CP38

Introduction

- CP38 is a instruction to Deduct Salary which issued by LHDN. This CP38 instruction requires that the employer make additional deductions in monthly installments from the salary of the taxpayer (other than a Monthly Tax Deduction) towards settlement of taxpayer’s income tax arrears.

- The Salary Deduction Order (CP38) for tax payment in instalments aims to ease the burden of the taxpayer who should be paying the tax arrears in one lump sum under the Income Tax Act 1967.

Insert CP38

-

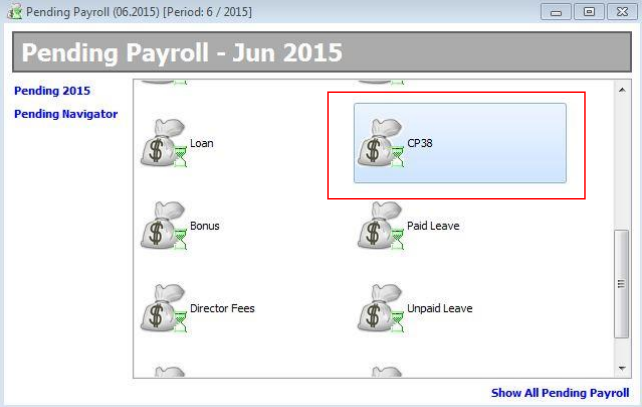

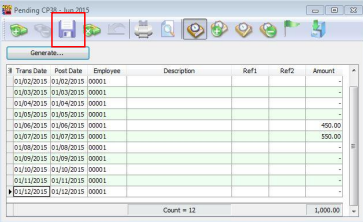

Open Pending Payroll and choose CP38

-

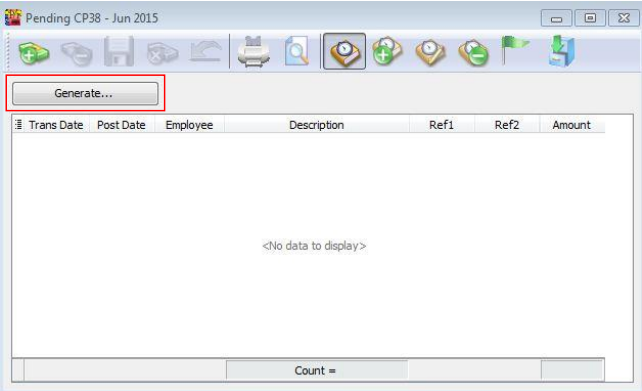

Press GENERATE on the top left of the window.

-

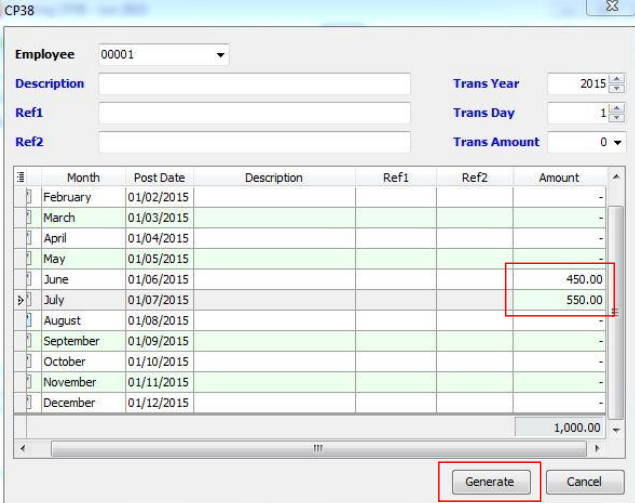

Key in the Amount you receive from LHDN Letter, for example this employee ( 00001- Lucious ) had to pay CP38 on June ( RM450 ) and July ( RM550 ). Press GENERATE.

-

Press SAVE

-

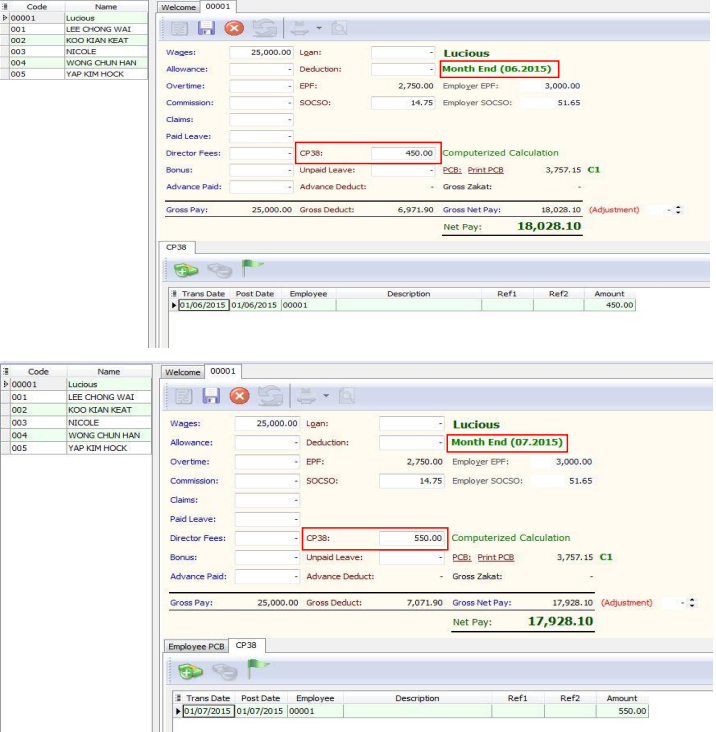

This pending task only needs to be completed once. It will impact both the June and July month-end processes. The following pictures below will illustrate the end result :