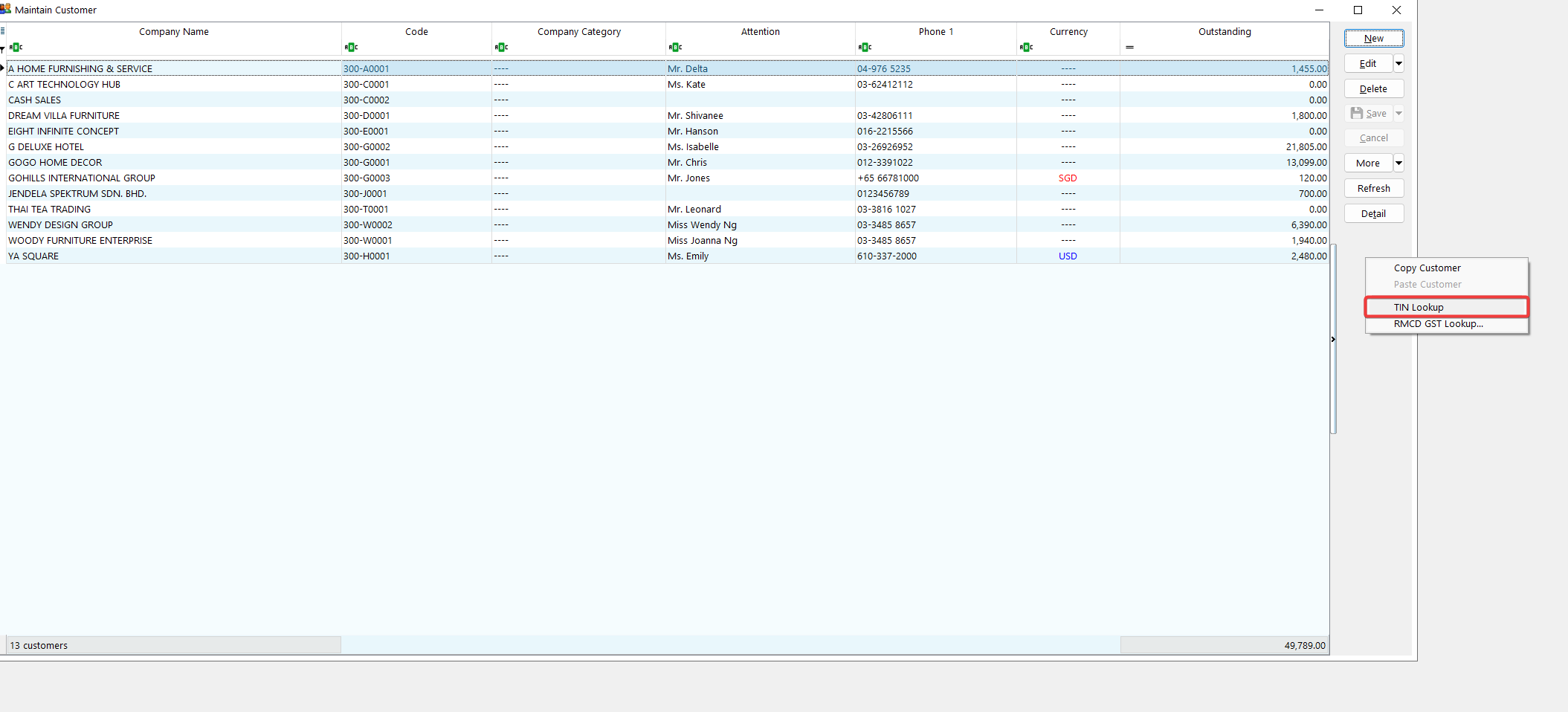

Navigate to Customer > Maintain Customer or Supplier > Maintain Supplier.

-

Right click on the menu bar (located at the right side of the window), select TIN Lookup.

-

In the Tin Lookup window, you will be able to view all of your customers / suppliers details such as Old BRN, New BRN, TIN and etc. Click on the 🔍 to do a quick lookup on the missing fields, when you are done, click Save to apply.

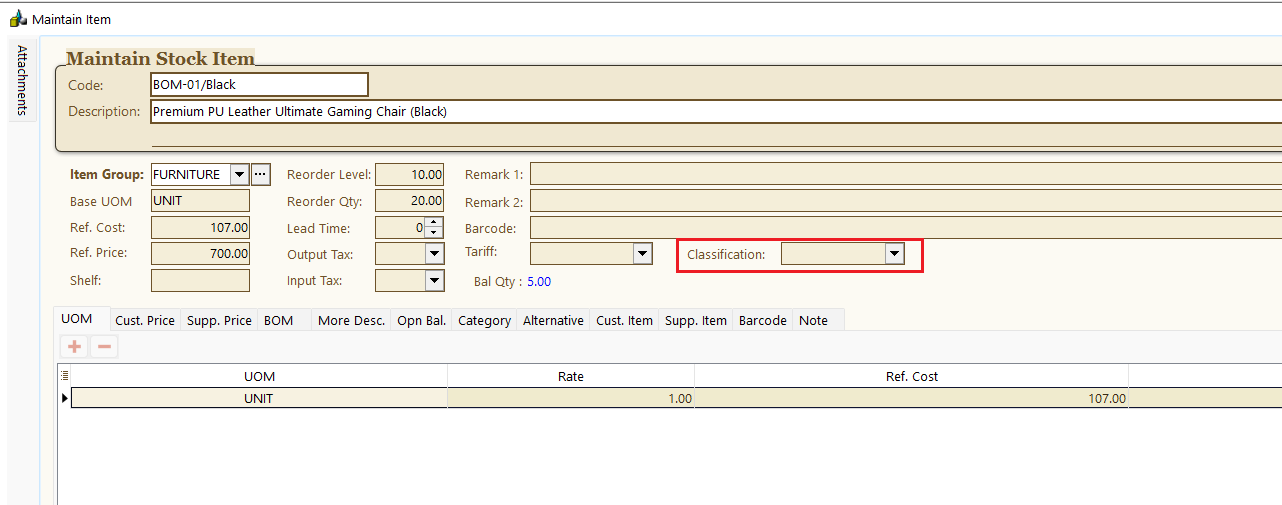

Update Stock Item

IRBM (LHDN) has introduced Classification Codes to define the category of products or services being billed as a result of a commercial transaction.

-

Go to Stock > Maintain Stock Item > Edit stock

-

Update the classification accordingly.

-

Repeat Step 1-2 for all stocks.

You can also override the stock item classification codes during sales invoice entry.